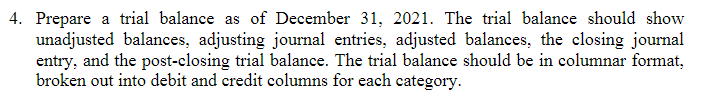

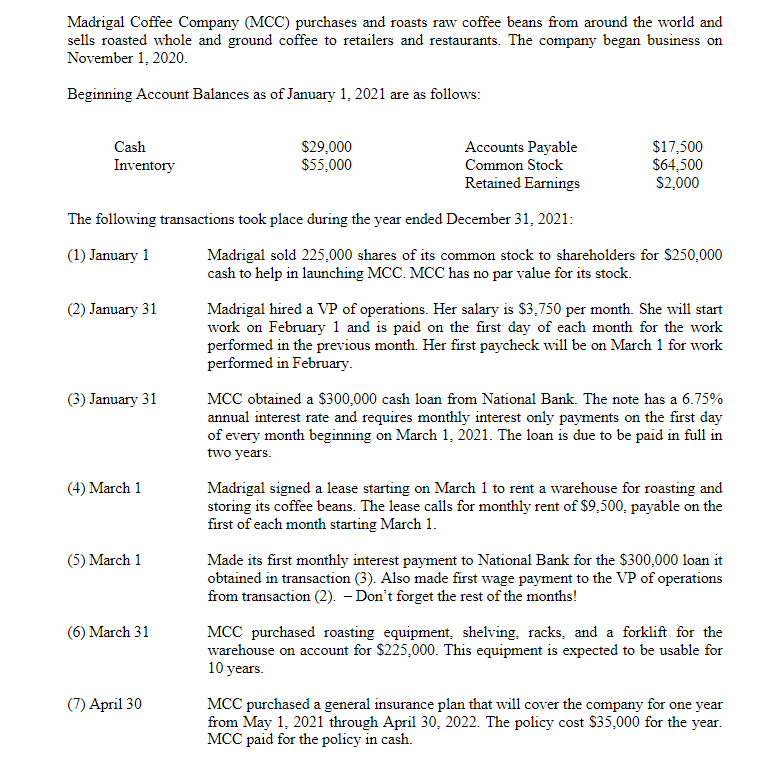

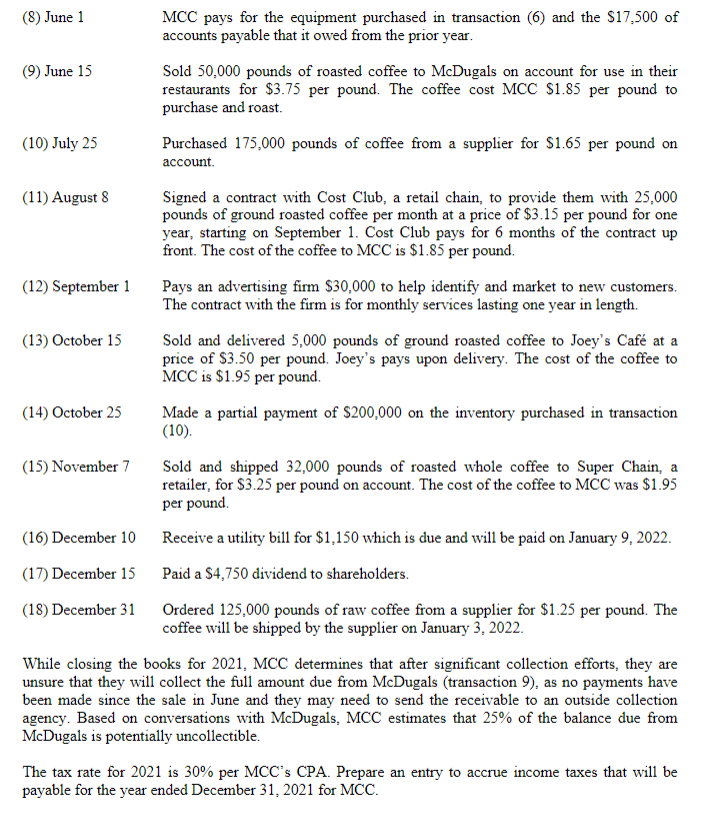

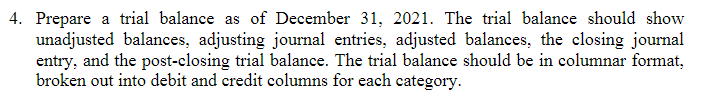

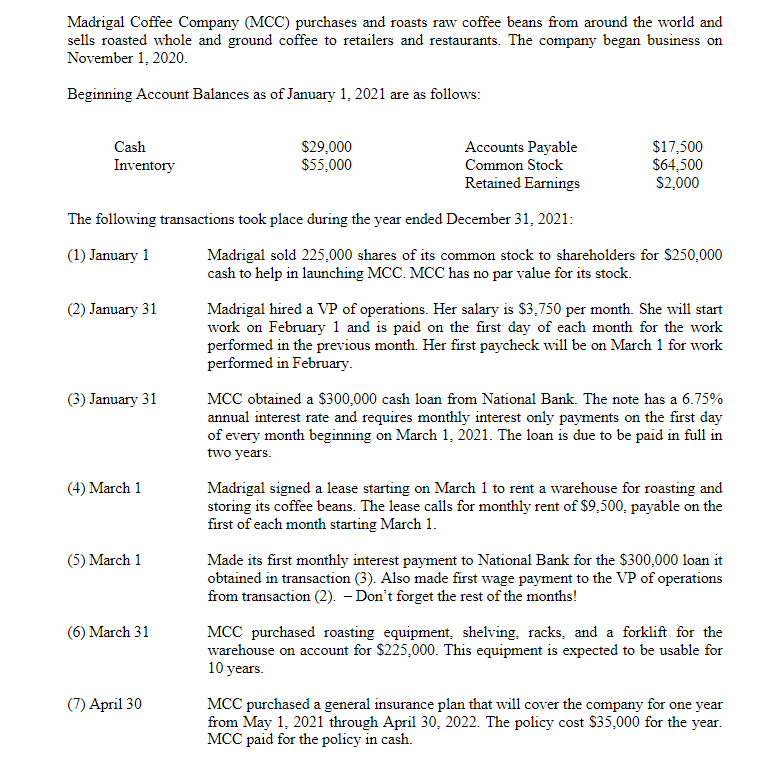

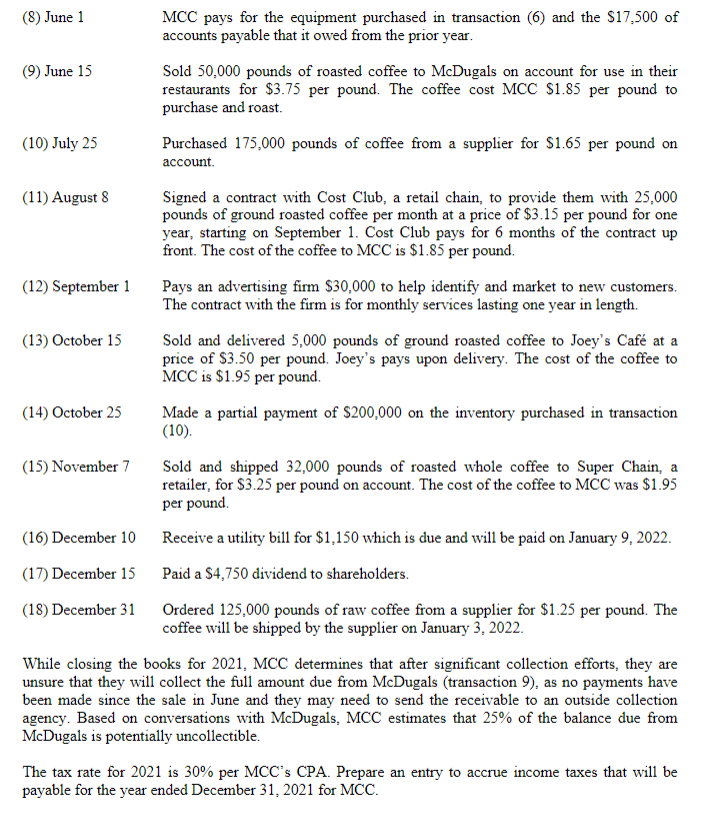

4. Prepare a trial balance as of December 31, 2021. The trial balance should show unadjusted balances, adjusting journal entries, adjusted balances, the closing journal entry, and the post-closing trial balance. The trial balance should be in columnar format, broken out into debit and credit columns for each category. Madrigal Coffee Company (MCC) purchases and roasts raw coffee beans from around the world and sells roasted whole and ground coffee to retailers and restaurants. The company began business on November 1, 2020. Beginning Account Balances as of January 1, 2021 are as follows: The following transactions took place during the year ended December 31, 2021: (1) January 1 Madrigal sold 225,000 shares of its common stock to shareholders for $250,000 cash to help in launching MCC. MCC has no par value for its stock. (2) January 31 Madrigal hired a VP of operations. Her salary is $3,750 per month. She will start work on February 1 and is paid on the first day of each month for the work performed in the previous month. Her first paycheck will be on March 1 for work performed in February. (3) January 31 MCC obtained a $300,000 cash loan from National Bank. The note has a 6.75% annual interest rate and requires monthly interest only payments on the first day of every month beginning on March 1,2021. The loan is due to be paid in full in two years. (4) March 1 Madrigal signed a lease starting on March 1 to rent a warehouse for roasting and storing its coffee beans. The lease calls for monthly rent of $9,500, payable on the first of each month starting March 1. (5) March 1 Made its first monthly interest payment to National Bank for the $300,000 loan it obtained in transaction (3). Also made first wage payment to the VP of operations from transaction (2). - Don't forget the rest of the months! (6) March 31 MCC purchased roasting equipment, shelving, racks, and a forklift for the warehouse on account for $225,000. This equipment is expected to be usable for 10 years. (7) April 30 MCC purchased a general insurance plan that will cover the company for one year from May 1, 2021 through April 30, 2022. The policy cost $35,000 for the year. MCC pays for the equipment purchased in transaction (6) and the $17,500 of accounts payable that it owed from the prior year. Sold 50,000 pounds of roasted coffee to McDugals on account for use in their restaurants for $3.75 per pound. The coffee cost MCC $1.85 per pound to purchase and roast. Purchased 175,000 pounds of coffee from a supplier for $1.65 per pound on account. Signed a contract with Cost Club, a retail chain, to provide them with 25,000 pounds of ground roasted coffee per month at a price of $3.15 per pound for one year, starting on September 1. Cost Club pays for 6 months of the contract up front. The cost of the coffee to MCC is $1.85 per pound. Pays an advertising firm $30,000 to help identify and market to new customers. The contract with the firm is for monthly services lasting one year in length. Sold and delivered 5,000 pounds of ground roasted coffee to Joey's Caf at a price of $3.50 per pound. Joey's pays upon delivery. The cost of the coffee to MCC is $1.95 per pound. Made a partial payment of $200,000 on the inventory purchased in transaction (10). Sold and shipped 32,000 pounds of roasted whole coffee to Super Chain, a retailer, for $3.25 per pound on account. The cost of the coffee to MCC was $1.95 per pound. Receive a utility bill for $1,150 which is due and will be paid on January 9, 2022. Paid a $4,750 dividend to shareholders. Ordered 125,000 pounds of raw coffee from a supplier for $1.25 per pound. The coffee will be shipped by the supplier on January 3, 2022. ooks for 2021, MCC determines that after significant collection efforts, they are collect the full amount due from McDugals (transaction 9), as no payments have sale in June and they may need to send the receivable to an outside collection onversations with McDugals, MCC estimates that 25% of the balance due from ally uncollectible. 1 is 30% per MCC's CPA. Prepare an entry to accrue income taxes that will be ended December 31,2021 for MCC