Answered step by step

Verified Expert Solution

Question

1 Approved Answer

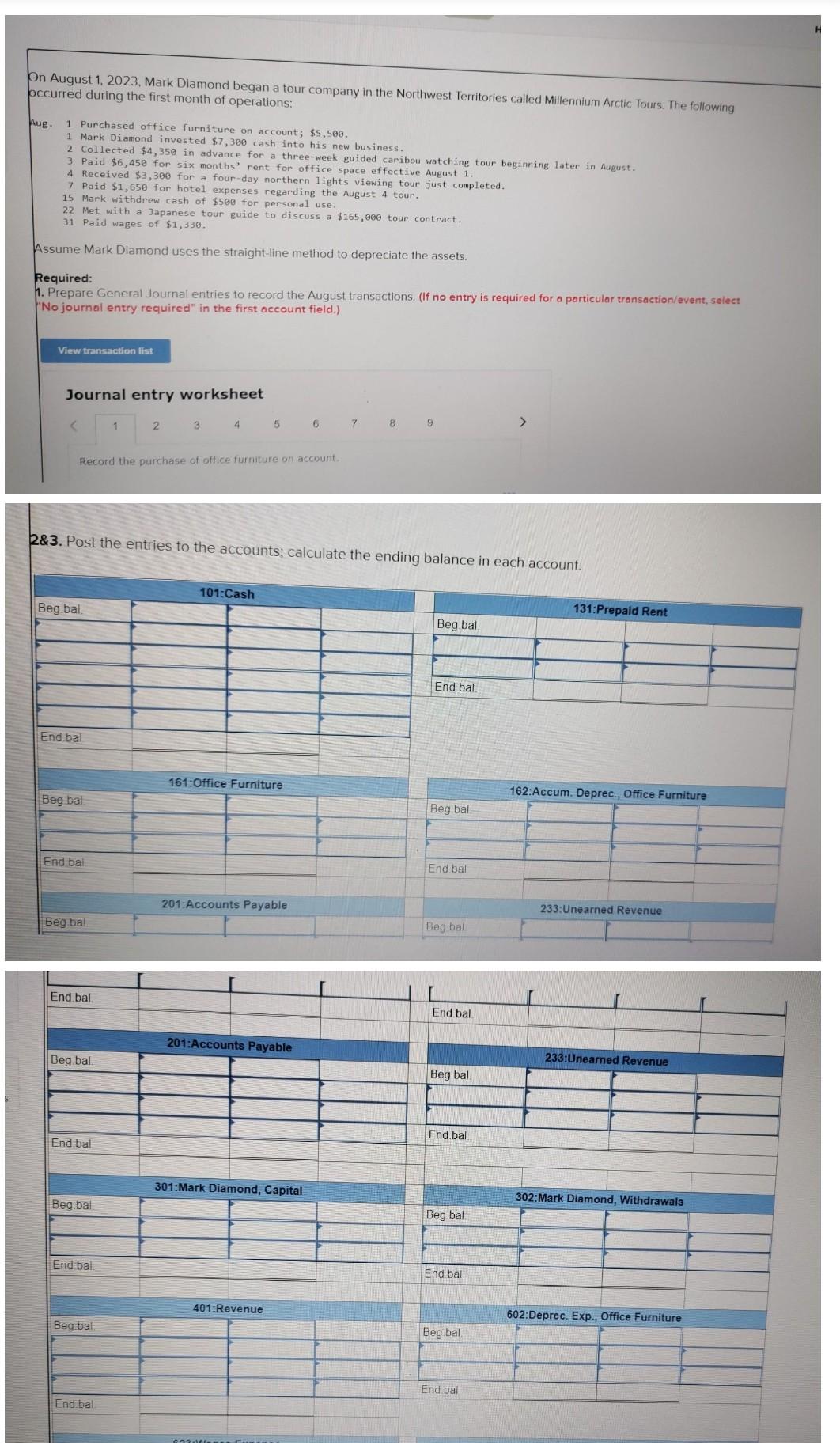

4. Prepare an unadjusted trial balance at August 31,2023. 5. Using the following information, prepare the adjusting entries on August 31. (If no entry is

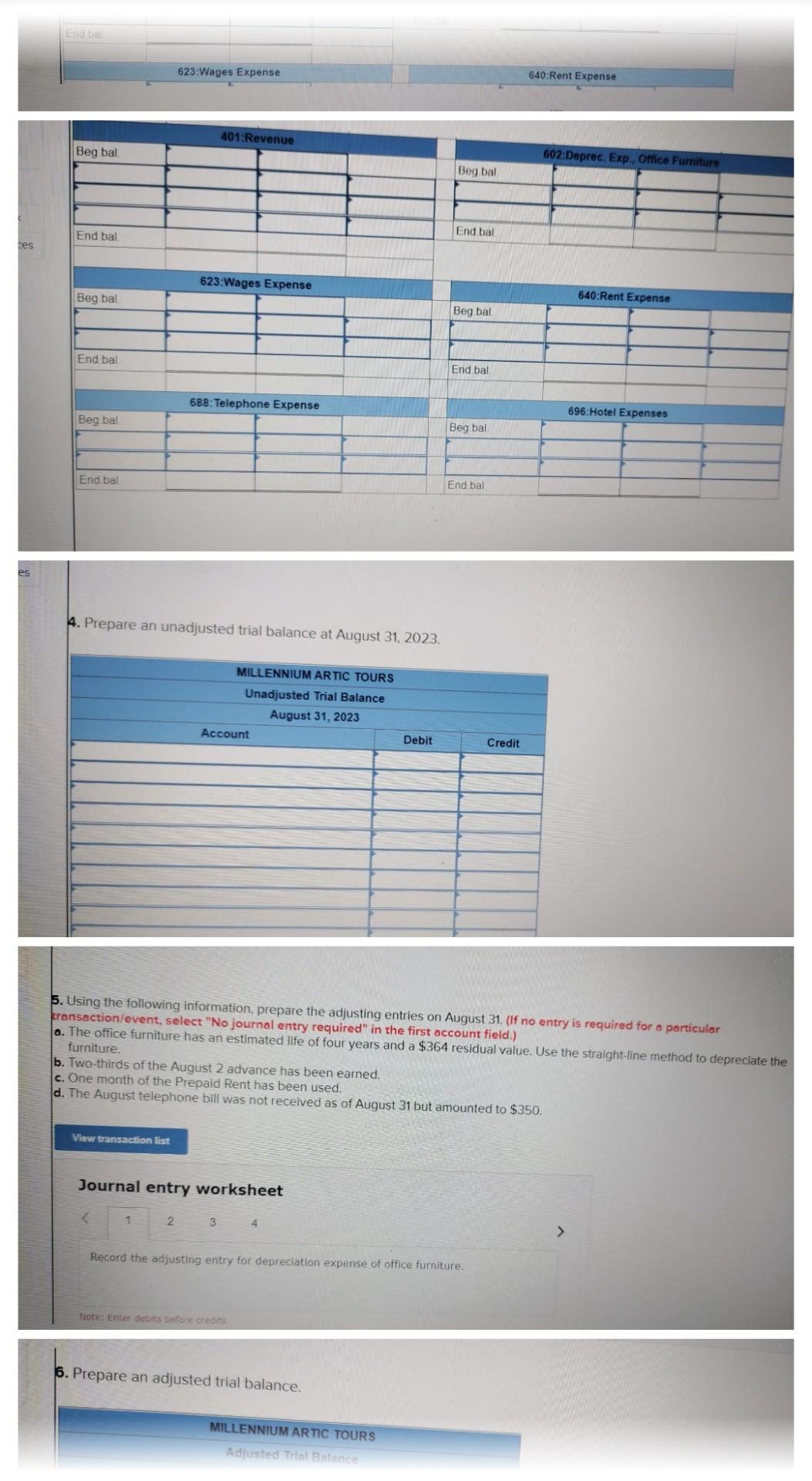

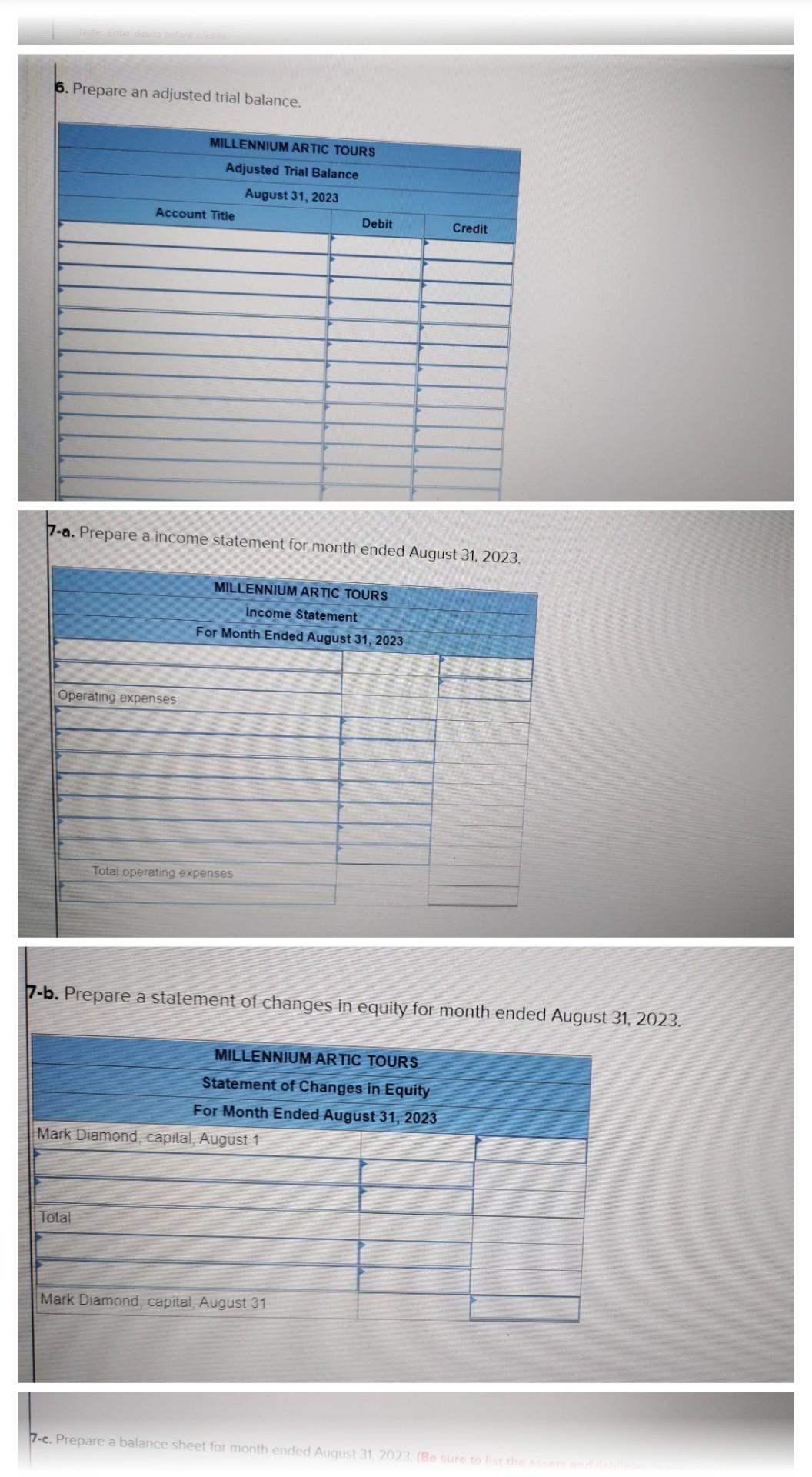

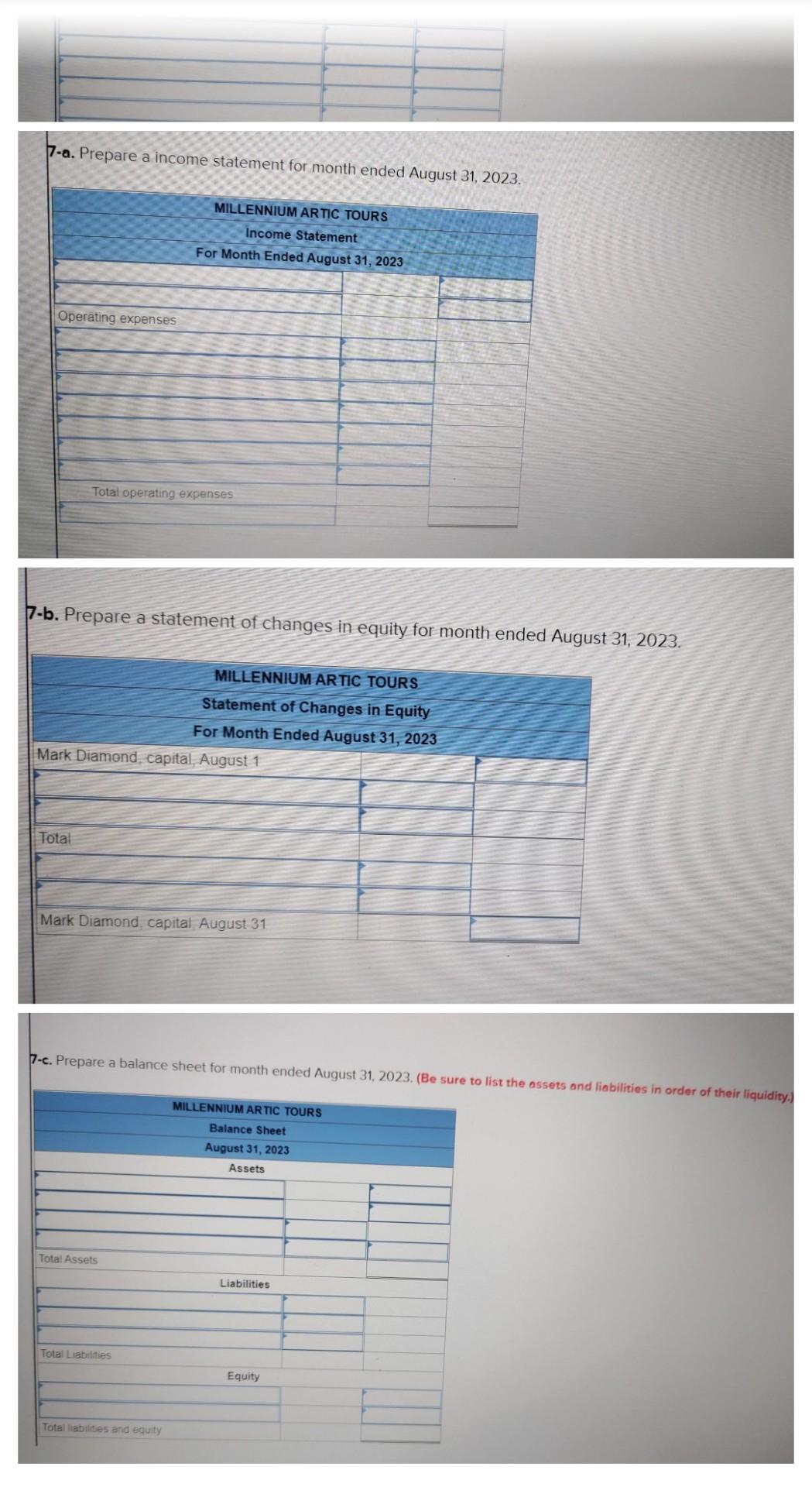

4. Prepare an unadjusted trial balance at August 31,2023. 5. Using the following information, prepare the adjusting entries on August 31. (If no entry is required for a particular cransaction/event, select "No journal entry required" in the first occount field.) a. The office furniture has an estimated life of four years and a $364 residual value. Use the straight-line method to depreciate the furniture. b. Two-thirds of the August 2 advance has been earned. c. One month of the Prepaid Rent has been used. d. The August telephone bill was not received as of August 31 but amounted to $350. Journal entry worksheet Record the adjusting entry for depreciation expense of office furniture. Note: Enter debits before cedita 6. Prepare an adjusted trial balance. On August 1. 2023, Mark Diamond began a tour company in the Northwest Territories called Millennium Arctic Tours. The following occurred during the first month of operations: Aug. 1 Purchased office furniture on account; \$5,500. 1 Mark Diamond invested $7,300 cash into his new business. 2 Collected $4,350 in advance for a three-week guided caribou watching tour beginning later in August. 3 Paid $6,450 for six months' rent for office space effective August 1 . 4 Received $3,300 for a four-day northern lights viewing tour just completed. 7 Paid $1,650 for hotel expenses regarding the August 4 tour. 15 Mark withdrew cash of $500 for personal use, 22 Met with a Japanese tour guide to discuss a $165,000 tour contract. 31 Paid wages of $1,330. Assume Mark Diamond uses the straight-line method to depreciate the assets. Required: 1. Prepare General Journal entries to record the August transactions. (If no entry is required for a particular transaction/event, select 'No journal entry required" in the first account field.) 2\&3. Post the entries to the accounts; calculate the ending balance in each account. 6. Prepare an adjusted trial balance, 7-a. Prepare a income statement for month ended August 31, 2023. 7-b. Prepare a statement of changes in equity for month ended August 31,2023. 7c 7-a. Prepare a income statement for month ended August 31,2023, 7-b. Prepare a statement of changes in equity for month ended August 31,2023 . 7-c. Prepare a balance sheet for month ended August 31, 2023. (Be sure to list the assets and liabilities in order of their liquidity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started