Answered step by step

Verified Expert Solution

Question

1 Approved Answer

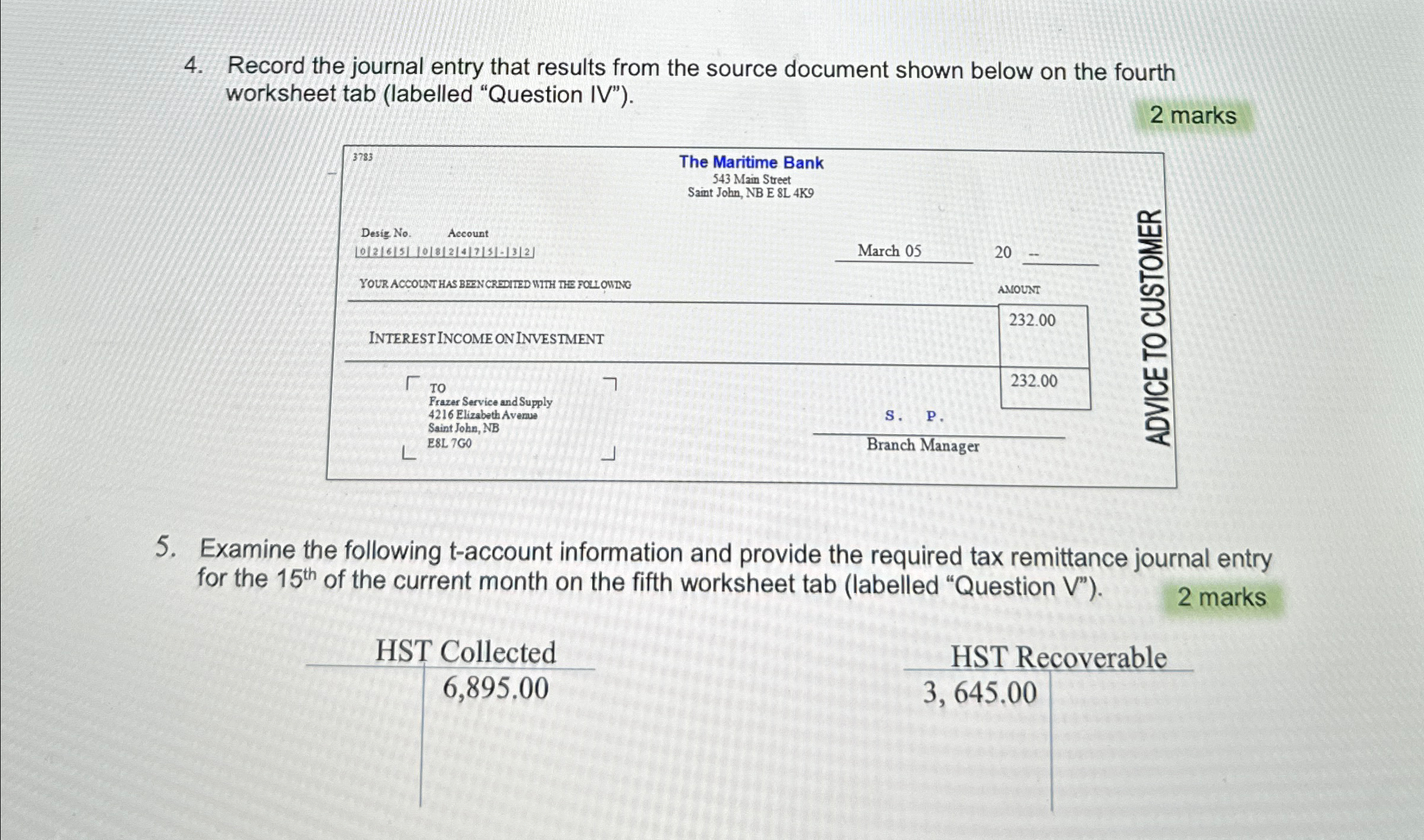

4. Record the journal entry that results from the source document shown below on the fourth worksheet tab (labelled Question IV). 3783 Desig. No.

4. Record the journal entry that results from the source document shown below on the fourth worksheet tab (labelled "Question IV"). 3783 Desig. No. Account 0265 082475-32 YOUR ACCOUNT HAS BEEN CREDITED WITH THE FOLLOWING INTEREST INCOME ON INVESTMENT Frazer Service and Supply 4216 Elizabeth Avenue Saint John, NB E8L 7G0 L L The Maritime Bank 543 Main Street Saint John, NB E 8L 4K9 March 05 20 AMOUNT 232.00 232.00 S. P. Branch Manager 2 marks ADVICE TO CUSTOMER 5. Examine the following t-account information and provide the required tax remittance journal entry for the 15th of the current month on the fifth worksheet tab (labelled "Question V"). HST Collected 6,895.00 HST Recoverable 3,645.00 2 marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started