Answered step by step

Verified Expert Solution

Question

1 Approved Answer

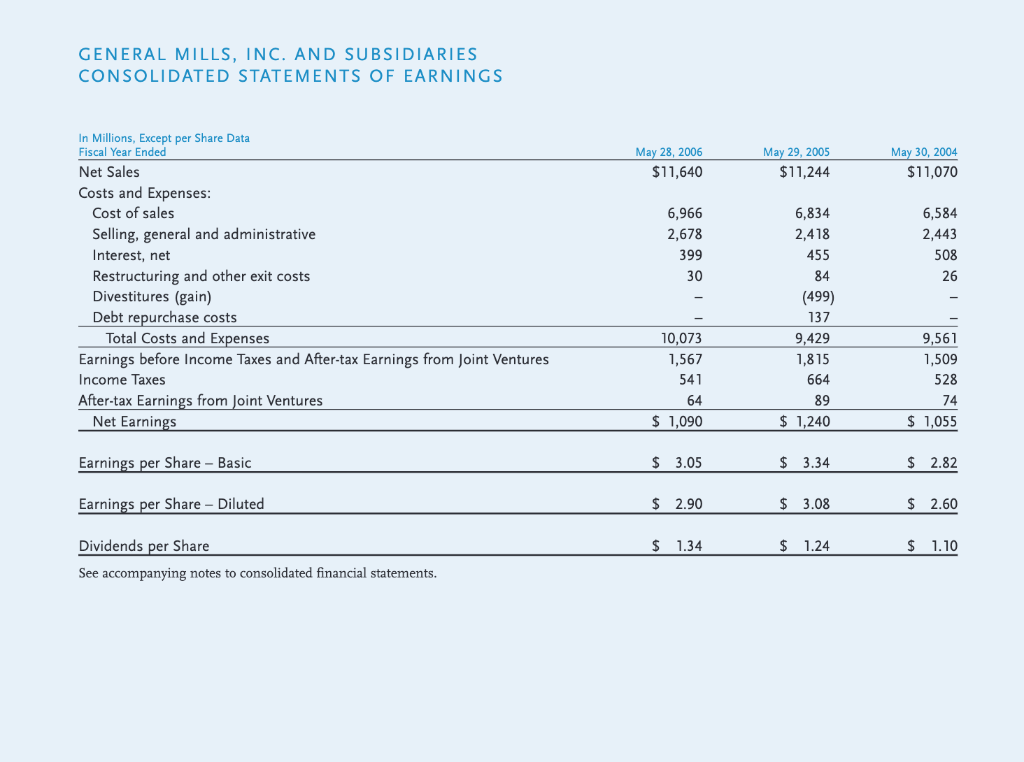

4) Refer to General Mills 2006 Statement of Earnings a. How did the company recognize revenue? Is it consistent with revenue recognition principle? b. Why

4) Refer to General Mills 2006 Statement of Earnings

4) Refer to General Mills 2006 Statement of Earnings

a. How did the company recognize revenue? Is it consistent with revenue recognition principle?

b. Why did the company separately list Restructuring and other exit costs, Divestitures, and Debt repurchase costs? Why didnt the company combine those costs with Selling, general and administrative expenses?

c. What were the major expenses of the company? Where was the shipping expenses (i.e., expenses occurring during selling) included?

GENERAL MILLS, INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF EARNINGS May 28, 2006 $11,640 May 29, 2005 $11,244 May 30, 2004 $11,070 In Millions, Except per Share Data Fiscal Year Ended Net Sales Costs and Expenses: Cost of sales Selling, general and administrative Interest, net Restructuring and other exit costs Divestitures (gain) Debt repurchase costs Total Costs and Expenses Earnings before Income Taxes and After-tax Earnings from Joint Ventures Income Taxes After-tax Earnings from Joint Ventures Net Earnings 6,966 2,678 399 30 6,584 2,443 508 26 6,834 2,418 455 84 (499) 137 9,429 1,815 664 89 $ 1,240 10,073 1,567 541 64 $ 1,090 9,561 1,509 528 74 $ 1,055 Earnings per Basic 3.05 3.3 Earnings per Share - Diluted $ 2.90 $ 3.08 $ 2.60 $ 1.34 $ 1.24 $ 1.10 Dividends per Share See accompanying notes to consolidated financial statementsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started