Answered step by step

Verified Expert Solution

Question

1 Approved Answer

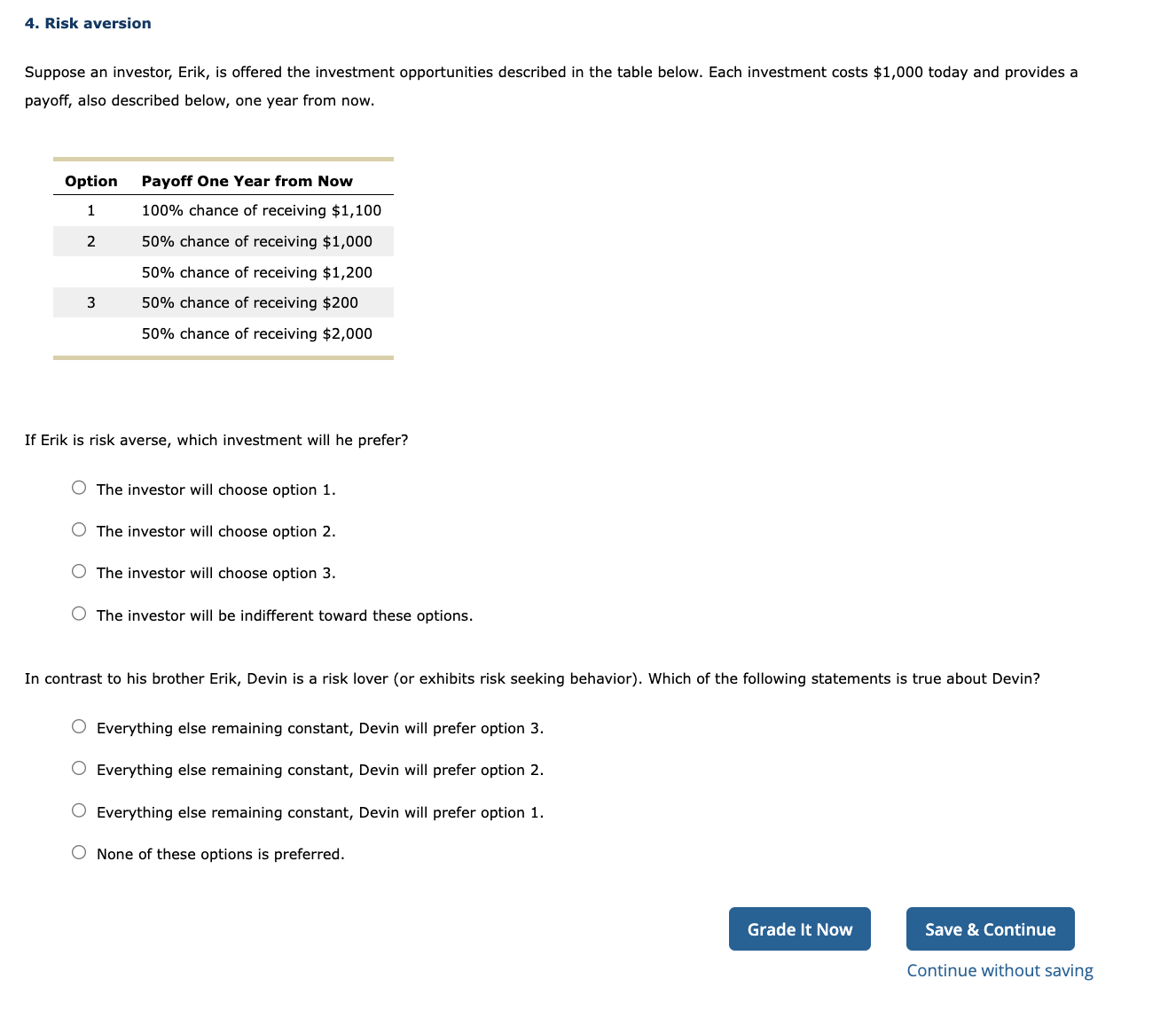

4. Risk aversion Suppose an investor, Erik, is offered the investment opportunities described in the table below. Each investment costs $1,000 today and provides a

4. Risk aversion Suppose an investor, Erik, is offered the investment opportunities described in the table below. Each investment costs $1,000 today and provides a payoff, also described below, one year from now. If Erik is risk averse, which investment will he prefer? The investor will choose option 1. The investor will choose option 2. The investor will choose option 3. The investor will be indifferent toward these options. In contrast to his brother Erik, Devin is a risk lover (or exhibits risk seeking behavior). Which of the following statements is true about Devin? Everything else remaining constant, Devin will prefer option 3. Everything else remaining constant, Devin will prefer option 2. Everything else remaining constant, Devin will prefer option 1. None of these options is preferred

4. Risk aversion Suppose an investor, Erik, is offered the investment opportunities described in the table below. Each investment costs $1,000 today and provides a payoff, also described below, one year from now. If Erik is risk averse, which investment will he prefer? The investor will choose option 1. The investor will choose option 2. The investor will choose option 3. The investor will be indifferent toward these options. In contrast to his brother Erik, Devin is a risk lover (or exhibits risk seeking behavior). Which of the following statements is true about Devin? Everything else remaining constant, Devin will prefer option 3. Everything else remaining constant, Devin will prefer option 2. Everything else remaining constant, Devin will prefer option 1. None of these options is preferred Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started