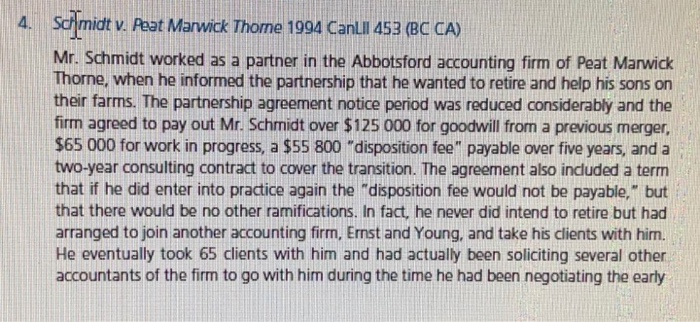

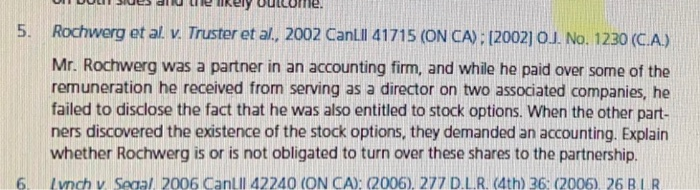

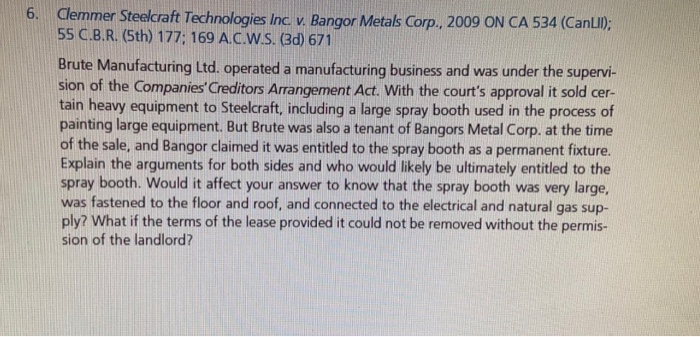

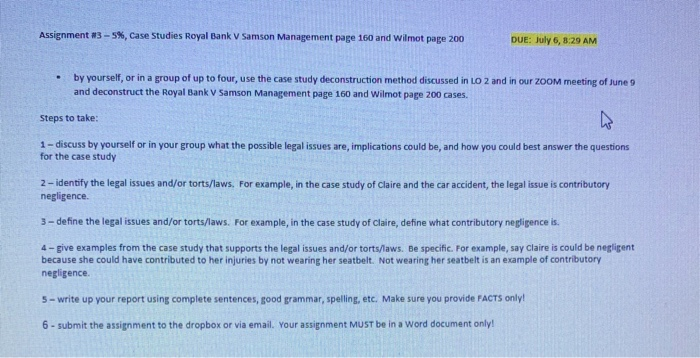

4. Se midt v. Peat Marwick Thorne 1994 Canli 453 (BC CA) Mr. Schmidt worked as a partner in the Abbotsford accounting firm of Peat Marwick Thorne, when he informed the partnership that he wanted to retire and help his sons on their farms. The partnership agreement notice period was reduced considerably and the firm agreed to pay out Mr. Schmidt over $125 000 for goodwill from a previous merger, $65 000 for work in progress, a $55 800 "disposition fee" payable over five years, and a two-year consulting contract to cover the transition. The agreement also included a term that if he did enter into practice again the disposition fee would not be payable, but that there would be no other ramifications. In fact, he never did intend to retire but had arranged to join another accounting firm, Ernst and Young, and take his clients with him. He eventually took 65 clients with him and had actually been soliciting several other accountants of the firm to go with him during the time he had been negotiating the early 5. Rochwerg et al. v. Truster et al., 2002 Cant.ll 41715 (ON CA): [2002] OJ. No. 1230 (C.A.) Mr. Rochwerg was a partner in an accounting firm, and while he paid over some of the remuneration he received from serving as a director on two associated companies, he failed to disclose the fact that he was also entitled to stock options. When the other part- ners discovered the existence of the stock options, they demanded an accounting. Explain whether Rochwerg is or is not obligated to turn over these shares to the partnership. 6 Lynch v. Segal. 2006 Canll 42240 (ON CA): (2006), 277 D.LR. (4th) 36: (2006). 26 BIR 6. Clemmer Steelcraft Technologies Inc. v. Bangor Metals Corp., 2009 ON CA 534 (Canlll); 55 C.B.R. (5th) 177; 169 A.C.W.S. (3d) 671 Brute Manufacturing Ltd. operated a manufacturing business and was under the supervi- sion of the Companies' Creditors Arrangement Act. With the court's approval it sold cer- tain heavy equipment to Steelcraft, including a large spray booth used in the process of painting large equipment. But Brute was also a tenant of Bangors Metal Corp. at the time of the sale, and Bangor claimed it was entitled to the spray booth as a permanent fixture. Explain the arguments for both sides and who would likely be ultimately entitled to the spray booth. Would it affect your answer to know that the spray booth was very large, was fastened to the floor and roof, and connected to the electrical and natural gas sup- ply? What if the terms of the lease provided it could not be removed without the permis- sion of the landlord? Assignment #3 - 5%, Case Studies Royal Bank v Samson Management page 160 and Wilmot page 200 DUE: July 6, 8:29 AM . by yourself, or in a group of up to four, use the case study deconstruction method discussed in LO 2 and in our ZOOM meeting of June 9 and deconstruct the Royal Bank V Samson Management page 160 and Wilmot page 200 cases. Steps to take: 1 - discuss by yourself or in your group what the possible legal issues are, implications could be, and how you could best answer the questions for the case study 2-identify the legal issues and/or torts/laws. For example, in the case study of Claire and the car accident, the legal issue is contributory negligence. 3 - define the legal issues and/or torts/laws. For example, in the case study of Claire, define what contributory negligence is. 4 - give examples from the case study that supports the legal issues and/or torts/laws. Be specific. For example, say Claire is could be negligent because she could have contributed to her injuries by not wearing her seatbelt. Not wearing her seatbelt is an example of contributory negligence 5 - write up your report using complete sentences, good grammar, spelling, etc. Make sure you provide FACTS only! 6 - submit the assignment to the dropbox or via email. Your assignment MUST be in a Word document only