Answered step by step

Verified Expert Solution

Question

1 Approved Answer

4. Sirius Technologies, a manufacturer of personal digital assistants (PDAs), is looking to acquire Leonid Corporation, a weaker competitor. Sirius believes Leonid's PDAs are

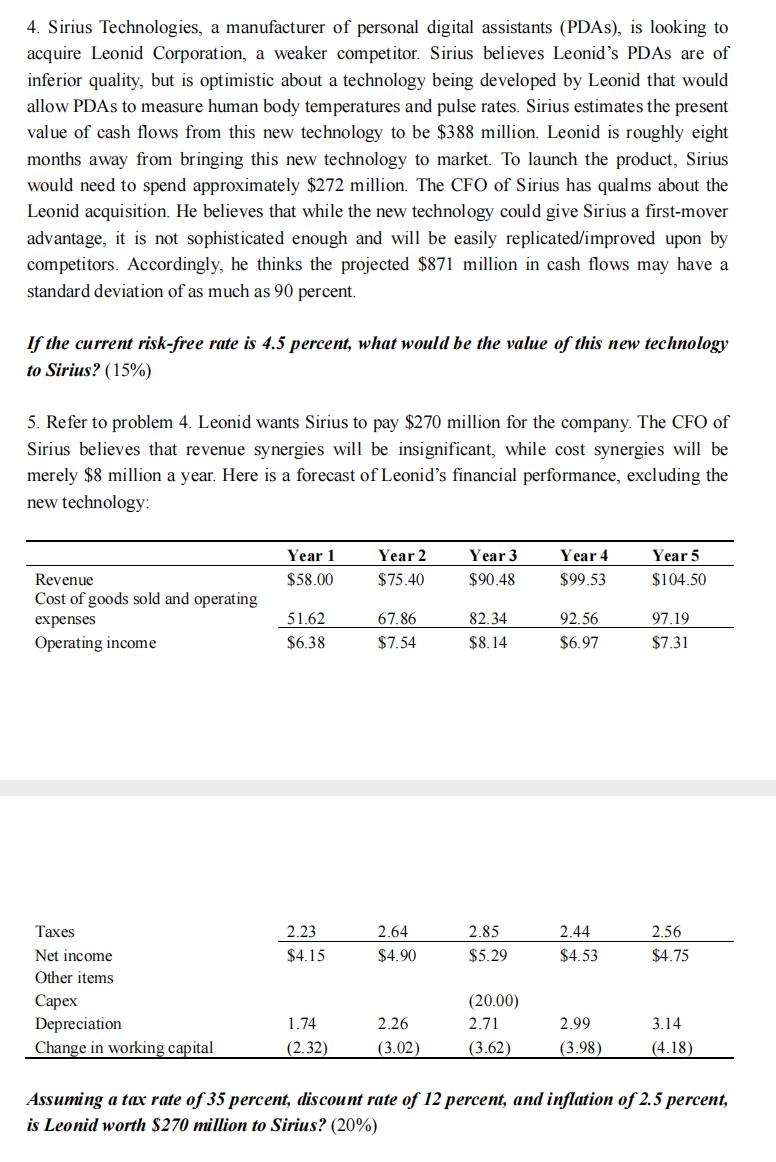

4. Sirius Technologies, a manufacturer of personal digital assistants (PDAs), is looking to acquire Leonid Corporation, a weaker competitor. Sirius believes Leonid's PDAs are of inferior quality, but is optimistic about a technology being developed by Leonid that would allow PDAs to measure human body temperatures and pulse rates. Sirius estimates the present value of cash flows from this new technology to be $388 million. Leonid is roughly eight months away from bringing this new technology to market. To launch the product, Sirius would need to spend approximately $272 million. The CFO of Sirius has qualms about the Leonid acquisition. He believes that while the new technology could give Sirius a first-mover advantage, it is not sophisticated enough and will be easily replicated/improved upon by competitors. Accordingly, he thinks the projected $871 million in cash flows may have a standard deviation of as much as 90 percent. If the current risk-free rate is 4.5 percent, what would be the value of this new technology to Sirius? (15%) 5. Refer to problem 4. Leonid wants Sirius to pay $270 million for the company. The CFO of Sirius believes that revenue synergies will be insignificant, while cost synergies will be merely $8 million a year. Here is a forecast of Leonid's financial performance, excluding the new technology: Revenue Cost of goods sold and operating expenses Operating income Taxes Net income Other items Capex Depreciation Change in working capital Year 1 $58.00 51.62 $6.38 2.23 $4.15 1.74 (2.32) Year 2 $75.40 67.86 $7.54 2.64 $4.90 2.26 (3.02) Year 3 $90.48 82.34 $8.14 2.85 $5.29 (20.00) 2.71 (3.62) Year 4 $99.53 92.56 $6.97 2.44 $4.53 2.99 (3.98) Year 5 $104.50 97.19 $7.31 2.56 $4.75 3.14 (4.18) Assuming a tax rate of 35 percent, discount rate of 12 percent, and inflation of 2.5 percent, is Leonid worth $270 million to Sirius? (20%) 4. Sirius Technologies, a manufacturer of personal digital assistants (PDAs), is looking to acquire Leonid Corporation, a weaker competitor. Sirius believes Leonid's PDAs are of inferior quality, but is optimistic about a technology being developed by Leonid that would allow PDAs to measure human body temperatures and pulse rates. Sirius estimates the present value of cash flows from this new technology to be $388 million. Leonid is roughly eight months away from bringing this new technology to market. To launch the product, Sirius would need to spend approximately $272 million. The CFO of Sirius has qualms about the Leonid acquisition. He believes that while the new technology could give Sirius a first-mover advantage, it is not sophisticated enough and will be easily replicated/improved upon by competitors. Accordingly, he thinks the projected $871 million in cash flows may have a standard deviation of as much as 90 percent. If the current risk-free rate is 4.5 percent, what would be the value of this new technology to Sirius? (15%) 5. Refer to problem 4. Leonid wants Sirius to pay $270 million for the company. The CFO of Sirius believes that revenue synergies will be insignificant, while cost synergies will be merely $8 million a year. Here is a forecast of Leonid's financial performance, excluding the new technology: Revenue Cost of goods sold and operating expenses Operating income Taxes Net income Other items Capex Depreciation Change in working capital Year 1 $58.00 51.62 $6.38 2.23 $4.15 1.74 (2.32) Year 2 $75.40 67.86 $7.54 2.64 $4.90 2.26 (3.02) Year 3 $90.48 82.34 $8.14 2.85 $5.29 (20.00) 2.71 (3.62) Year 4 $99.53 92.56 $6.97 2.44 $4.53 2.99 (3.98) Year 5 $104.50 97.19 $7.31 2.56 $4.75 3.14 (4.18) Assuming a tax rate of 35 percent, discount rate of 12 percent, and inflation of 2.5 percent, is Leonid worth $270 million to Sirius? (20%)

Step by Step Solution

★★★★★

3.27 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

4 To calculate the value of the new technology to Sirius we can use the discounted cash flow DCF approach The present value of the cash flows from the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started