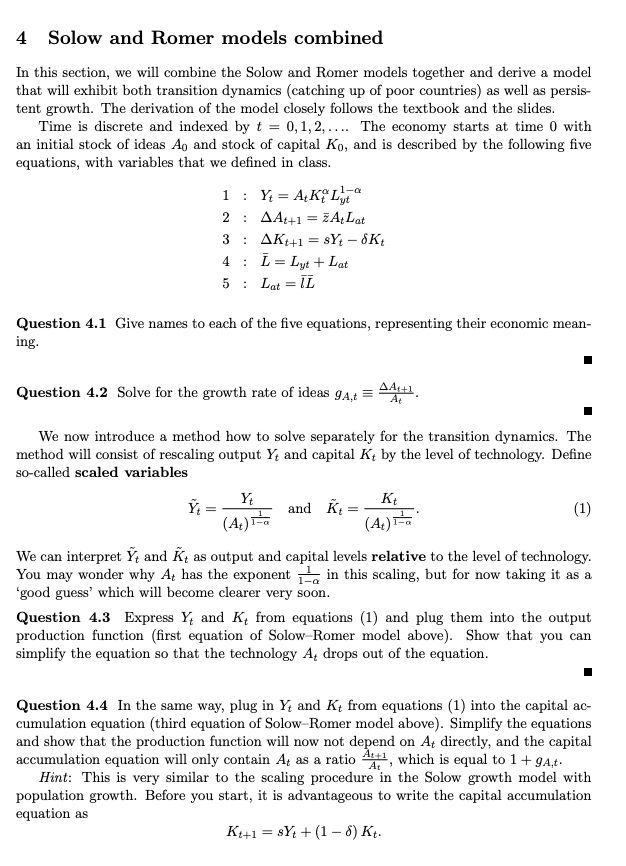

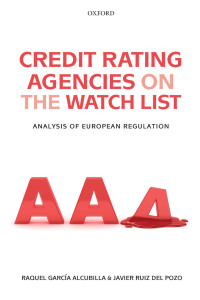

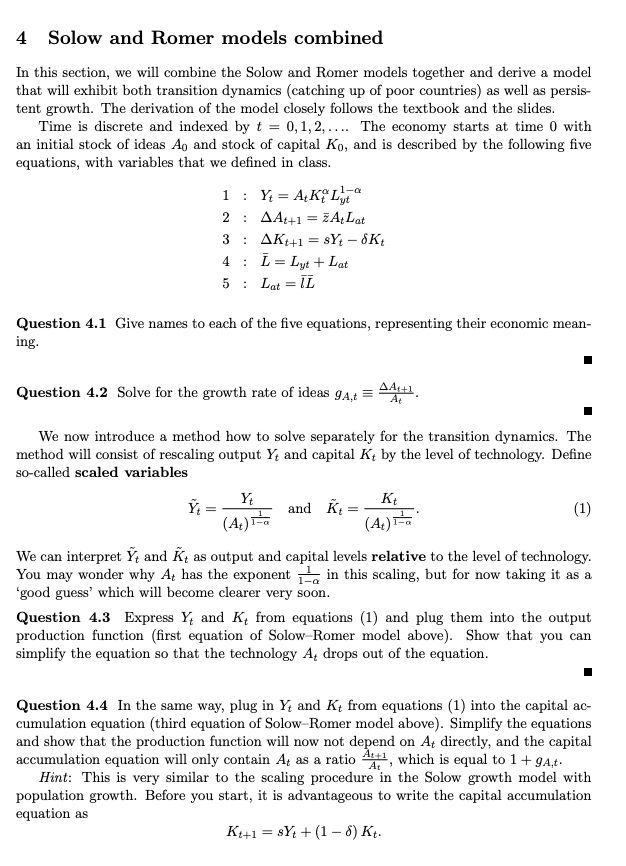

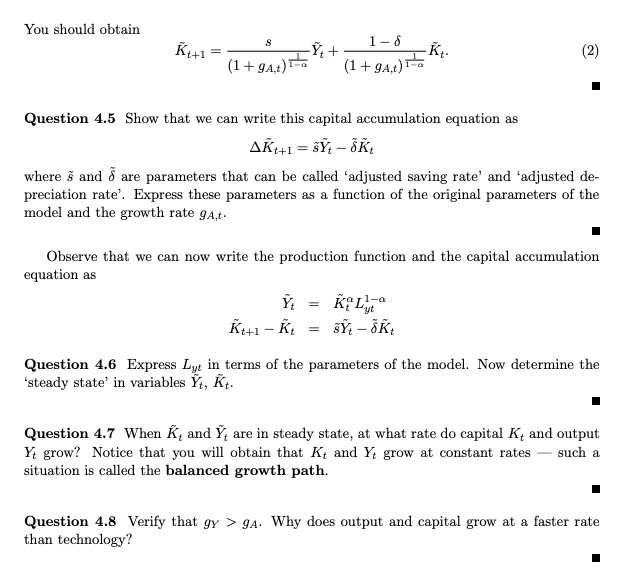

4 Solow and Romer models combined In this section, we will combine the Solow and Romer models together and derive a model that will exhibit both transition dynamics (catching up of poor countries) as well as persis- tent growth. The derivation of the model closely follows the textbook and the slides. Time is discrete and indexed by t = 0,1,2,.... The economy starts at time 0 with an initial stock of ideas Ao and stock of capital Ko, and is described by the following five equations, with variables that we defined in class. : Y = AKIL : A4+1 = 2 A Lat : Akt+1 = SY-8K7 I = Lyt +Lat 5 : Lat = IL 1 1-a 2 3 4 : Question 4.1 Give names to each of the five equations, representing their economic mean- ing. Question 4.2 Solve for the growth rate of ideas 9A, A4+1 A We now introduce a method how to solve separately for the transition dynamics. The method will consist of rescaling output Yt and capital Kt by the level of technology. Define so-called scaled variables Yt Kt and K = (1) (Ac) 1-a (Ac)-a We can interpret t and Ke as output and capital levels relative to the level of technology. You may wonder why A4 has the exponent 1 in this scaling, but for now taking it as a "good guess' which will become clearer very soon. Question 4.3 Express Y, and Ky from equations (1) and plug them into the output production function (first equation of Solow-Romer model above). Show that you can simplify the equation so that the technology A4 drops out of the equation. Question 4.4 In the same way, plug in Yt and Kt from equations (1) into the capital ac- cumulation equation (third equation of Solow-Romer model above). Simplify the equations and show that the production function will now not depend on At directly, and the capital accumulation equation will only contain At as a ratio 4+1, which is equal to 1+9A,t. Hint: This is very similar to the scaling procedure in the Solow growth model with population growth. Before you start, it is advantageous to write the capital accumulation equation as Kt+1 = sY+ +(1-6) Kt. At You should obtain S Kt+1 1-8 -Y + (1 +9A,) -K. (2) (1 + 9A,t) 1 Question 4.5 Show that we can write this capital accumulation equation as AK4+1 = sr - where ; and are parameters that can be called adjusted saving rate' and adjusted de- preciation rate'. Express these parameters as a function of the original parameters of the model and the growth rate gat. 1 Observe that we can now write the production function and the capital accumulation equation as Y; = Kt+1 - K = si - Kt 'yt Question 4.6 Express Lyt in terms of the parameters of the model. Now determine the 'steady state' in variables #t, Kt. Question 4.7 When K4 and are in steady state, at what rate do capital K4 and output Yt grow? Notice that you will obtain that Kt and Y4 grow at constant rates such a situation is called the balanced growth path. Question 4.8 Verify that gy > 9A. Why does output and capital grow at a faster rate than technology? 4 Solow and Romer models combined In this section, we will combine the Solow and Romer models together and derive a model that will exhibit both transition dynamics (catching up of poor countries) as well as persis- tent growth. The derivation of the model closely follows the textbook and the slides. Time is discrete and indexed by t = 0,1,2,.... The economy starts at time 0 with an initial stock of ideas Ao and stock of capital Ko, and is described by the following five equations, with variables that we defined in class. : Y = AKIL : A4+1 = 2 A Lat : Akt+1 = SY-8K7 I = Lyt +Lat 5 : Lat = IL 1 1-a 2 3 4 : Question 4.1 Give names to each of the five equations, representing their economic mean- ing. Question 4.2 Solve for the growth rate of ideas 9A, A4+1 A We now introduce a method how to solve separately for the transition dynamics. The method will consist of rescaling output Yt and capital Kt by the level of technology. Define so-called scaled variables Yt Kt and K = (1) (Ac) 1-a (Ac)-a We can interpret t and Ke as output and capital levels relative to the level of technology. You may wonder why A4 has the exponent 1 in this scaling, but for now taking it as a "good guess' which will become clearer very soon. Question 4.3 Express Y, and Ky from equations (1) and plug them into the output production function (first equation of Solow-Romer model above). Show that you can simplify the equation so that the technology A4 drops out of the equation. Question 4.4 In the same way, plug in Yt and Kt from equations (1) into the capital ac- cumulation equation (third equation of Solow-Romer model above). Simplify the equations and show that the production function will now not depend on At directly, and the capital accumulation equation will only contain At as a ratio 4+1, which is equal to 1+9A,t. Hint: This is very similar to the scaling procedure in the Solow growth model with population growth. Before you start, it is advantageous to write the capital accumulation equation as Kt+1 = sY+ +(1-6) Kt. At You should obtain S Kt+1 1-8 -Y + (1 +9A,) -K. (2) (1 + 9A,t) 1 Question 4.5 Show that we can write this capital accumulation equation as AK4+1 = sr - where ; and are parameters that can be called adjusted saving rate' and adjusted de- preciation rate'. Express these parameters as a function of the original parameters of the model and the growth rate gat. 1 Observe that we can now write the production function and the capital accumulation equation as Y; = Kt+1 - K = si - Kt 'yt Question 4.6 Express Lyt in terms of the parameters of the model. Now determine the 'steady state' in variables #t, Kt. Question 4.7 When K4 and are in steady state, at what rate do capital K4 and output Yt grow? Notice that you will obtain that Kt and Y4 grow at constant rates such a situation is called the balanced growth path. Question 4.8 Verify that gy > 9A. Why does output and capital grow at a faster rate than technology