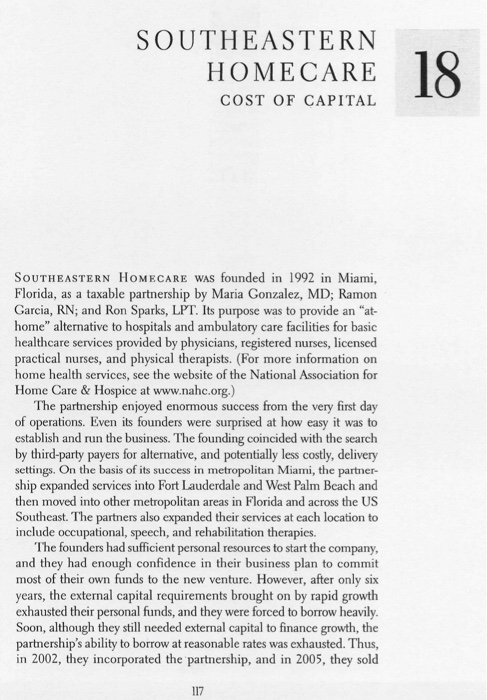

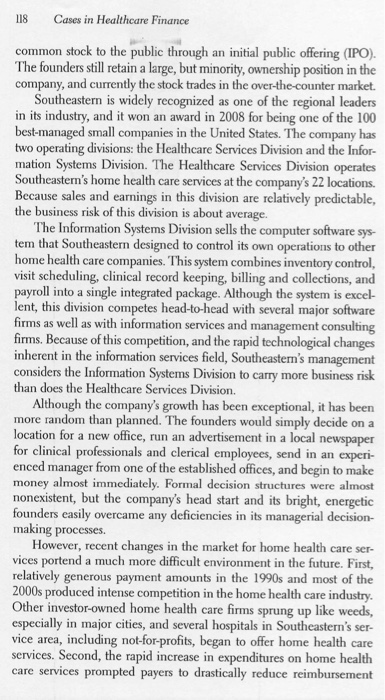

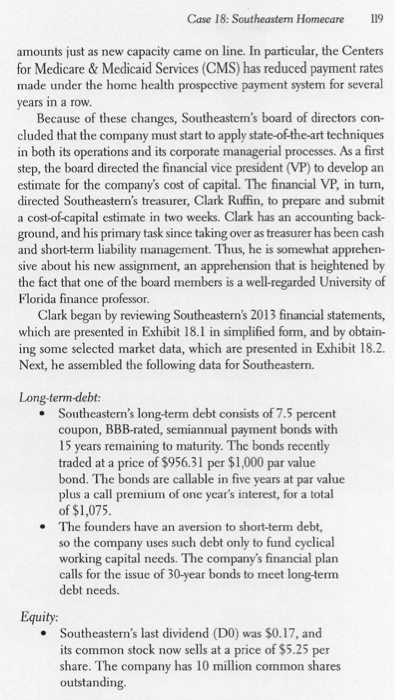

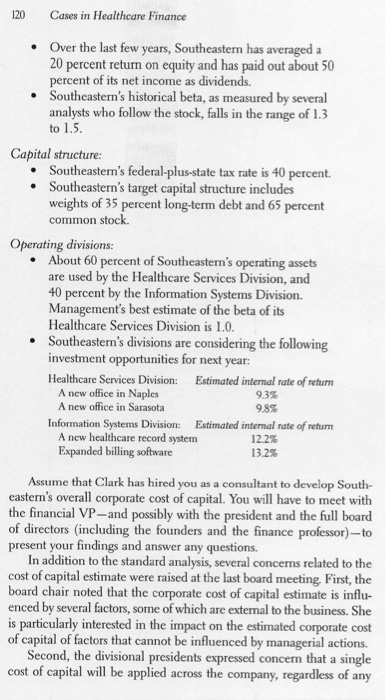

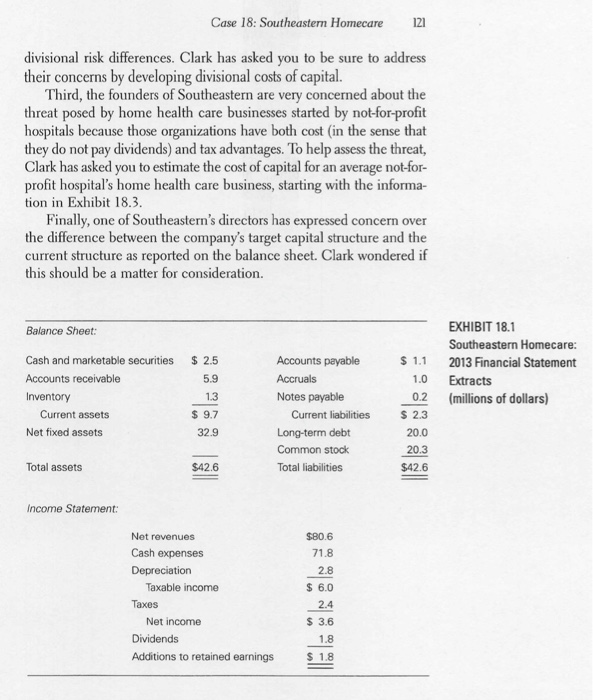

4. Southeastern Homecare has two operating divisions: the Healthcare Services Division and the Information Systems Division. a. Estimate the divisional cost of capital for each of Southeastern's divisions assuming that both divisions have the same optimal (target) capital structure. (Hint: Use the CAPM to produce a cost of equity for each division and assume the same corporate tax rate and debt cost for each division.) b. Southeastern's divisions are each considering two investment opportunities for next year. In which of the projects should Southeastern invest? C. The divisional presidents have expressed concern that a single cost of capital will be applied across the company, regardless of any divisional risk differences. What would be the short-term and long- term consequences of Southeastern using a single cost of capital for both divisions? d. Is the divisional cost of capital applicable for all projects within that division? Explain. e. Suppose that one division has a greater capacity for debt financing than the other (perhaps due to higher asset value and profitability.) How could different target capital structures be incorporated into the divisional costs of capital? SOUTHEASTERN HOMECARE COST OF CAPITAL SOUTHEASTERN HOMECARE WAS founded in 1992 in Miami, Florida, as a taxable partnership by Maria Gonzalez, MD; Ramon Garcia, RN; and Ron Sparks, LPT. Its purpose was to provide an "at- home" alternative to hospitals and ambulatory care facilities for basic healthcare services provided by physicians, registered nurses, licensed practical nurses, and physical therapists. (For more information on home health services, see the website of the National Association for Home Care & Hospice at www.nahc.org.) The partnership enjoyed enormous success from the very first day of operations. Even its founders were surprised at how easy it was to establish and run the business. The founding coincided with the search by third-party payers for alternative, and potentially less costly, delivery settings. On the basis of its success in metropolitan Miami, the partner ship expanded services into Fort Lauderdale and West Palm Beach and then moved into other metropolitan areas in Florida and across the US Southeast. The partners also expanded their services at each location to include occupational, speech, and rehabilitation therapies. The founders had sufficient personal resources to start the company, and they had enough confidence in their business plan to commit most of their own funds to the new venture. However, after only six years, the external capital requirements brought on by rapid growth exhausted their personal funds, and they were forced to borrow heavily. Soon, although they still needed external capital to finance growth, the partnership's ability to borrow at reasonable rates was exhausted. Thus, in 2002, they incorporated the partnership, and in 2005, they sold 17 118 Cases in Healthcare Finance common stock to the public through an initial public offering (IPO). The founders still retain a large, but minority, ownership position in the company, and currently the stock trades in the over-the-counter market. Southeastern is widely recognized as one of the regional leaders in its industry, and it won an award in 2008 for being one of the 100 best-managed small companies in the United States. The company has two operating divisions: the Healthcare Services Division and the Infor- mation Systems Division. The Healthcare Services Division operates Southeastern's home health care services at the company's 22 locations. Because sales and earnings in this division are relatively predictable, the business risk of this division is about average. The Information Systems Division sells the computer software sys- tem that Southeastern designed to control its own operations to other home health care companies. This system combines inventory control, visit scheduling, clinical record keeping, billing and collections, and payroll into a single integrated package. Although the system is excel- lent, this division competes head-to-head with several major software firms as well as with information services and management consulting firms. Because of this competition, and the rapid technological changes inherent in the information services field, Southeaster's management considers the Information Systems Division to carry more business risk than does the Healthcare Services Division. Although the company's growth has been exceptional, it has been more random than planned. The founders would simply decide on a location for a new office, run an advertisement in a local newspaper for clinical professionals and clerical employees, send in an experi- enced manager from one of the established offices, and begin to make money almost immediately. Formal decision structures were almost nonexistent, but the company's head start and its bright, energetic founders easily overcame any deficiencies in its managerial decision- making processes. However, recent changes in the market for home health care ser- vices portend a much more difficult environment in the future. First, relatively generous payment amounts in the 1990s and most of the 2000s produced intense competition in the home health care industry. Other investor-owned home health care firms sprung up like weeds, especially in major cities, and several hospitals in Southeastern's ser- vice area, including not-for-profits, began to offer home health care services. Second, the rapid increase in expenditures on home health care services prompted payers to drastically reduce reimbursement Case 18: Southeastern Homecare 119 amounts just as new capacity came on line. In particular, the Centers for Medicare & Medicaid Services (CMS) has reduced payment rates made under the home health prospective payment system for several years in a row. Because of these changes, Southeaster's board of directors con- cluded that the company must start to apply state-of-the-art techniques in both its operations and its corporate managerial processes. As a first step, the board directed the financial vice president (VP) to develop an estimate for the company's cost of capital. The financial VP, in tum, directed Southeastern's treasurer, Clark Ruffin, to prepare and submit a cost-of-capital estimate in two weeks. Clark has an accounting back- ground, and his primary task since taking over as treasurer has been cash and short-term liability management. Thus, he is somewhat apprehen- sive about his new assignment, an apprehension that is heightened by the fact that one of the board members is a well-regarded University of Florida finance professor. Clark began by reviewing Southeastern's 2013 financial statements, which are presented in Exhibit 18.1 in simplified form, and by obtain- ing some selected market data, which are presented in Exhibit 18.2. Next, he assembled the following data for Southeastern. Long-term-debt: Southeastern's long-term debt consists of 7.5 percent coupon, BBB-rated, semiannual payment bonds with 15 years remaining to maturity. The bonds recently traded at a price of $956.31 per $1,000 par value bond. The bonds are callable in five years at par value plus a call premium of one year's interest, for a total of $1,075. The founders have an aversion to short-term debt, so the company uses such debt only to fund cyclical working capital needs. The company's financial plan calls for the issue of 30-year bonds to meet long-term debt needs. Equity: Southeastern's last dividend (DO) was $0.17, and its common stock now sells at a price of $5.25 per share. The company has 10 million common shares outstanding 120 Cases in Healthcare Finance Over the last few years, Southeastern has averaged a 20 percent return on equity and has paid out about 50 percent of its net income as dividends. Southeastern's historical beta, as measured by several analysts who follow the stock, falls in the range of 1.3 to 1.5. Capital structure: Southeastern's federal-plus-state tax rate is 40 percent. Southeastern's target capital structure includes weights of 35 percent long-term debt and 65 percent common stock. Operating divisions: About 60 percent of Southeastern's operating assets are used by the Healthcare Services Division, and 40 percent by the Information Systems Division. Management's best estimate of the beta of its Healthcare Services Division is 1.0. Southeastern's divisions are considering the following investment opportunities for next year: Healthcare Services Division: Estimated internal rate of retum A new office in Naples A new office in Sarasota 9.8% Information Systems Division: Estimated internal rate of return A new healthcare record system 12.2% Expanded billing software 13.2% 9.33 Assume that Clark has hired you as a consultant to develop South- eastern's overall corporate cost of capital. You will have to meet with the financial VP-and possibly with the president and the full board of directors (including the founders and the finance professor)--to present your findings and answer any questions. In addition to the standard analysis, several concerns related to the cost of capital estimate were raised at the last board meeting, First, the board chair noted that the corporate cost of capital estimate is influ- enced by several factors, some of which are external to the business. She is particularly interested in the impact on the estimated corporate cost of capital of factors that cannot be influenced by managerial actions. Second, the divisional presidents expressed concern that a single cost of capital will be applied across the company, regardless of any Case 18: Southeastern Homecare 121 divisional risk differences. Clark has asked you to be sure to address their concerns by developing divisional costs of capital. Third, the founders of Southeastern are very concerned about the threat posed by home health care businesses started by not-for-profit hospitals because those organizations have both cost in the sense that they do not pay dividends) and tax advantages. To help assess the threat, Clark has asked you to estimate the cost of capital for an average not-for- profit hospital's home health care business, starting with the informa- tion in Exhibit 18.3. Finally, one of Southeastern's directors has expressed concern over the difference between the company's target capital structure and the current structure as reported on the balance sheet. Clark wondered if this should be a matter for consideration. Balance Sheet: $ 1.1 $2.5 5.9 EXHIBIT 18.1 Southeastern Homecare: 2013 Financial Statement Extracts (millions of dollars) Cash and marketable securities Accounts receivable Inventory Current assets Net fixed assets 1.0 0.2 $ 9.7 Accounts payable Accruals Notes payable Current liabilities Long-term debt Common stock Total liabilities $ 23 32.9 20.0 20.3 Total assets $42.6 $426 Income Statement: $80.6 Net revenues Cash expenses Depreciation Taxable income Taxes Net income Dividends Additions to retained earnings EME 122 Cases in Healthcare Finance EXHIBIT 18.2 Selected Market Data Expected Rate of Return on the Market: Expected rate of return on the S&P 500 Index = 11.0% Required Rate of Return on Long-Term Debt of an Average Company: Yield to maturity on A-rated long-term debt for a company with a beta of 1.0 -70% Current yield curve on US Treasury Securities: Yield 2.5% 3.0 3.3 Term to Maturity 3 months 6 months 9 months 1 year 5 years 10 years 15 years 20 years 25 years 30 years EXHIBIT 18.3 Selected Not-for-Profit Hospital Data Average Long-Term Capital Structure: 30 percent debt 70 percent equity (net assets) Average Cost of Debt: Interest rate on A-rated tax-exempt bonds = 5.0% 4. Southeastern Homecare has two operating divisions: the Healthcare Services Division and the Information Systems Division. a. Estimate the divisional cost of capital for each of Southeastern's divisions assuming that both divisions have the same optimal (target) capital structure. (Hint: Use the CAPM to produce a cost of equity for each division and assume the same corporate tax rate and debt cost for each division.) b. Southeastern's divisions are each considering two investment opportunities for next year. In which of the projects should Southeastern invest? C. The divisional presidents have expressed concern that a single cost of capital will be applied across the company, regardless of any divisional risk differences. What would be the short-term and long- term consequences of Southeastern using a single cost of capital for both divisions? d. Is the divisional cost of capital applicable for all projects within that division? Explain. e. Suppose that one division has a greater capacity for debt financing than the other (perhaps due to higher asset value and profitability.) How could different target capital structures be incorporated into the divisional costs of capital? SOUTHEASTERN HOMECARE COST OF CAPITAL SOUTHEASTERN HOMECARE WAS founded in 1992 in Miami, Florida, as a taxable partnership by Maria Gonzalez, MD; Ramon Garcia, RN; and Ron Sparks, LPT. Its purpose was to provide an "at- home" alternative to hospitals and ambulatory care facilities for basic healthcare services provided by physicians, registered nurses, licensed practical nurses, and physical therapists. (For more information on home health services, see the website of the National Association for Home Care & Hospice at www.nahc.org.) The partnership enjoyed enormous success from the very first day of operations. Even its founders were surprised at how easy it was to establish and run the business. The founding coincided with the search by third-party payers for alternative, and potentially less costly, delivery settings. On the basis of its success in metropolitan Miami, the partner ship expanded services into Fort Lauderdale and West Palm Beach and then moved into other metropolitan areas in Florida and across the US Southeast. The partners also expanded their services at each location to include occupational, speech, and rehabilitation therapies. The founders had sufficient personal resources to start the company, and they had enough confidence in their business plan to commit most of their own funds to the new venture. However, after only six years, the external capital requirements brought on by rapid growth exhausted their personal funds, and they were forced to borrow heavily. Soon, although they still needed external capital to finance growth, the partnership's ability to borrow at reasonable rates was exhausted. Thus, in 2002, they incorporated the partnership, and in 2005, they sold 17 118 Cases in Healthcare Finance common stock to the public through an initial public offering (IPO). The founders still retain a large, but minority, ownership position in the company, and currently the stock trades in the over-the-counter market. Southeastern is widely recognized as one of the regional leaders in its industry, and it won an award in 2008 for being one of the 100 best-managed small companies in the United States. The company has two operating divisions: the Healthcare Services Division and the Infor- mation Systems Division. The Healthcare Services Division operates Southeastern's home health care services at the company's 22 locations. Because sales and earnings in this division are relatively predictable, the business risk of this division is about average. The Information Systems Division sells the computer software sys- tem that Southeastern designed to control its own operations to other home health care companies. This system combines inventory control, visit scheduling, clinical record keeping, billing and collections, and payroll into a single integrated package. Although the system is excel- lent, this division competes head-to-head with several major software firms as well as with information services and management consulting firms. Because of this competition, and the rapid technological changes inherent in the information services field, Southeaster's management considers the Information Systems Division to carry more business risk than does the Healthcare Services Division. Although the company's growth has been exceptional, it has been more random than planned. The founders would simply decide on a location for a new office, run an advertisement in a local newspaper for clinical professionals and clerical employees, send in an experi- enced manager from one of the established offices, and begin to make money almost immediately. Formal decision structures were almost nonexistent, but the company's head start and its bright, energetic founders easily overcame any deficiencies in its managerial decision- making processes. However, recent changes in the market for home health care ser- vices portend a much more difficult environment in the future. First, relatively generous payment amounts in the 1990s and most of the 2000s produced intense competition in the home health care industry. Other investor-owned home health care firms sprung up like weeds, especially in major cities, and several hospitals in Southeastern's ser- vice area, including not-for-profits, began to offer home health care services. Second, the rapid increase in expenditures on home health care services prompted payers to drastically reduce reimbursement Case 18: Southeastern Homecare 119 amounts just as new capacity came on line. In particular, the Centers for Medicare & Medicaid Services (CMS) has reduced payment rates made under the home health prospective payment system for several years in a row. Because of these changes, Southeaster's board of directors con- cluded that the company must start to apply state-of-the-art techniques in both its operations and its corporate managerial processes. As a first step, the board directed the financial vice president (VP) to develop an estimate for the company's cost of capital. The financial VP, in tum, directed Southeastern's treasurer, Clark Ruffin, to prepare and submit a cost-of-capital estimate in two weeks. Clark has an accounting back- ground, and his primary task since taking over as treasurer has been cash and short-term liability management. Thus, he is somewhat apprehen- sive about his new assignment, an apprehension that is heightened by the fact that one of the board members is a well-regarded University of Florida finance professor. Clark began by reviewing Southeastern's 2013 financial statements, which are presented in Exhibit 18.1 in simplified form, and by obtain- ing some selected market data, which are presented in Exhibit 18.2. Next, he assembled the following data for Southeastern. Long-term-debt: Southeastern's long-term debt consists of 7.5 percent coupon, BBB-rated, semiannual payment bonds with 15 years remaining to maturity. The bonds recently traded at a price of $956.31 per $1,000 par value bond. The bonds are callable in five years at par value plus a call premium of one year's interest, for a total of $1,075. The founders have an aversion to short-term debt, so the company uses such debt only to fund cyclical working capital needs. The company's financial plan calls for the issue of 30-year bonds to meet long-term debt needs. Equity: Southeastern's last dividend (DO) was $0.17, and its common stock now sells at a price of $5.25 per share. The company has 10 million common shares outstanding 120 Cases in Healthcare Finance Over the last few years, Southeastern has averaged a 20 percent return on equity and has paid out about 50 percent of its net income as dividends. Southeastern's historical beta, as measured by several analysts who follow the stock, falls in the range of 1.3 to 1.5. Capital structure: Southeastern's federal-plus-state tax rate is 40 percent. Southeastern's target capital structure includes weights of 35 percent long-term debt and 65 percent common stock. Operating divisions: About 60 percent of Southeastern's operating assets are used by the Healthcare Services Division, and 40 percent by the Information Systems Division. Management's best estimate of the beta of its Healthcare Services Division is 1.0. Southeastern's divisions are considering the following investment opportunities for next year: Healthcare Services Division: Estimated internal rate of retum A new office in Naples A new office in Sarasota 9.8% Information Systems Division: Estimated internal rate of return A new healthcare record system 12.2% Expanded billing software 13.2% 9.33 Assume that Clark has hired you as a consultant to develop South- eastern's overall corporate cost of capital. You will have to meet with the financial VP-and possibly with the president and the full board of directors (including the founders and the finance professor)--to present your findings and answer any questions. In addition to the standard analysis, several concerns related to the cost of capital estimate were raised at the last board meeting, First, the board chair noted that the corporate cost of capital estimate is influ- enced by several factors, some of which are external to the business. She is particularly interested in the impact on the estimated corporate cost of capital of factors that cannot be influenced by managerial actions. Second, the divisional presidents expressed concern that a single cost of capital will be applied across the company, regardless of any Case 18: Southeastern Homecare 121 divisional risk differences. Clark has asked you to be sure to address their concerns by developing divisional costs of capital. Third, the founders of Southeastern are very concerned about the threat posed by home health care businesses started by not-for-profit hospitals because those organizations have both cost in the sense that they do not pay dividends) and tax advantages. To help assess the threat, Clark has asked you to estimate the cost of capital for an average not-for- profit hospital's home health care business, starting with the informa- tion in Exhibit 18.3. Finally, one of Southeastern's directors has expressed concern over the difference between the company's target capital structure and the current structure as reported on the balance sheet. Clark wondered if this should be a matter for consideration. Balance Sheet: $ 1.1 $2.5 5.9 EXHIBIT 18.1 Southeastern Homecare: 2013 Financial Statement Extracts (millions of dollars) Cash and marketable securities Accounts receivable Inventory Current assets Net fixed assets 1.0 0.2 $ 9.7 Accounts payable Accruals Notes payable Current liabilities Long-term debt Common stock Total liabilities $ 23 32.9 20.0 20.3 Total assets $42.6 $426 Income Statement: $80.6 Net revenues Cash expenses Depreciation Taxable income Taxes Net income Dividends Additions to retained earnings EME 122 Cases in Healthcare Finance EXHIBIT 18.2 Selected Market Data Expected Rate of Return on the Market: Expected rate of return on the S&P 500 Index = 11.0% Required Rate of Return on Long-Term Debt of an Average Company: Yield to maturity on A-rated long-term debt for a company with a beta of 1.0 -70% Current yield curve on US Treasury Securities: Yield 2.5% 3.0 3.3 Term to Maturity 3 months 6 months 9 months 1 year 5 years 10 years 15 years 20 years 25 years 30 years EXHIBIT 18.3 Selected Not-for-Profit Hospital Data Average Long-Term Capital Structure: 30 percent debt 70 percent equity (net assets) Average Cost of Debt: Interest rate on A-rated tax-exempt bonds = 5.0%