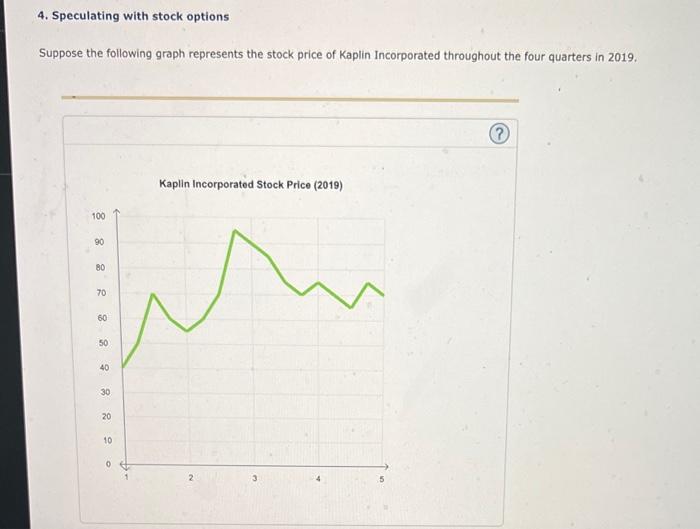

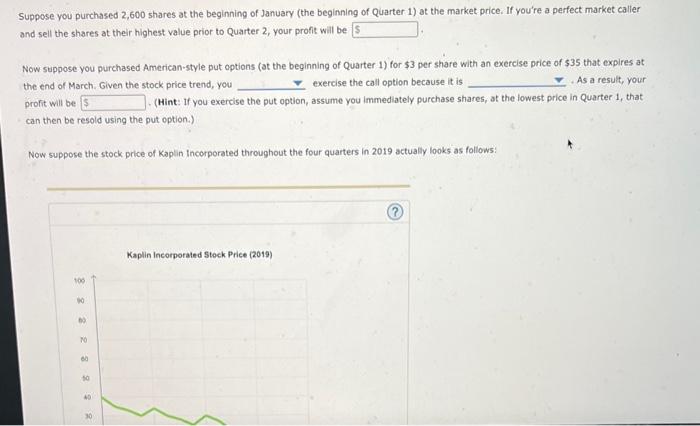

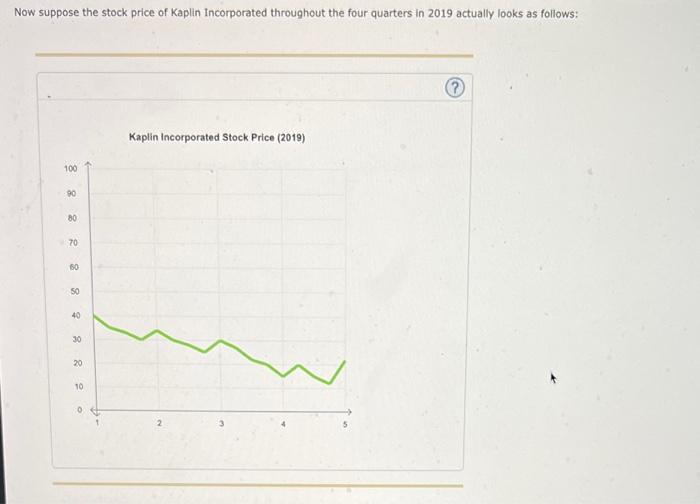

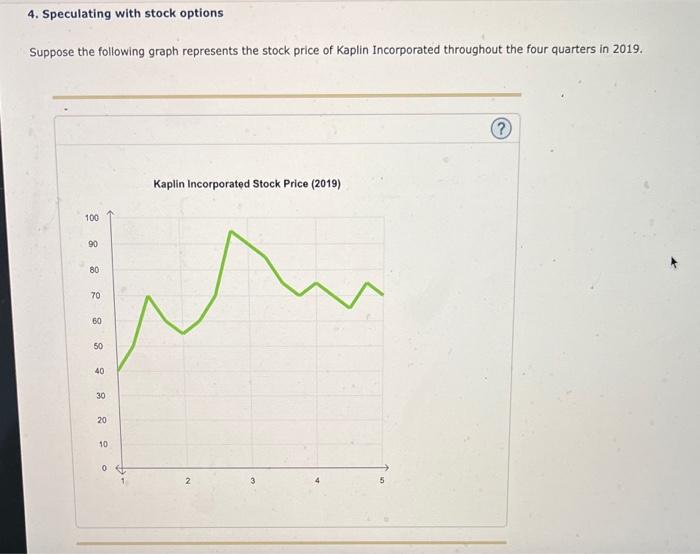

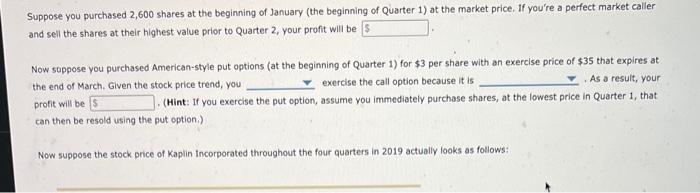

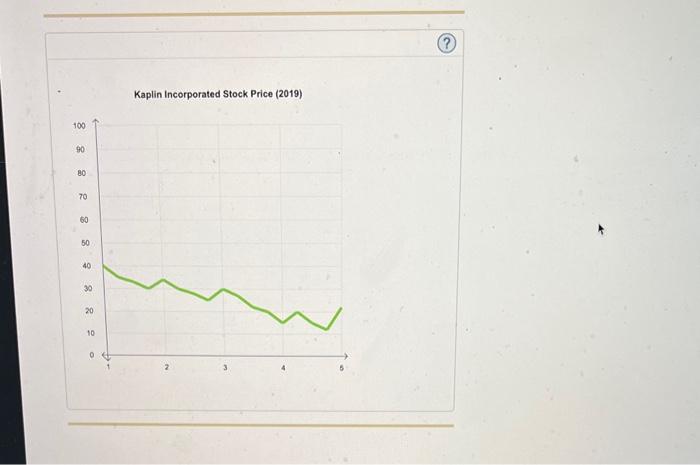

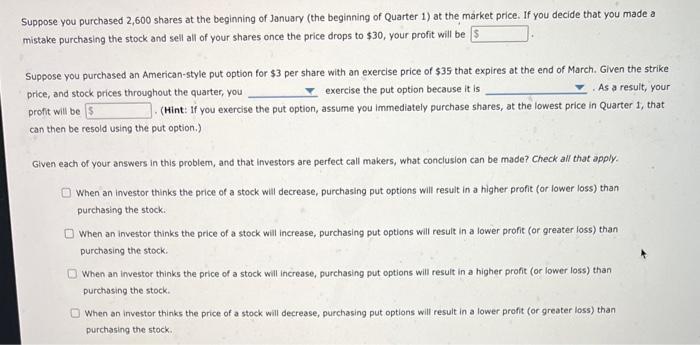

4. Speculating with stock options Suppose the following graph represents the stock price of Kaplin Incorporated throughout the four quarters in 2019. Suppose you purchased 2,600 shares at the beginning of January (the beginning of Quarter 1 ) at the market price. If you're a perfect market caller and sell the shares at their highest value prior to Quarter 2 , your profit will be Now suppose you purchased American-style put options (at the beginning of Quarter 1 ) for $3 per share with an exercise price of $35 that expires at the end of March. Given the stock price trend, you exercise the call option because it is As a result, your profit will be (Hint: If you exercise the put option, assume you immediately purchase shares, at the lowest price in Quarter 1 , that can then be resold using the put option.) Now suppose the stock price of Kaplin Incorporated throughout the four quarters in 2019 actually looks as follows: Now suppose the stock price of Kaplin Incorporated throughout the four quarters in 2019 actually looks as follows: Suppose you purchased 2,600 shares at the beginning of January (the beginning of Quarter 1 ) at the market price. If you declde that you made a mistake purchasing the stock and sell all of your shares once the price drops to $30, your profit will be Suppose you purchased an American-style put option for $3 per share with an exerclse price of $35 that explres at the end of March. Given the strike price, and stock prices throughout the quarter, you exercise the put option because it is profit wili be (Hint: If you exerdise the put option, assume you immediately purchase shares, at the lowest price in Quarter 1, that can then be resold using the put option.) Given each of your answers in this problem, and that investors are pertect call makers, what conclusion can be made? Check ail that apply. When an investor thinks the price of a stock will decrease, purchasing put options will result in a higher profit (or lower loss) than purchasing the stock. When an imestor thinks the price of a stock will increase, purchasing put options will result in a lower profit (or greater loss) than purchasing the stock. When an investor thinks the price of a stock will increase, purchasing put options will result in a higher profit (or lower loss) than purchasing the stock. When an irvestor thinks the price of a stock will decrease, purchasing put options will result in a lower profit (or greater loss) than purchasing the stock. 4. Speculating with stock options Suppose the following graph represents the stock price of Kaplin Incorporated throughout the four quarters in 2019. (?) Suppose you purchased 2,600 shares at the beginning of January (the beginning of Quarter 1 ) at the market price. If you're a perfect market caller and sell the shares at their highest value prior to Quarter 2 , your profit will be Now soppose you purchased American-style put options (at the beginning of Quarter 1 ) for $3 per share with an exercise price of $35 that expires at the end of March. Given the stock price trend, you exercise the call option because it is . As a result, your profit will be (Hint: If you exercise the put option, assume you immediately purchase shares, at the lowest price in Quarter 1 , that can then be resold using the put option.) Now suppose the stock price of Kaplin Incorporated throughout the four quarters in 2019 actually looks as follows: (?) Kaplin Incorporated Stock Price (2019) Suppose you purchased 2,600 shares at the beginning of January (the beginning of Quarter 1 ) at the market price. If you decide that you made a mistake purchasing the stock and sell all of your shares once the price drops to $30, your profit will be Suppose you purchased an American-style put option for $3 per share with an exercise price of $35 that expires at the end of March. Given the strike price, and stock prices throughout the quarter, you exercise the put option because it is . As a result, your prolit will be (Hint: If you exercise the put option, assume you immediately purchase shares, at the lowest price in Quarter 1, that can then be resold using the put option.) Given each of your answers in this problem, and that investors are perfect call makers, what conclusion can be made? Check all that apply. When an investor thinks the price of a stock will decrease, purchasing put options will result in a higher profit (or lower loss) than purchasing the stock: When an investor thinks the price of a stock will increase, purchasing put options will result in a lower profit (or greater loss) than purchasing the stock. When an investor thinks the price of a stock will increase, purchasing put options will result in a higher profit (or lower loss) than purchosing the stock. When an investor thinks the price of a stock will decrease, purchasing put options will result in a lower profit (or greater loss) than purchasing the stock. 4. Speculating with stock options Suppose the following graph represents the stock price of Kaplin Incorporated throughout the four quarters in 2019. Suppose you purchased 2,600 shares at the beginning of January (the beginning of Quarter 1 ) at the market price. If you're a perfect market caller and sell the shares at their highest value prior to Quarter 2 , your profit will be Now suppose you purchased American-style put options (at the beginning of Quarter 1 ) for $3 per share with an exercise price of $35 that expires at the end of March. Given the stock price trend, you exercise the call option because it is As a result, your profit will be (Hint: If you exercise the put option, assume you immediately purchase shares, at the lowest price in Quarter 1 , that can then be resold using the put option.) Now suppose the stock price of Kaplin Incorporated throughout the four quarters in 2019 actually looks as follows: Now suppose the stock price of Kaplin Incorporated throughout the four quarters in 2019 actually looks as follows: Suppose you purchased 2,600 shares at the beginning of January (the beginning of Quarter 1 ) at the market price. If you declde that you made a mistake purchasing the stock and sell all of your shares once the price drops to $30, your profit will be Suppose you purchased an American-style put option for $3 per share with an exerclse price of $35 that explres at the end of March. Given the strike price, and stock prices throughout the quarter, you exercise the put option because it is profit wili be (Hint: If you exerdise the put option, assume you immediately purchase shares, at the lowest price in Quarter 1, that can then be resold using the put option.) Given each of your answers in this problem, and that investors are pertect call makers, what conclusion can be made? Check ail that apply. When an investor thinks the price of a stock will decrease, purchasing put options will result in a higher profit (or lower loss) than purchasing the stock. When an imestor thinks the price of a stock will increase, purchasing put options will result in a lower profit (or greater loss) than purchasing the stock. When an investor thinks the price of a stock will increase, purchasing put options will result in a higher profit (or lower loss) than purchasing the stock. When an irvestor thinks the price of a stock will decrease, purchasing put options will result in a lower profit (or greater loss) than purchasing the stock. 4. Speculating with stock options Suppose the following graph represents the stock price of Kaplin Incorporated throughout the four quarters in 2019. (?) Suppose you purchased 2,600 shares at the beginning of January (the beginning of Quarter 1 ) at the market price. If you're a perfect market caller and sell the shares at their highest value prior to Quarter 2 , your profit will be Now soppose you purchased American-style put options (at the beginning of Quarter 1 ) for $3 per share with an exercise price of $35 that expires at the end of March. Given the stock price trend, you exercise the call option because it is . As a result, your profit will be (Hint: If you exercise the put option, assume you immediately purchase shares, at the lowest price in Quarter 1 , that can then be resold using the put option.) Now suppose the stock price of Kaplin Incorporated throughout the four quarters in 2019 actually looks as follows: (?) Kaplin Incorporated Stock Price (2019) Suppose you purchased 2,600 shares at the beginning of January (the beginning of Quarter 1 ) at the market price. If you decide that you made a mistake purchasing the stock and sell all of your shares once the price drops to $30, your profit will be Suppose you purchased an American-style put option for $3 per share with an exercise price of $35 that expires at the end of March. Given the strike price, and stock prices throughout the quarter, you exercise the put option because it is . As a result, your prolit will be (Hint: If you exercise the put option, assume you immediately purchase shares, at the lowest price in Quarter 1, that can then be resold using the put option.) Given each of your answers in this problem, and that investors are perfect call makers, what conclusion can be made? Check all that apply. When an investor thinks the price of a stock will decrease, purchasing put options will result in a higher profit (or lower loss) than purchasing the stock: When an investor thinks the price of a stock will increase, purchasing put options will result in a lower profit (or greater loss) than purchasing the stock. When an investor thinks the price of a stock will increase, purchasing put options will result in a higher profit (or lower loss) than purchosing the stock. When an investor thinks the price of a stock will decrease, purchasing put options will result in a lower profit (or greater loss) than purchasing the stock