Answered step by step

Verified Expert Solution

Question

1 Approved Answer

4. Suppose a bank has financed a $6,000,000 5-year loan with a semiannual coupon rate of 4.76% with a 3-year $6,000,000 CD with an

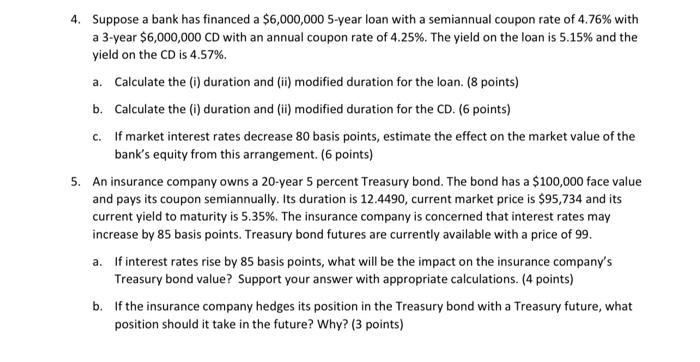

4. Suppose a bank has financed a $6,000,000 5-year loan with a semiannual coupon rate of 4.76% with a 3-year $6,000,000 CD with an annual coupon rate of 4.25%. The yield on the loan is 5.15% and the yield on the CD is 4.57%. a. Calculate the (i) duration and (ii) modified duration for the loan. (8 points) b. Calculate the (i) duration and (ii) modified duration for the CD. (6 points) c. If market interest rates decrease 80 basis points, estimate the effect on the market value of the bank's equity from this arrangement. (6 points) 5. An insurance company owns a 20-year 5 percent Treasury bond. The bond has a $100,000 face value and pays its coupon semiannually. Its duration is 12.4490, current market price is $95,734 and its current yield to maturity is 5.35%. The insurance company is concerned that interest rates may increase by 85 basis points. Treasury bond futures are currently available with a price of 99. a. If interest rates rise by 85 basis points, what will be the impact on the insurance company's Treasury bond value? Support your answer with appropriate calculations. (4 points) b. If the insurance company hedges its position in the Treasury bond with a Treasury future, what position should it take in the future? Why? (3 points)

Step by Step Solution

★★★★★

3.53 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

leen la caleulation of Duration of year y Cath PVA S151 k 6oa0Dx233...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started