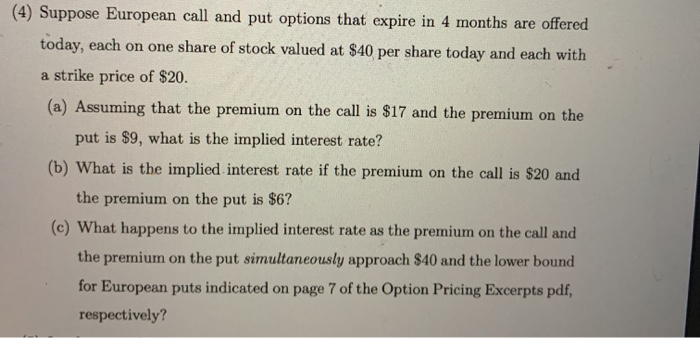

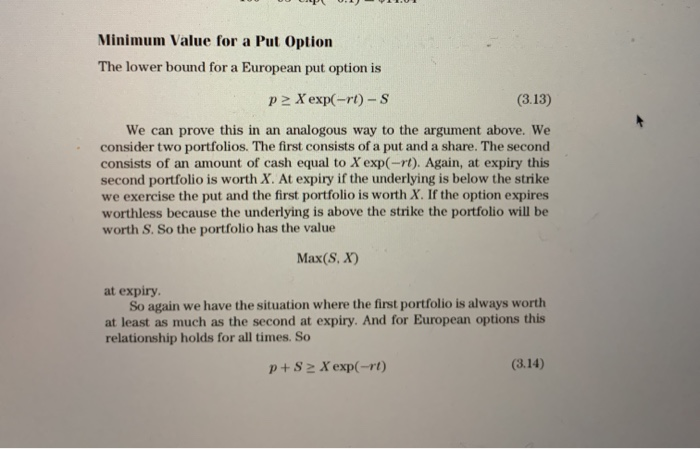

(4) Suppose European call and put options that expire in 4 months are offered today, each on one share of stock valued at $40 per share today and each with a strike price of $20. (a) Assuming that the premium on the call is $17 and the premium on the put is $9, what is the implied interest rate? (b) What is the implied interest rate if the premium on the call is $20 and the premium on the put is $6? (c) What happens to the implied interest rate as the premium on the call and the premium on the put simultaneously approach $40 and the lower bound for European puts indicated on page 7 of the Option Pricing Excerpts pdf, respectively? OOP 0. 1 110 Minimum Value for a Put Option The lower bound for a European put option is P2 X exp(-rt) -S (3.13) We can prove this in an analogous way to the argument above. We consider two portfolios. The first consists of a put and a share. The second consists of an amount of cash equal to X exp(-rt). Again, at expiry this second portfolio is worth X. At expiry if the underlying is below the strike we exercise the put and the first portfolio is worth X. If the option expires worthless because the underlying is above the strike the portfolio will be worth S. So the portfolio has the value Max(S.X) at expiry. So again we have the situation where the first portfolio is always worth at least as much as the second at expiry. And for European options this relationship holds for all times. So p+S2 X exp(-rt) (3.14) (4) Suppose European call and put options that expire in 4 months are offered today, each on one share of stock valued at $40 per share today and each with a strike price of $20. (a) Assuming that the premium on the call is $17 and the premium on the put is $9, what is the implied interest rate? (b) What is the implied interest rate if the premium on the call is $20 and the premium on the put is $6? (c) What happens to the implied interest rate as the premium on the call and the premium on the put simultaneously approach $40 and the lower bound for European puts indicated on page 7 of the Option Pricing Excerpts pdf, respectively? OOP 0. 1 110 Minimum Value for a Put Option The lower bound for a European put option is P2 X exp(-rt) -S (3.13) We can prove this in an analogous way to the argument above. We consider two portfolios. The first consists of a put and a share. The second consists of an amount of cash equal to X exp(-rt). Again, at expiry this second portfolio is worth X. At expiry if the underlying is below the strike we exercise the put and the first portfolio is worth X. If the option expires worthless because the underlying is above the strike the portfolio will be worth S. So the portfolio has the value Max(S.X) at expiry. So again we have the situation where the first portfolio is always worth at least as much as the second at expiry. And for European options this relationship holds for all times. So p+S2 X exp(-rt) (3.14)