Answered step by step

Verified Expert Solution

Question

1 Approved Answer

4. Suppose that a set of portfolio managers has a chance p = 50% of beating the market by 10% in a given year

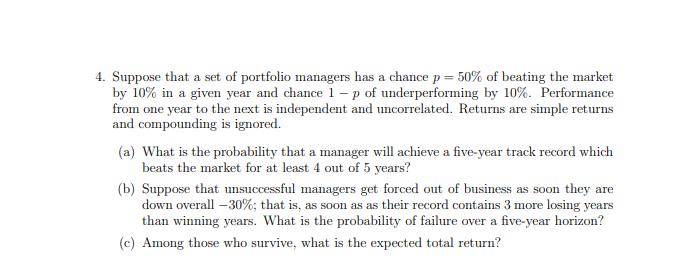

4. Suppose that a set of portfolio managers has a chance p = 50% of beating the market by 10% in a given year and chance 1 - p of underperforming by 10%. Performance from one year to the next is independent and uncorrelated. Returns are simple returns and compounding is ignored. (a) What is the probability that a manager will achieve a five-year track record which beats the market for at least 4 out of 5 years? (b) Suppose that unsuccessful managers get forced out of business as soon they are down overall -30%; that is, as soon as as their record contains 3 more losing years than winning years. What is the probability of failure over a five-year horizon? (c) Among those who survive, what is the expected total return?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Probability of Beating the Market for at Least 4 out of 5 Years We can solve this problem using binomial probability Each year theres a 50 chance of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started