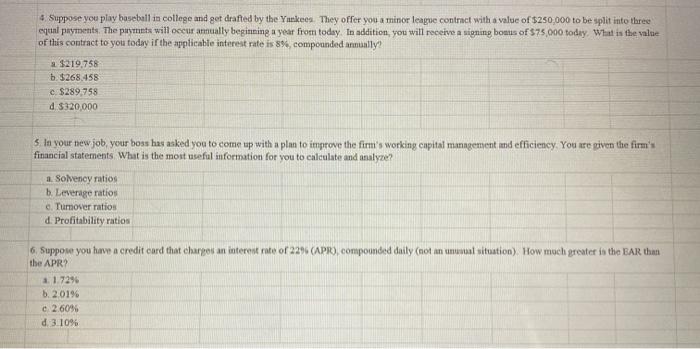

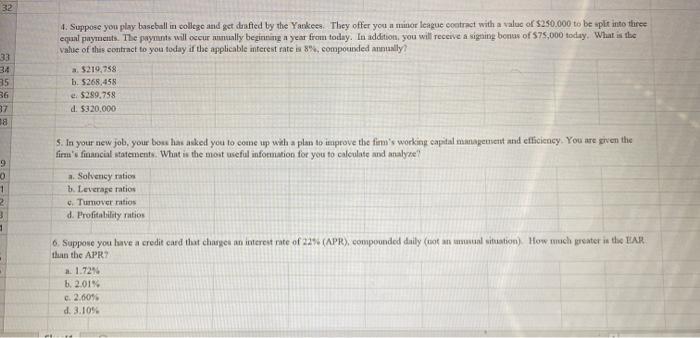

4. Suppose you play baseball in college and get drafted by the Yuukes. They offer you a minor league contract with a value of $250,000 to be split into three equal payments. The puytints will occur ammually beginning a year from today. In addition, you will receive a signing bonus of $75,000 today. What is the value of this contract to you today if the applicable interest rate is 8%, compounded annually $219,758 b. $268.458 c. $289,758 d. $320,000 5 lavour newjob, your boss has asked you to come up with a plan to improve the firm's working capital management and efficiency. You are given the firm's financial statements What is the most useful information for you to calculate and analyze? 1. Solvency ratios b. Leverage ratios Tumover ratios d. Profitability ratios 6. Suppose you have a credit card that charpes an interest rate of 22% (APR), compounded daily (not an unusual situation) How much greater in the EAR than the APR? 1.1.7296 b.20196 c. 2.6096 d. 3.10% 32 33 34 35 36 87 8 4. Suppose you play baseball in college and get drafted by the Yankees They offer you a minor league contract with a value of $250.000 to be split into three equal payments. The paymns will occur annually beginning a year from today. In addition, you will receive a signing bonus of $75,000 today. What is the value of this contract to you today the applicable interest rate a 8%, compounded annually? a. 5219.258 b. $268.458 e $289,758 d. $320.000 9 0 1 S. In your new job, your bow has asked you to come up with a plan to improve the firm's working capital management and efficiency. You are given the firm's financial statements. What is the most useful information for you to calculate and analyze a. Solvency ratios h. Leverage ratios Turnover ratios d. Profitability ratios 2 3 6. Suppose you have a credit card that changes an interest rate of 224 (APR), compounded daily (tulation) How much greater is the HAR than the APR a. 1.72% b. 2.01% c. 2.00% d. 3.10%