Answered step by step

Verified Expert Solution

Question

1 Approved Answer

4. (The asset-market economy) Suppose there are two assets available to investors: a risk-free asset with a price of p1 = 1 and that

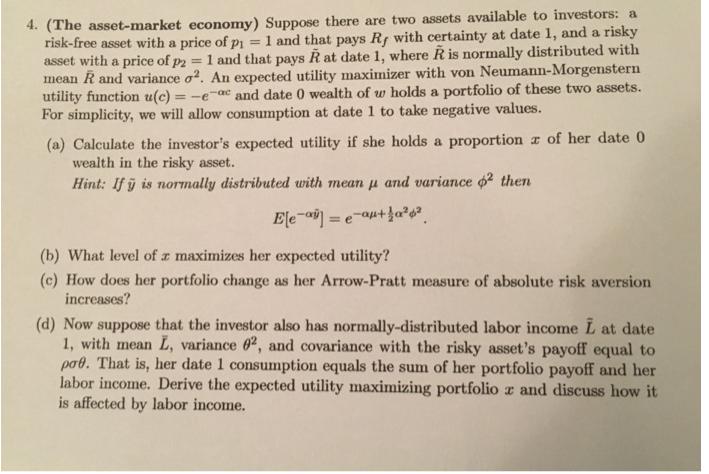

4. (The asset-market economy) Suppose there are two assets available to investors: a risk-free asset with a price of p1 = 1 and that pays Ry with certainty at date 1, and a risky asset with a price of p2 = 1 and that pays R at date 1, where R is normally distributed with mean R and variance o2. An expected utility maximizer with von Neumann-Morgenstern utility function u(c) =-e- and date 0 wealth of w holds a portfolio of these two assets. For simplicity, we will allow consumption at date 1 to take negative values. (a) Calculate the investor's expected utility if she holds a proportion of her date 0 wealth in the risky asset. Hint: If y is normally distributed with mean p and variance 2 then Ele-ae-au+fad (b) What level of a maximizes her expected utility? (c) How does her portfolio change as her Arrow-Pratt measure of absolute risk aversion increases? (d) Now suppose that the investor also has normally-distributed labor income L at date 1, with mean L, variance 02, and covariance with the risky asset's payoff equal to pare. That is, her date 1 consumption equals the sum of her portfolio payoff and her labor income. Derive the expected utility maximizing portfolio z and discuss how it is affected by labor income.

Step by Step Solution

★★★★★

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

The detailed ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started