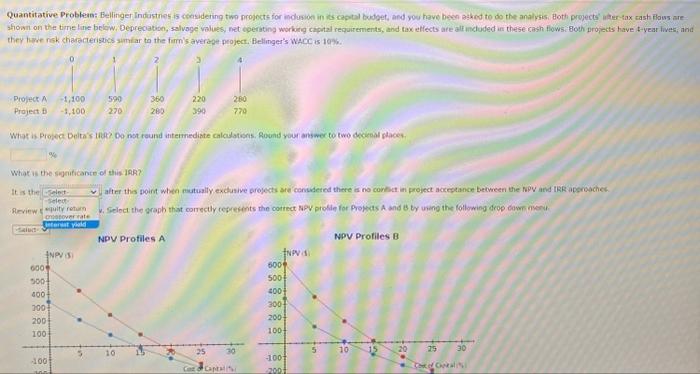

4. The Basics of Capital Budgeting: NPV Profile

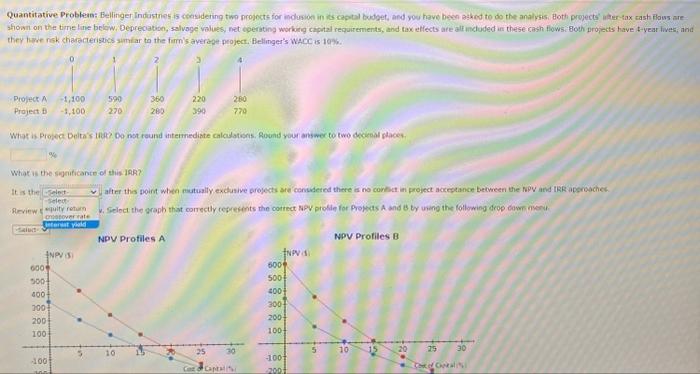

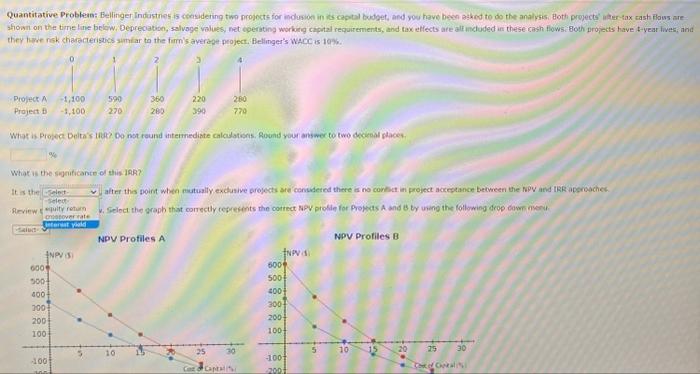

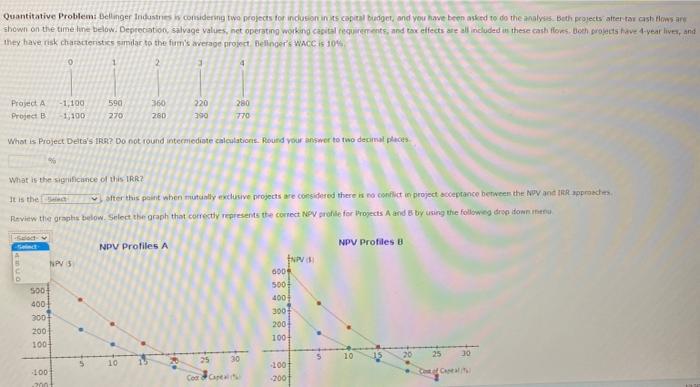

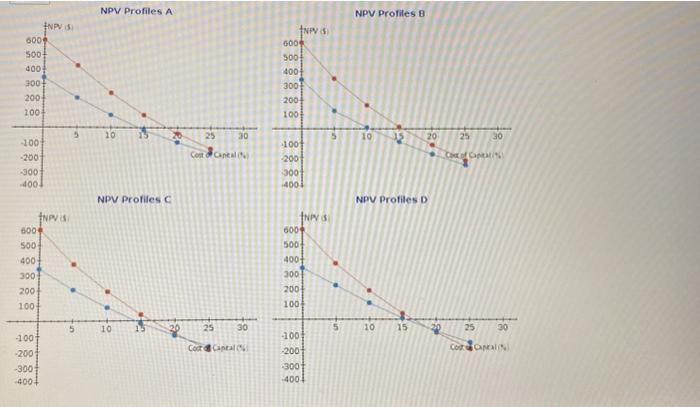

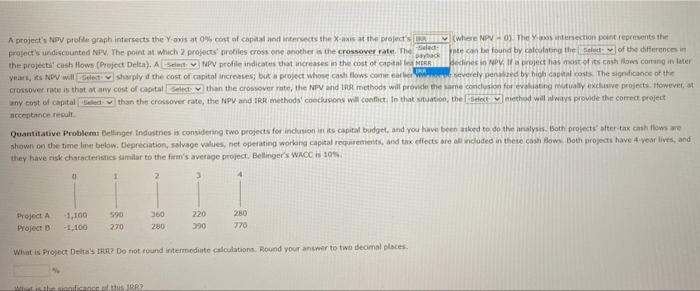

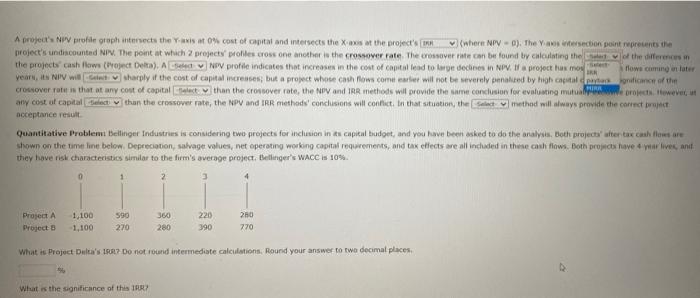

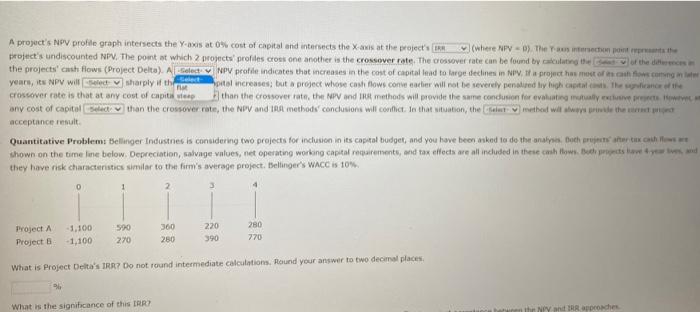

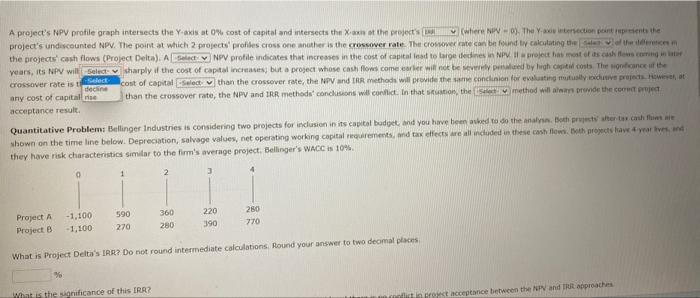

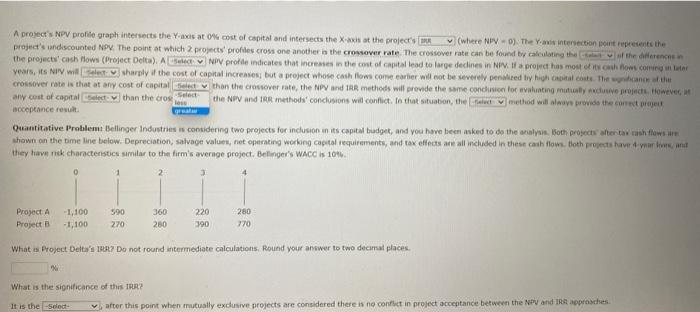

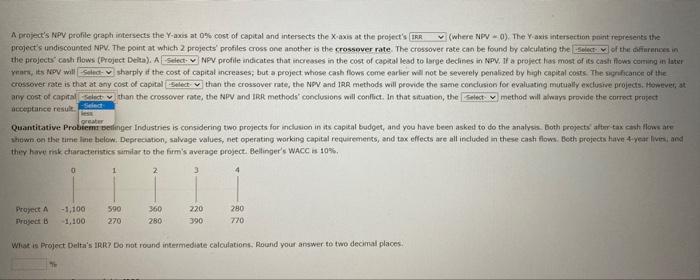

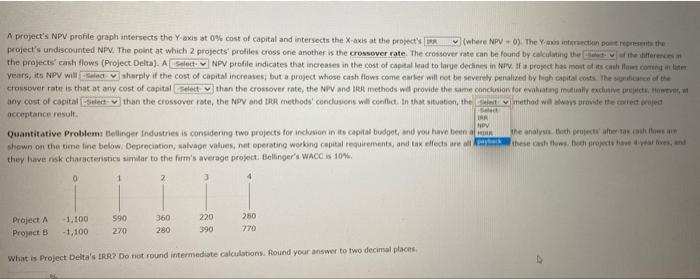

they have nisk charecteristics sumiar to the farm's average peoject. Alellinger's wacc is 10%. What is the signicante of this 19R? It is the alter this point when mutually exdusive projects are convidered there is no conbat in project acceptance between the Npy and IgR abgroschek. Quantitative Problemi Bellanger Industres in considernig two nrojects for indusion in ins capoul budget, and you have been asked to do the analyis. Beth prolects atrer tar qst How5:ari shown on the time line below. Deprecation, salyage values, net operating wokkng capital requiremente, and tax elfects ate all included in these cash flors, beeh grogects hive 4-yeat hiver, and they have risk characteristics samdar to the firm's average projert Bellnger's wacc is 104 . What is Project Dela's tiR? Do not round intecmediate calculatione. Rouind vour antspor to two decimat places What is the significance of this lRk? It is the I after this paint when mutually exilusive projects are considesed there in no conflict in project acceptance benwees the NPV and IRR approkd es NPV Profiles C (wase NPV - 0) the yo pos intersection) point repcesents the project's undicicounted Nily, The point at which 2 projects' prodiles cross ane another is the crossover rate, The let cas be found by colculating the of the differencen im the projecti' cash llows [Project Deleat), A WF profle indicates that increases in the owst of capital les jedines io Rpy, If as project has most of its cash haps courang in later crossover rase is that at ary const of caghal any cost ef capital than the crossover rate, the NPV and IRR enethods' coochashors wil conflict. in that situation, the riethod wal wways provede the corteo project fcccetincen resuit they fave risk chatartristics simillar to the finti's average project, Bellinger's WMOC is 10 S.F. Wivat is frosect Delra's that? Do fot cound intermodiate calculations; Round your ancwir to twa decimal plsces. A project' NIV profile graph intmenects the Y-axis at 0% cost of captal and intersects the X-aws at the broject's oroject's undiscounted Niv. The point at which 2 projects' poholles coss one another is the crossover fate. The oressayer tate can be found by calculating the crosvover rate is that at any cost of copital than the crossover rate, the NoV and IRR methods will provide the same conclusion for evaliasing mutual any cost of capial than the crossover rate, the NPV and IRR miethods' condusions will confict, In that situationy the methad mill always promble the coriect pentit acceptance result they have risk characteristios similar to the firm's average project. Bellinger's WACC is 10 . What is Projoct Delta's tos? Do not roend intermediate calculstions, Round your answer to two decimal places, What io the significance of this 1re? A project's NiY profile graph intersects the Y-asis at 0% cost of capital and intersects the X-axis at the project: (where NPV a B) The Faes interaechum poin impragts the broject's undiscounted NPV, The point ot which 2 projects' profiles cross one another is the crossover rate. The coossover iate can be found br caiculatno tis the projects' cash flows (Project Delta). A) yeari, its NPV will sharply if ty crossever cate is that at any cost of capiti any cost of cacital than the crossover rate, the NPV and 196 methods' conctusions will cooffic. le that situaton, the acceptance result: they have risk characteristics similar to the firm's average project. Bellinger's whcc is 10% What is Project Delta's IRRT Do not round intermediate calculations. Pound your answer to two decimbl placesi. What is the significance of this trRe? A project's NPV protile graph intersects the Y-anis at owe cost of capital and intersects the X-amin st the project's project's undiscounted NPV. The point at which 2 projects' profiles cross one anather is the croscover rate . The crobwer mate can be found Ey calailating the years, its tipe will crossover rate is ti -ost of capital ary cost of capital than the crossover rate, the NPV and IRR methods' conchissons will corllid in that shimenos, the acceptance result. they have risk characteristics similar to the fim's average project. Bellinger's WAcc is 10 s. . What is troject Delta's IRR? Do not round intermediate calculations, Round your answer to two deomal places What is the gigrificance of this IRR? A projectis NPV profle graph intersets the Y-axes at 0N cost of capital and intersects the X-axis st the project's project's undiscounted NDY The point at which 2 projects' profiles cross one anotier i the crossover rate. The crossover rate can be found twr cakculating the the project'' cash Hows (Project Delta). A years, its Nivin mill sharnly if the crossover rate is that at any cost of capital any cost of captal boceptance resilh. they harve nak characterstics smilar to the firm's average project, Belinger's WacC is 10 ons. What is Project Deltr's 13 B Do not round intemmediate calculations. Round wour anwwer to two decamal places. What is the significance of this tirk? If is the atter this point when mutually exdusive projects are considered there is ne confict in project acceptance betweve the Nevy and iph appragdhes. A projec's NPV profile graph intersects the Y-axis at O\% cost of capital and intersects the X-axis at the project's (where NPV - 0). The Y.axis intersection phint represents the project's undiscounted NPV. The point at which 2 projects' profiles cross one another is the crossover rate. The crossover rate can be found by calculating the the grojecti' cavh flows (Project Delta). A NPV profile indicates that increases in the cost of captal lesd to lurge declines in NpV, if a project hiss most of its casht liows coming in later rearn, its fov wall sharply if the cost of capital increases; but a project whose cash flows come earlier will not be severely penalixed by high capital costs The significance of thic crossover rate is that at any cost of capital than the crossover nate, the NOV and 12R methods will peovide the same condusion for evaliating mutually exdusive projects. Homevevet, at any cost ot capita than the crossover rate, the NPV and IRR methods' condusions will conflict. In that stuatien, the method will ahways provide the correct propect acceptance resuit Quantitative Probeme befinger Industres is considering two projects for inclusion in its capital budget, and you have been asked to do the analysis. Both brojests' alter tax cish Flows ate Whown on the time line below, Deprecaston, salvage walues, net operating working capical requirements, and tax effects are all included in these cash flown. Beeli grejects have 4 year fivini, and ther hove risk daracteristics similar to the firm's average project. Bellinger's wACC is 10%. What is Project Delta's IRR? Do not round intermediate caloulations, Round your answer to two decimal places. A project's NPV profite graph intersects the Y-axis at 0\%h cost of capital and intersects the X-axis at the project's project's undiscounted NPV. The point at which 2 projects' proliles cross one another is the crossover rate. The crosserer rate can be found by ealialining ite the projects' cash flows (Project Delta). A years, its NPV will crossover rate is that at any cost of capital any cost of cagital than the crossover rate, the NPV and wit methods' condusichs will conllic. In that situation, the acceptance result. Quantitative Problem Bellinger fndustries is considering two jrojects for indusion in ts capalal budgot, and rou have been : shown on the time line below: Depreciation, salvage values, net epereting workng capital requirements, and tak elfexts are dil, ther have risk characteristics simalar to the firm's average project. Bellinger's WacC is 10%. What is Project Delta's tRR? Do not round intermediate calculabions. Aound your answer to two decirnal places. they have nisk charecteristics sumiar to the farm's average peoject. Alellinger's wacc is 10%. What is the signicante of this 19R? It is the alter this point when mutually exdusive projects are convidered there is no conbat in project acceptance between the Npy and IgR abgroschek. Quantitative Problemi Bellanger Industres in considernig two nrojects for indusion in ins capoul budget, and you have been asked to do the analyis. Beth prolects atrer tar qst How5:ari shown on the time line below. Deprecation, salyage values, net operating wokkng capital requiremente, and tax elfects ate all included in these cash flors, beeh grogects hive 4-yeat hiver, and they have risk characteristics samdar to the firm's average projert Bellnger's wacc is 104 . What is Project Dela's tiR? Do not round intecmediate calculatione. Rouind vour antspor to two decimat places What is the significance of this lRk? It is the I after this paint when mutually exilusive projects are considesed there in no conflict in project acceptance benwees the NPV and IRR approkd es NPV Profiles C (wase NPV - 0) the yo pos intersection) point repcesents the project's undicicounted Nily, The point at which 2 projects' prodiles cross ane another is the crossover rate, The let cas be found by colculating the of the differencen im the projecti' cash llows [Project Deleat), A WF profle indicates that increases in the owst of capital les jedines io Rpy, If as project has most of its cash haps courang in later crossover rase is that at ary const of caghal any cost ef capital than the crossover rate, the NPV and IRR enethods' coochashors wil conflict. in that situation, the riethod wal wways provede the corteo project fcccetincen resuit they fave risk chatartristics simillar to the finti's average project, Bellinger's WMOC is 10 S.F. Wivat is frosect Delra's that? Do fot cound intermodiate calculations; Round your ancwir to twa decimal plsces. A project' NIV profile graph intmenects the Y-axis at 0% cost of captal and intersects the X-aws at the broject's oroject's undiscounted Niv. The point at which 2 projects' poholles coss one another is the crossover fate. The oressayer tate can be found by calculating the crosvover rate is that at any cost of copital than the crossover rate, the NoV and IRR methods will provide the same conclusion for evaliasing mutual any cost of capial than the crossover rate, the NPV and IRR miethods' condusions will confict, In that situationy the methad mill always promble the coriect pentit acceptance result they have risk characteristios similar to the firm's average project. Bellinger's WACC is 10 . What is Projoct Delta's tos? Do not roend intermediate calculstions, Round your answer to two decimal places, What io the significance of this 1re? A project's NiY profile graph intersects the Y-asis at 0% cost of capital and intersects the X-axis at the project: (where NPV a B) The Faes interaechum poin impragts the broject's undiscounted NPV, The point ot which 2 projects' profiles cross one another is the crossover rate. The coossover iate can be found br caiculatno tis the projects' cash flows (Project Delta). A) yeari, its NPV will sharply if ty crossever cate is that at any cost of capiti any cost of cacital than the crossover rate, the NPV and 196 methods' conctusions will cooffic. le that situaton, the acceptance result: they have risk characteristics similar to the firm's average project. Bellinger's whcc is 10% What is Project Delta's IRRT Do not round intermediate calculations. Pound your answer to two decimbl placesi. What is the significance of this trRe? A project's NPV protile graph intersects the Y-anis at owe cost of capital and intersects the X-amin st the project's project's undiscounted NPV. The point at which 2 projects' profiles cross one anather is the croscover rate . The crobwer mate can be found Ey calailating the years, its tipe will crossover rate is ti -ost of capital ary cost of capital than the crossover rate, the NPV and IRR methods' conchissons will corllid in that shimenos, the acceptance result. they have risk characteristics similar to the fim's average project. Bellinger's WAcc is 10 s. . What is troject Delta's IRR? Do not round intermediate calculations, Round your answer to two deomal places What is the gigrificance of this IRR? A projectis NPV profle graph intersets the Y-axes at 0N cost of capital and intersects the X-axis st the project's project's undiscounted NDY The point at which 2 projects' profiles cross one anotier i the crossover rate. The crossover rate can be found twr cakculating the the project'' cash Hows (Project Delta). A years, its Nivin mill sharnly if the crossover rate is that at any cost of capital any cost of captal boceptance resilh. they harve nak characterstics smilar to the firm's average project, Belinger's WacC is 10 ons. What is Project Deltr's 13 B Do not round intemmediate calculations. Round wour anwwer to two decamal places. What is the significance of this tirk? If is the atter this point when mutually exdusive projects are considered there is ne confict in project acceptance betweve the Nevy and iph appragdhes. A projec's NPV profile graph intersects the Y-axis at O\% cost of capital and intersects the X-axis at the project's (where NPV - 0). The Y.axis intersection phint represents the project's undiscounted NPV. The point at which 2 projects' profiles cross one another is the crossover rate. The crossover rate can be found by calculating the the grojecti' cavh flows (Project Delta). A NPV profile indicates that increases in the cost of captal lesd to lurge declines in NpV, if a project hiss most of its casht liows coming in later rearn, its fov wall sharply if the cost of capital increases; but a project whose cash flows come earlier will not be severely penalixed by high capital costs The significance of thic crossover rate is that at any cost of capital than the crossover nate, the NOV and 12R methods will peovide the same condusion for evaliating mutually exdusive projects. Homevevet, at any cost ot capita than the crossover rate, the NPV and IRR methods' condusions will conflict. In that stuatien, the method will ahways provide the correct propect acceptance resuit Quantitative Probeme befinger Industres is considering two projects for inclusion in its capital budget, and you have been asked to do the analysis. Both brojests' alter tax cish Flows ate Whown on the time line below, Deprecaston, salvage walues, net operating working capical requirements, and tax effects are all included in these cash flown. Beeli grejects have 4 year fivini, and ther hove risk daracteristics similar to the firm's average project. Bellinger's wACC is 10%. What is Project Delta's IRR? Do not round intermediate caloulations, Round your answer to two decimal places. A project's NPV profite graph intersects the Y-axis at 0\%h cost of capital and intersects the X-axis at the project's project's undiscounted NPV. The point at which 2 projects' proliles cross one another is the crossover rate. The crosserer rate can be found by ealialining ite the projects' cash flows (Project Delta). A years, its NPV will crossover rate is that at any cost of capital any cost of cagital than the crossover rate, the NPV and wit methods' condusichs will conllic. In that situation, the acceptance result. Quantitative Problem Bellinger fndustries is considering two jrojects for indusion in ts capalal budgot, and rou have been : shown on the time line below: Depreciation, salvage values, net epereting workng capital requirements, and tak elfexts are dil, ther have risk characteristics simalar to the firm's average project. Bellinger's WacC is 10%. What is Project Delta's tRR? Do not round intermediate calculabions. Aound your answer to two decirnal places