4 THE COST OF CAPITAL AND CAPITAL STRUCTURE the corporation holding the common stock will earn after tax. The firm has earned before tax

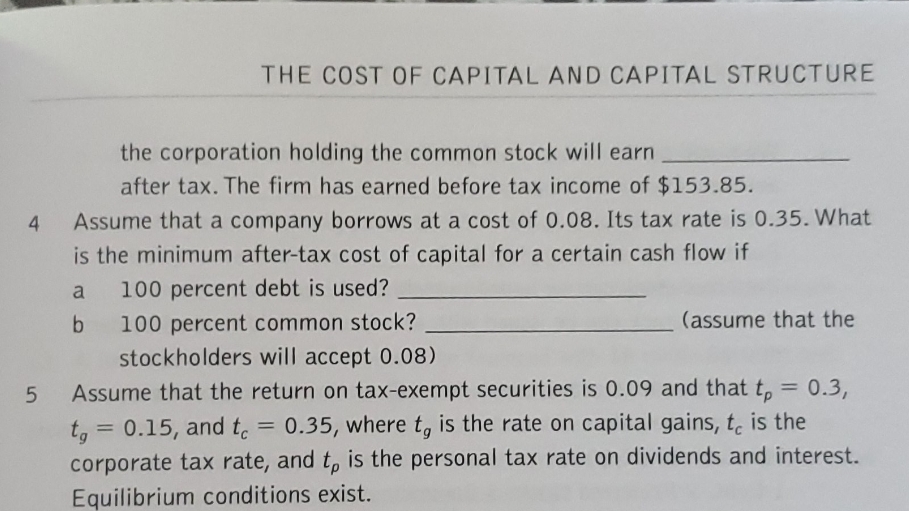

4 THE COST OF CAPITAL AND CAPITAL STRUCTURE the corporation holding the common stock will earn after tax. The firm has earned before tax income of $153.85. Assume that a company borrows at a cost of 0.08. Its tax rate is 0.35. What is the minimum after-tax cost of capital for a certain cash flow if a 100 percent debt is used? b 100 percent common stock? stockholders will accept 0.08) (assume that the tp 5 Assume that the return on tax-exempt securities is 0.09 and that = 0.3, t, = 0.15, and t = 0.35, where t, is the rate on capital gains, t, is the corporate tax rate, and to is the personal tax rate on dividends and interest. Equilibrium conditions exist.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer To calculate the minimum aftertax cost of capital for a certain cash flow when 100 debt is us...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started