Answered step by step

Verified Expert Solution

Question

1 Approved Answer

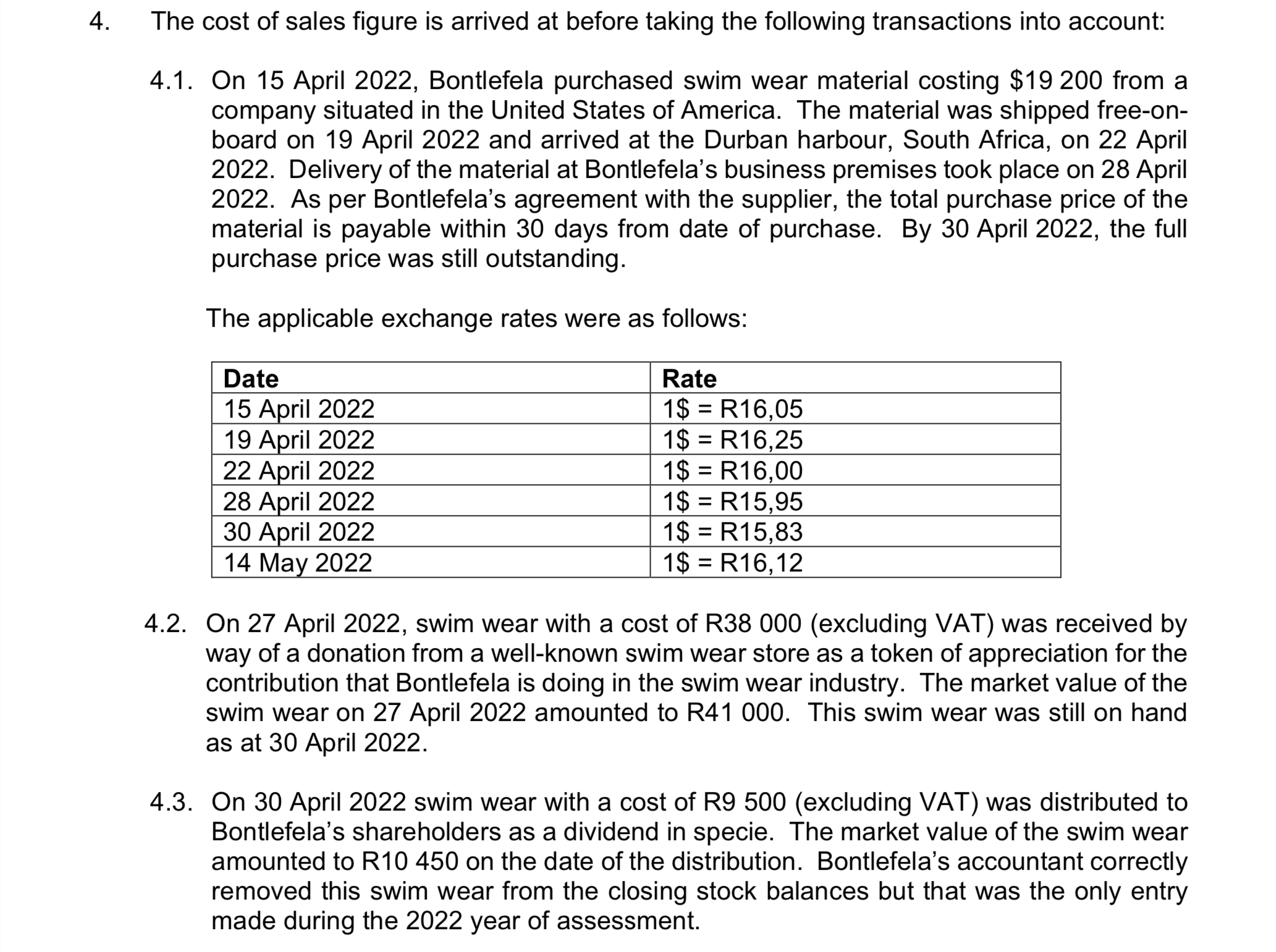

4. The cost of sales figure is arrived at before taking the following transactions into account: 4.1. On 15 April 2022, Bontlefela purchased swim

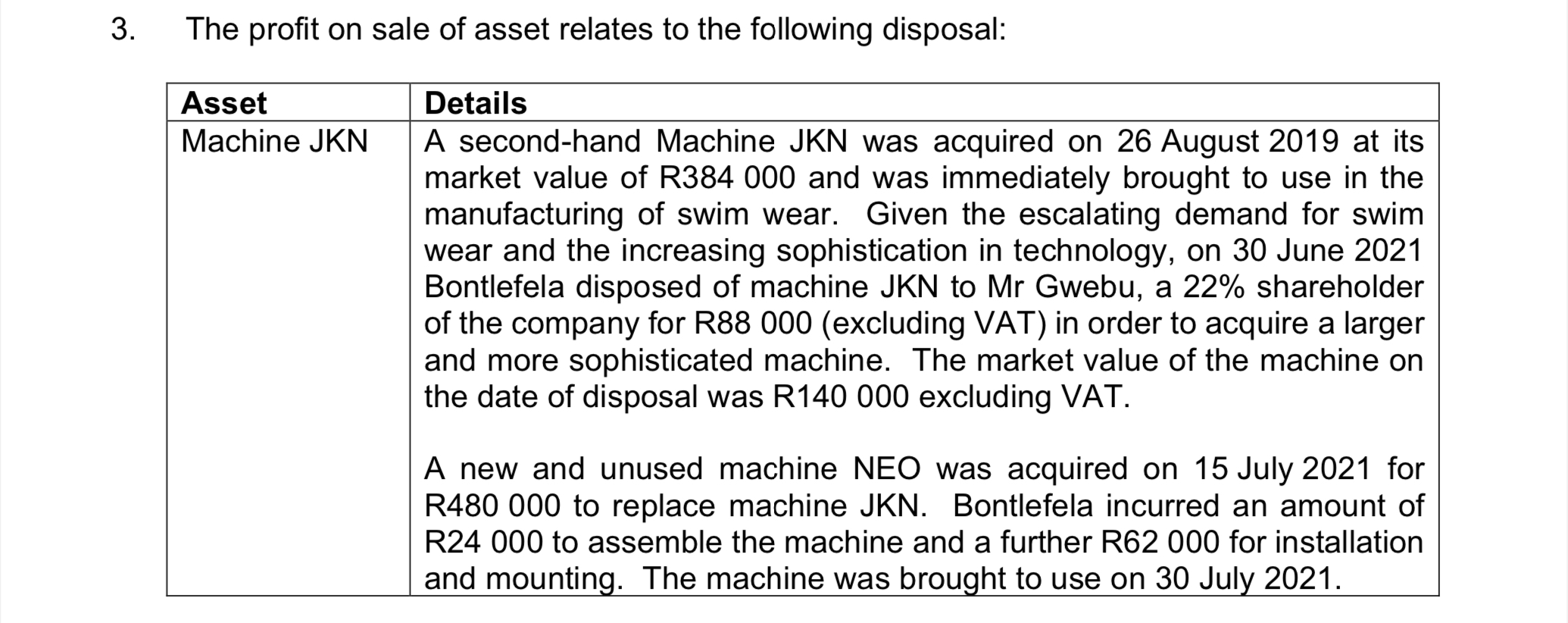

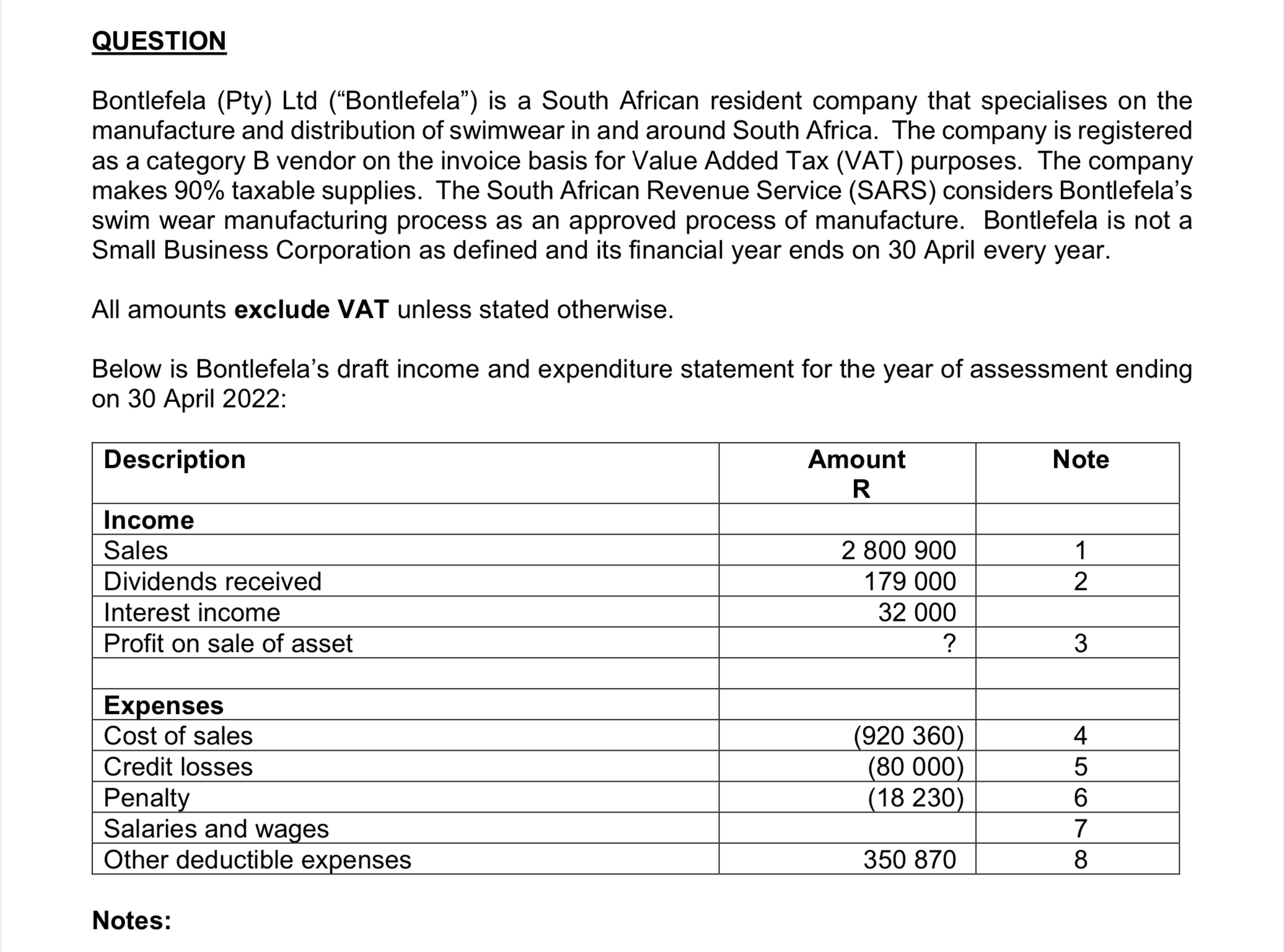

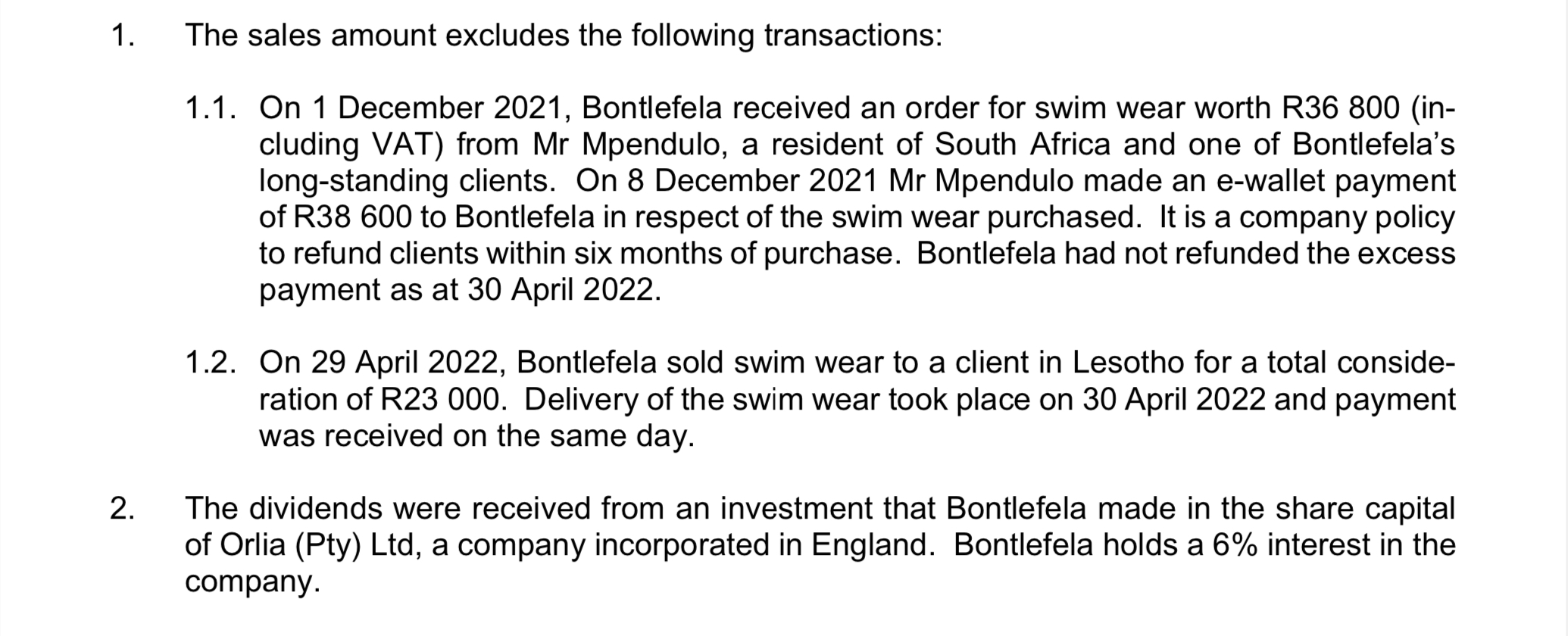

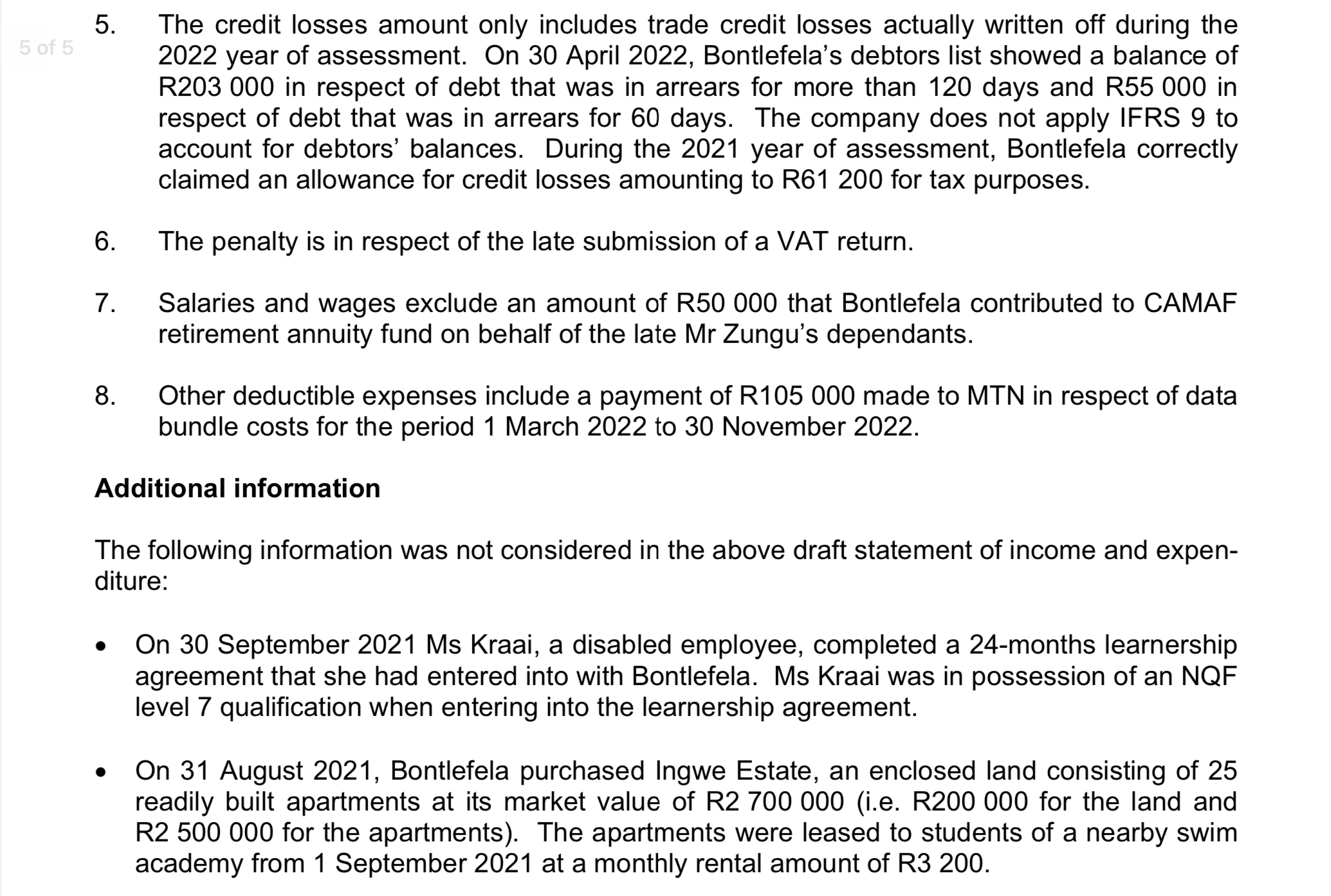

4. The cost of sales figure is arrived at before taking the following transactions into account: 4.1. On 15 April 2022, Bontlefela purchased swim wear material costing $19 200 from a company situated in the United States of America. The material was shipped free-on- board on 19 April 2022 and arrived at the Durban harbour, South Africa, on 22 April 2022. Delivery of the material at Bontlefela's business premises took place on 28 April 2022. As per Bontlefela's agreement with the supplier, the total purchase price of the material is payable within 30 days from date of purchase. By 30 April 2022, the full purchase price was still outstanding. The applicable exchange rates were as follows: Date 15 April 2022 19 April 2022 22 April 2022 28 April 2022 30 April 2022 14 May 2022 Rate 1$ = R16,05 1$ = R16,25 1$ = R16,00 1$ = R15,95 1$ = R15,83 1$ = R16,12 4.2. On 27 April 2022, swim wear with a cost of R38 000 (excluding VAT) was received by way of a donation from a well-known swim wear store as a token of appreciation for the contribution that Bontlefela is doing in the swim wear industry. The market value of the swim wear on 27 April 2022 amounted to R41 000. This swim wear was still on hand as at 30 April 2022. 4.3. On 30 April 2022 swim wear with a cost of R9 500 (excluding VAT) was distributed to Bontlefela's shareholders as a dividend in specie. The market value of the swim wear amounted to R10 450 on the date of the distribution. Bontlefela's accountant correctly removed this swim wear from the closing stock balances but that was the only entry made during the 2022 year of assessment. REQUIRED: Calculate the normal tax liability of Bontlefela (Pty Ltd for the year of assessment ending on 30 April 2022. Provide brief reasons where amounts have a nil effect on normal tax. Marks 40 3. The profit on sale of asset relates to the following disposal: Asset Machine JKN Details A second-hand Machine JKN was acquired on 26 August 2019 at its market value of R384 000 and was immediately brought to use in the manufacturing of swim wear. Given the escalating demand for swim wear and the increasing sophistication in technology, on 30 June 2021 Bontlefela disposed of machine JKN to Mr Gwebu, a 22% shareholder of the company for R88 000 (excluding VAT) in order to acquire a larger and more sophisticated machine. The market value of the machine on the date of disposal was R140 000 excluding VAT. A new and unused machine NEO was acquired on 15 July 2021 for R480 000 to replace machine JKN. Bontlefela incurred an amount of R24 000 to assemble the machine and a further R62 000 for installation and mounting. The machine was brought to use on 30 July 2021. QUESTION Bontlefela (Pty) Ltd ("Bontlefela") is a South African resident company that specialises on the manufacture and distribution of swimwear in and around South Africa. The company is registered as a category B vendor on the invoice basis for Value Added Tax (VAT) purposes. The company makes 90% taxable supplies. The South African Revenue Service (SARS) considers Bontlefela's swim wear manufacturing process as an approved process of manufacture. Bontlefela is not a Small Business Corporation as defined and its financial year ends on 30 April every year. All amounts exclude VAT unless stated otherwise. Below is Bontlefela's draft income and expenditure statement for the year of assessment ending on 30 April 2022: Description Income Sales Dividends received Interest income Profit on sale of asset Expenses Cost of sales Credit losses Penalty Salaries and wages Other deductible expenses Notes: Amount R 2 800 900 179 000 32 000 ? (920 360) (80 000) (18 230) 350 870 Note 1 2 3 456 7 8 1. 2. The sales amount excludes the following transactions: 1.1. On 1 December 2021, Bontlefela received an order for swim wear worth R36 800 (in- cluding VAT) from Mr Mpendulo, a resident of South Africa and one of Bontlefela's long-standing clients. On 8 December 2021 Mr Mpendulo made an e-wallet payment of R38 600 to Bontlefela in respect of the swim wear purchased. It is a company policy to refund clients within six months of purchase. Bontlefela had not refunded the excess payment as at 30 April 2022. 1.2. On 29 April 2022, Bontlefela sold swim wear to a client in Lesotho for a total conside- ration of R23 000. Delivery of the swim wear took place on 30 April 2022 and payment was received on the same day. The dividends were received from an investment that Bontlefela made in the share capital of Orlia (Pty) Ltd, a company incorporated in England. Bontlefela holds a 6% interest in the company. 5. 5 of 5 6. 7. 8. The credit losses amount only includes trade credit losses actually written off during the 2022 year of assessment. On 30 April 2022, Bontlefela's debtors list showed a balance of R203 000 in respect of debt that was in arrears for more than 120 days and R55 000 in respect of debt that was in arrears for 60 days. The company does not apply IFRS 9 to account for debtors' balances. During the 2021 year of assessment, Bontlefela correctly claimed an allowance for credit losses amounting to R61 200 for tax purposes. The penalty is in respect of the late submission of a VAT return. Salaries and wages exclude an amount of R50 000 that Bontlefela contributed to CAMAF retirement annuity fund on behalf of the late Mr Zungu's dependants. Other deductible expenses include a payment of R105 000 made to MTN in respect of data bundle costs for the period 1 March 2022 to 30 November 2022. Additional information The following information was not considered in the above draft statement of income and expen- diture: On 30 September 2021 Ms Kraai, a disabled employee, completed a 24-months learnership agreement that she had entered into with Bontlefela. Ms Kraai was in possession of an NQF level 7 qualification when entering into the learnership agreement. On 31 August 2021, Bontlefela purchased Ingwe Estate, an enclosed land consisting of 25 readily built apartments at its market value of R2 700 000 (i.e. R200 000 for the land and R2 500 000 for the apartments). The apartments were leased to students of a nearby swim academy from 1 September 2021 at a monthly rental amount of R3 200.

Step by Step Solution

★★★★★

3.37 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Answer To calculate the normal tax liability of Bontlefela Pty Ltd for the year of assessment ending on 30 April 2022 we need to make the following adjustments to the draft income and expenditure stat...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started