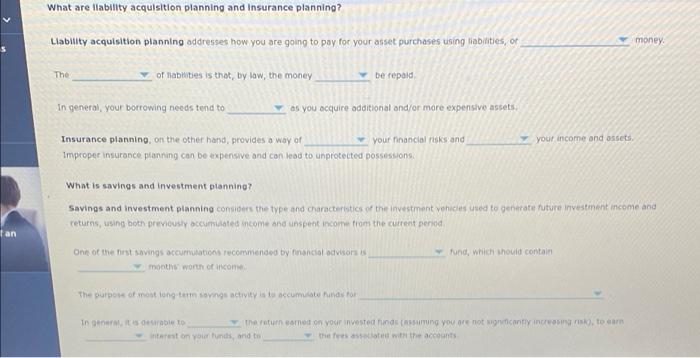

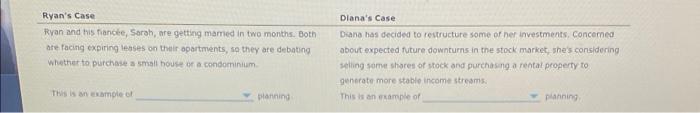

4. The financial planning process - Part 2 - What are the activities involved in the process of personal financial planning? Personal financial planning requires you to engage in a variety of different planning activities, including asset acquisition planning, tobility and Insurance planning, savings, investinent, and tax planning; employee benefit and retirement planning, and estate planning, The nature and complexity of these planning activities will now from your goals and personal circumstances, such as your current and expected future Incuene, your wealth and available mrencial resources, and the current place in your life cycle. Changes in your circumstances or the economy con necessitate changes to these planning activities What is assut acquisition planning? Asset acquisition planning is one of the earliest financial activities you undertake in ufe. It involves the purchase of tangible and financial stats, liquid assets, Investments, and personal and real property including and are held either to consume and use or to generate a return or income as an investment. An Finandal assets are example of an intangible asset is In general, the cost and value of your tangible, personal and real assets tend to with your age, income, and with otherings What are ability acquisition planning and insurance planning? money Liability acquisition planning addresses how you are going to pay for your asset purchases using abilities, or The of labuities is that, by low, the money be repaid In general, your borrowing needs tend to as you acquire additional and/or more expensive assets. your income and assets Insurance planning, on the other hand, provides a way of your inancial risks and Improper insurance planning can be expensive and can lead to unprotected possessions What is savings and investment planning? Savings and investment planning considers the type and characteristics of the investment vehicles used to generate future investment income and returns, using both previously accumulated income and unspent income from the current period fund, which should contain One of the first savings accumulations recommended by financial advisors months worth of income The purpose of most long-term savings activity is to accumulate funds for In general, it is de beto the returneamed on your invested in casuming you are not significantly increasing nisk), to com interest on your funds, and to theres associated with the accounts Savings and Investment planning considers the type and characteristics of the investment vehides used to generate future Investment income and returns, using both previously accumulated income and unspent Income from the current period ols Pund, which should contain One of the first savings accumulations recommended by financial advisors is months worth of income The purpose of most long-term savings activity is to accumulate funds for In general, it is desirable to the returneamed on your invested funds (assuming you are not significantly increasing risk), to earn interest on your funds, and to the fees associated with the accounts: ning iment Ryan's Caso Ryan and his dance, Sarah, are getting married in two months. Both are facing expiring lenses on the apartments, so they are debating Whether to purchase a small house or a condominium Diana's Case Diana has decided to restructure some of her investments. Concerned about expected future downturns in the stock market shes considering Selling some shares of stock and purchasing a rental property to generate more stable income streams This is an example of planning This is example of planning 4. The financial planning process - Part 2 What are the activities involved in the process of personal financial planning? Personal financial planning requires you to engage in a variety of different planning activities, including asset acquisition planning ability and Insurance planning, sovingi, Investment, and tax planning employee benent and retirement planning; and estate plonning The nature and comploxity of these planning activities will flow from your goals and personal circumstances, such as your current and expected future income, your wealth and available financial resources, and the current place in your life cycle. Changes in your circumstances or the economy con hacessitate changes to these planning activities What is asset acquisition planning? in including Asset acquisition planning one of the arrest hinancial activibes you undertaken ret involves the purchase or tangible and financial assets, liquid assets, investmentsand personal and real property and are hether to consume and use of to generate a retumor income as an investment. An financial assets are example of an intangible set is In general, the cost and value of your tangible, per rent tend to with your age income, and weath, all other things remaining constant. The value of your handidats, on the other hand, tends to be action of economic conditions and your investment Futun What are Ilability acquisition planning and Insurance planning? Llability acquisition planning addresses how you are going to pay for your asset purchases using liabilities, or money The of liabilities is that, by low, the money be repaid In general, your borrowing needs tend to as you acquire additional and/or more expensive assets your income and assets Insurance planning, on the other hand, provides a way of your financial risks and Improper insurance planning can be expensive and can lead to unprotected possessions What is savings and investment planning? Savings and investment planning considers the type and characteristics of the investment vehicles used to generatit future investment income and returns, using both previously accumulated income and unspent income from the current period tan Fund, which should contain One of the nest savings accumulation recommended by tinancial advisors months worth of income The purpose of most long term songs activity is to accumulate indstor In to the return came on your invested and insurung you are not conting to sam ist on your funds, and to the fees with the accounts Ryan's Case Ryan and his fiance, Sarah, are getting mamed in two months. Both are facing expiring leases on their apartments, so they are debating whether to purchase a small house of condominium Diana's Case Diana has decided to restructure some of her investments, Concemea about expected future downturns in the stock market she's considering Selling some shares of stock and purchasing a rental property to generate more stable income stream: This is an example of planning This is an example of planning