Answered step by step

Verified Expert Solution

Question

1 Approved Answer

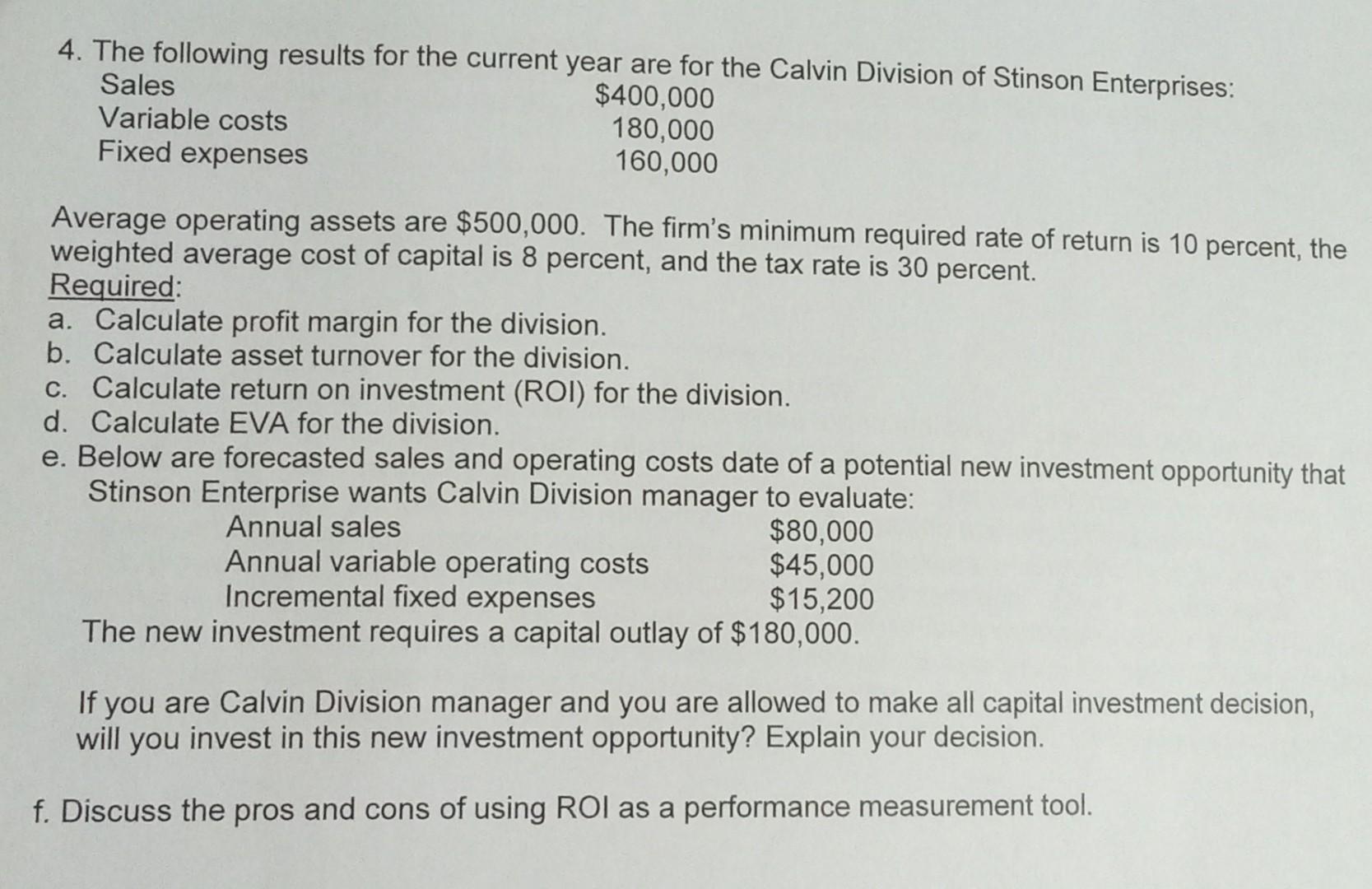

4. The following results for the current year are for the Calvin Division of Stinson Enterprises: Sales $400,000 180,000 Variable costs Fixed expenses 160,000

4. The following results for the current year are for the Calvin Division of Stinson Enterprises: Sales $400,000 180,000 Variable costs Fixed expenses 160,000 Average operating assets are $500,000. The firm's minimum required rate of return is 10 percent, the weighted average cost of capital is 8 percent, and the tax rate is 30 percent. Required: a. Calculate profit margin for the division. b. Calculate asset turnover for the division. c. Calculate return on investment (ROI) for the division. d. Calculate EVA for the division. e. Below are forecasted sales and operating costs date of a potential new investment opportunity that Stinson Enterprise wants Calvin Division manager to evaluate: Annual sales Annual variable operating costs $80,000 $45,000 $15,200 Incremental fixed expenses The new investment requires a capital outlay of $180,000. If you are Calvin Division manager and you are allowed to make all capital investment decision, will you invest in this new investment opportunity? Explain your decision. f. Discuss the pros and cons of using ROI as a performance measurement tool.

Step by Step Solution

★★★★★

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

a Profit margin is calculated as the ratio of operating income to sales Operating income Sales Variable costs Fixed expenses 400000 180000 160000 60000 Profit margin Operating income Sales 60000 40000...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started