Answered step by step

Verified Expert Solution

Question

1 Approved Answer

4. The following will show you the useful information for this question: 1. A call option priced at $4 today at strike price $15 is

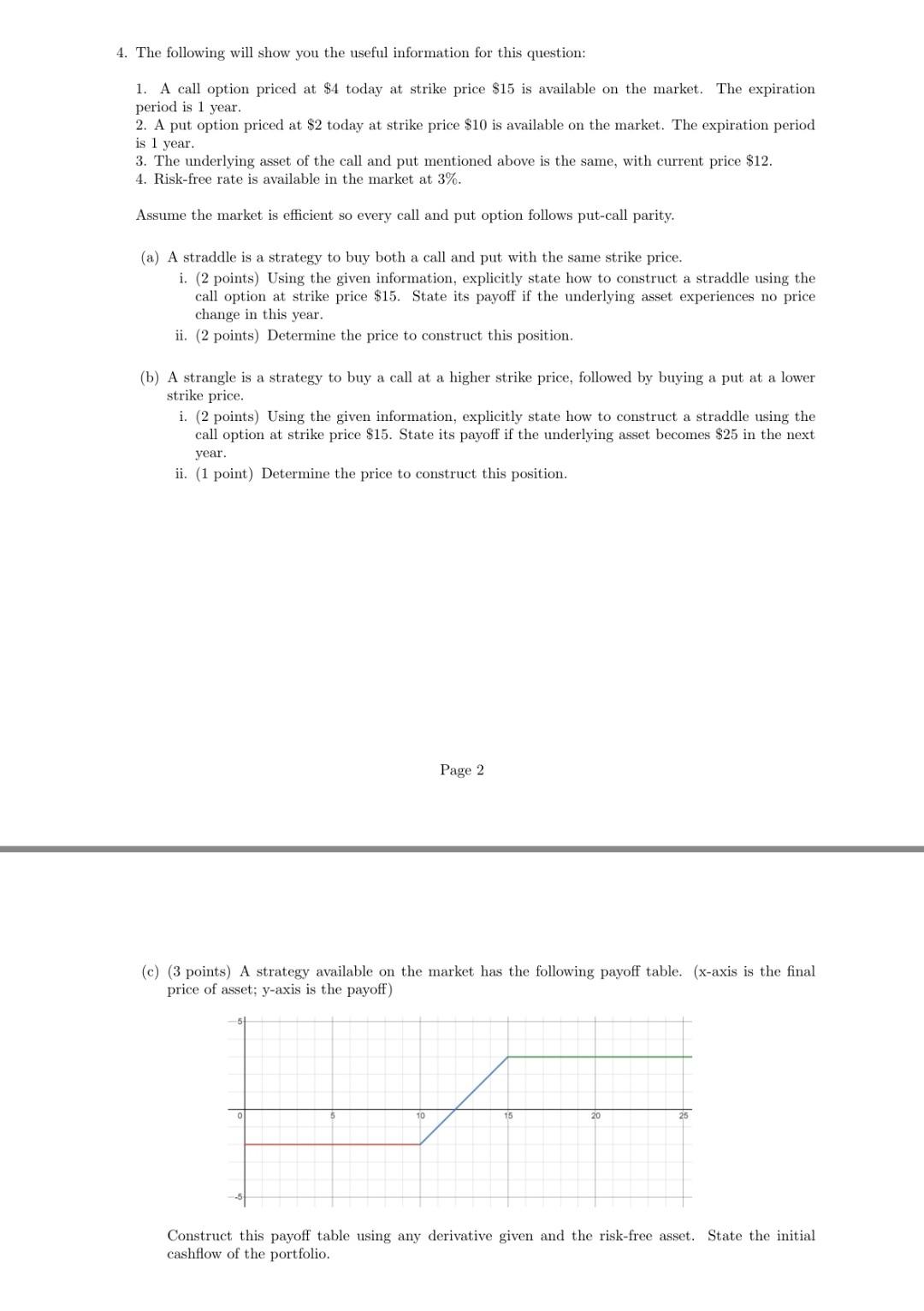

4. The following will show you the useful information for this question: 1. A call option priced at $4 today at strike price $15 is available on the market. The expiration period is 1 year. 2. A put option priced at $2 today at strike price $10 is available on the market. The expiration period is 1 year 3. The underlying asset of the call and put mentioned above is the same, with current price $12. 4. Risk-free rate is available in the market at 3%. Assume the market is efficient so every call and put option follows put-call parity. (a) A straddle is a strategy to buy both a call and put with the same strike price. i. (2 points) Using the given information, explicitly state how to construct a straddle using the call option at strike price $15. State its payoff if the underlying asset experiences no price change in this year. ii. (2 points) Determine the price to construct this position. (b) A strangle is a strategy to buy a call at a higher strike price, followed by buying a put at a lower strike price. i. (2 points) Using the given information, explicitly state how to construct a straddle using the call option at strike price $15. State its payoff if the underlying asset becomes $25 in the next year. ii. (1 point) Determine the price to construct this position. Page 2 (c) (3 points) A strategy available on the market has the following payoff table. (x-axis is the final price of asset; y-axis is the payoff) 15 20 25 Construct this payoff table using any derivative given and the risk-free asset. State the initial cashflow of the portfolio

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started