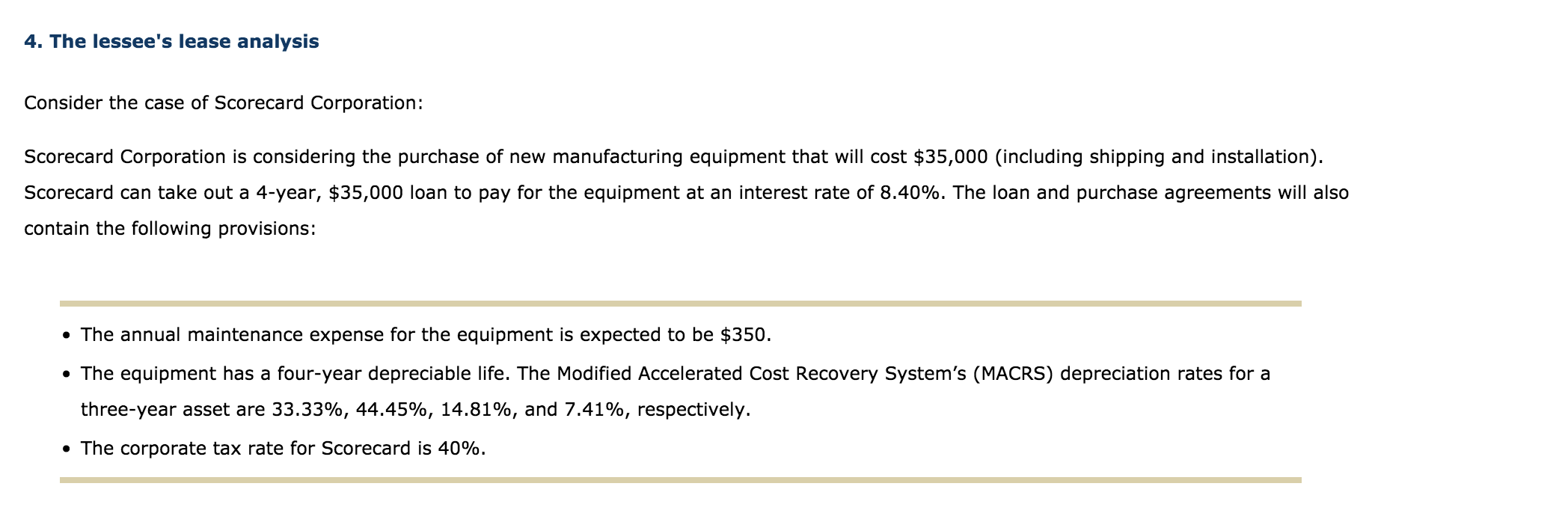

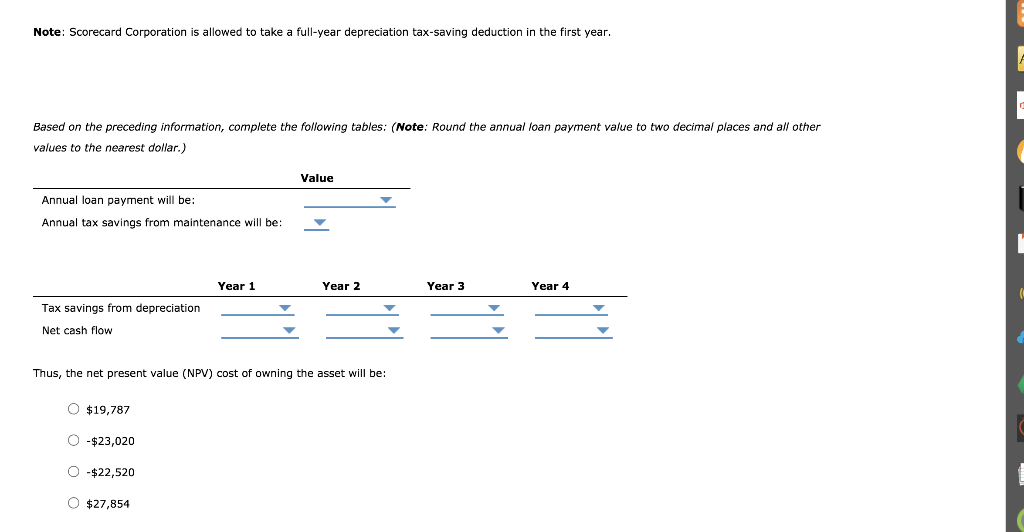

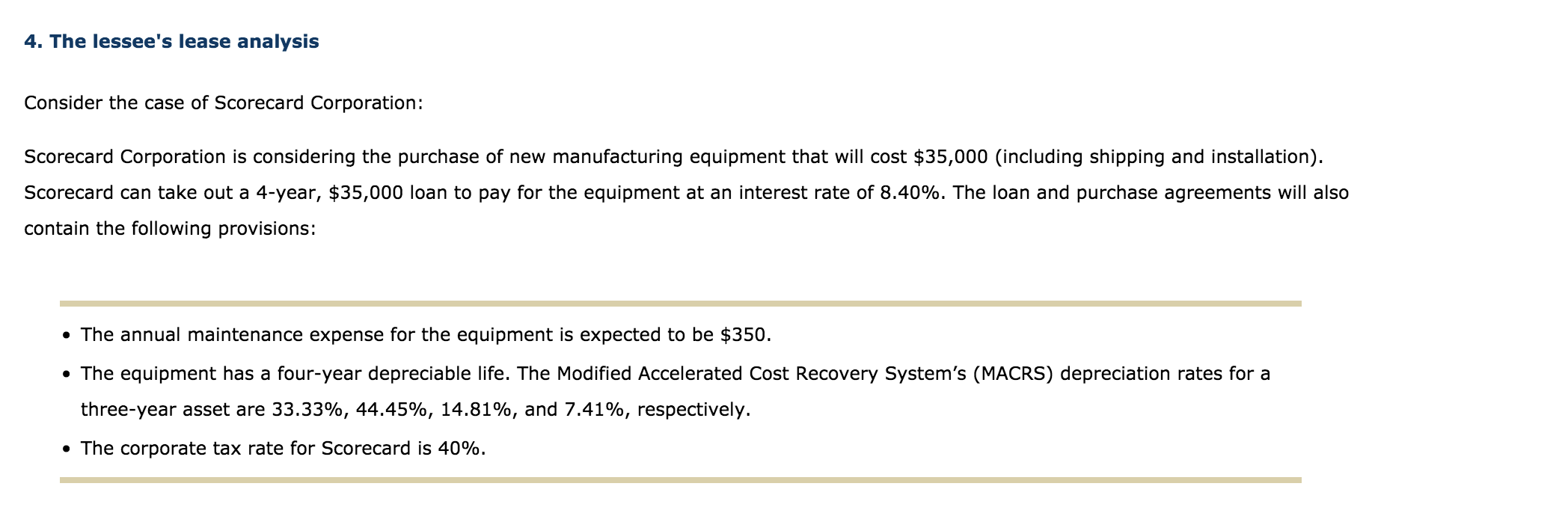

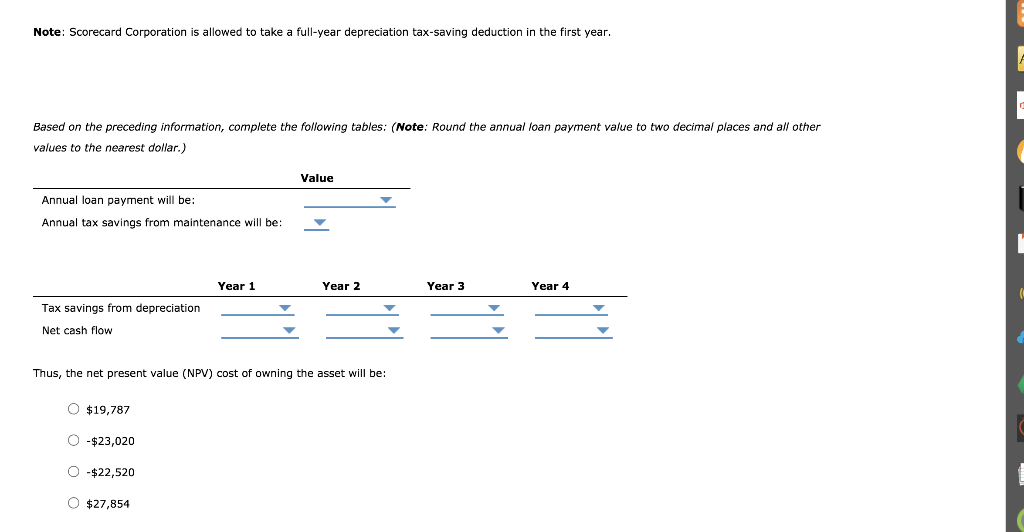

4. The lessee's lease analysis Consider the case of Scorecard Corporation: Scorecard Corporation is considering the purchase of new manufacturing equipment that will cost $35,000 (including shipping and installation). Scorecard can take out a 4-year, $35,000 loan to pay for the equipment at an interest rate of 8.40%. The loan and purchase agreements will also contain the following provisions: The annual maintenance expense for the equipment is expected to be $350. The equipment has a four-year depreciable life. The Modified Accelerated Cost Recovery System's (MACRS) depreciation rates for a three-year asset are 33.33%, 44.45%, 14.81%, and 7.41%, respectively. The corporate tax rate for Scorecard is 40%. Note: Scorecard Corporation is allowed to take a full-year depreciation tax-saving deduction in the first year. Based on the preceding information, complete the following tables: (Note: Round the annual loan payment value to two decimal places and all other values to the nearest dollar.) Value Annual loan payment will be: Annual tax savings from maintenance will be: Year 1 Year 2 Year 3 Year 4 Tax savings from depreciation Net cash flow Thus, the net present value (NPV) cost of owning the asset will be: $19,787 0-$23,020 O-$22,520 O $27,854 4. The lessee's lease analysis Consider the case of Scorecard Corporation: Scorecard Corporation is considering the purchase of new manufacturing equipment that will cost $35,000 (including shipping and installation). Scorecard can take out a 4-year, $35,000 loan to pay for the equipment at an interest rate of 8.40%. The loan and purchase agreements will also contain the following provisions: The annual maintenance expense for the equipment is expected to be $350. The equipment has a four-year depreciable life. The Modified Accelerated Cost Recovery System's (MACRS) depreciation rates for a three-year asset are 33.33%, 44.45%, 14.81%, and 7.41%, respectively. The corporate tax rate for Scorecard is 40%. Note: Scorecard Corporation is allowed to take a full-year depreciation tax-saving deduction in the first year. Based on the preceding information, complete the following tables: (Note: Round the annual loan payment value to two decimal places and all other values to the nearest dollar.) Value Annual loan payment will be: Annual tax savings from maintenance will be: Year 1 Year 2 Year 3 Year 4 Tax savings from depreciation Net cash flow Thus, the net present value (NPV) cost of owning the asset will be: $19,787 0-$23,020 O-$22,520 O $27,854