Answered step by step

Verified Expert Solution

Question

1 Approved Answer

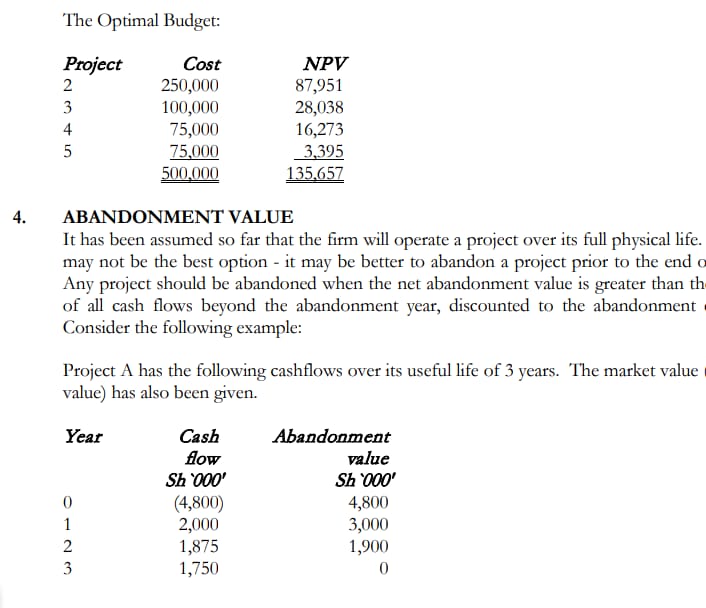

4. The Optimal Budget: Project Cost NPV 2 250,000 87,951 3 100,000 28,038 4 75,000 16,273 5 75,000 3,395 500,000 135,657 ABANDONMENT VALUE It

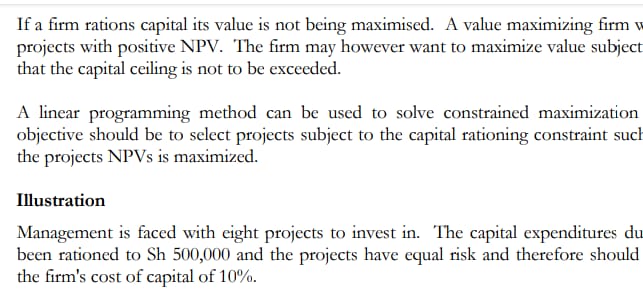

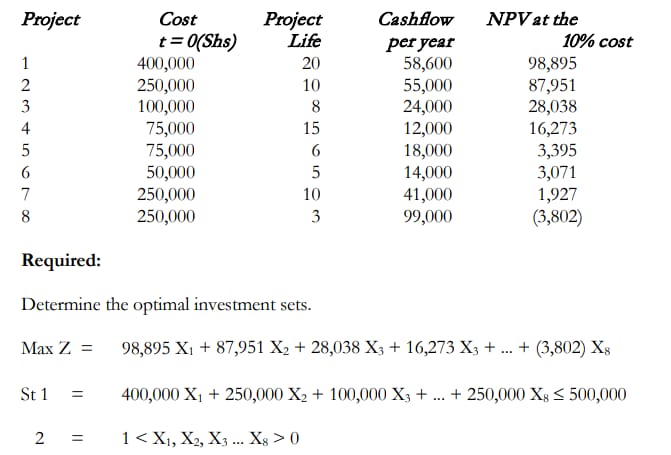

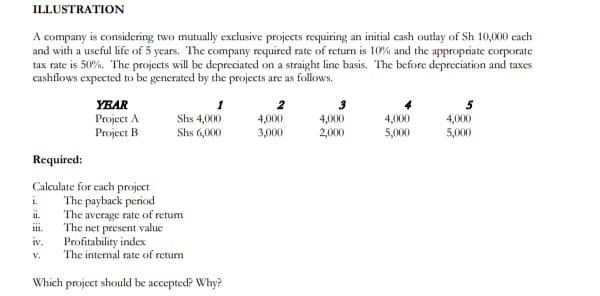

4. The Optimal Budget: Project Cost NPV 2 250,000 87,951 3 100,000 28,038 4 75,000 16,273 5 75,000 3,395 500,000 135,657 ABANDONMENT VALUE It has been assumed so far that the firm will operate a project over its full physical life. may not be the best option - it may be better to abandon a project prior to the end o Any project should be abandoned when the net abandonment value is greater than the of all cash flows beyond the abandonment year, discounted to the abandonment Consider the following example: Project A has the following cashflows over its useful life of 3 years. The market value value) has also been given. Year Cash Abandonment flow Sh'000' value Sh'000' 0123 (4,800) 4,800 2,000 3,000 1,875 1,900 1,750 0 If a firm rations capital its value is not being maximised. A value maximizing firm w projects with positive NPV. The firm may however want to maximize value subject that the capital ceiling is not to be exceeded. A linear programming method can be used to solve constrained maximization objective should be to select projects subject to the capital rationing constraint such the projects NPVs is maximized. Illustration Management is faced with eight projects to invest in. The capital expenditures du been rationed to Sh 500,000 and the projects have equal risk and therefore should the firm's cost of capital of 10%. Project Cost Project Cashflow NPV at the t=0(Shs) Life per year 10% cost 12345678 400,000 20 58,600 98,895 250,000 10 55,000 87,951 100,000 8 24,000 28,038 75,000 15 12,000 16,273 75,000 50,000 250,000 10 250,000 6503 18,000 3,395 14,000 3,071 41,000 1,927 99,000 (3,802) Required: Determine the optimal investment sets. Max Z = 98,895 X 87,951 X2 + 28,038 X3 + 16,273 X3 + + (3,802) X8 St 1 = 400,000 X1+250,000 X2 + 100,000 X3 + +250,000 X 500,000 2 = 1 0 Required: Determine when to abandon the project assuming a discount rate of 10% ILLUSTRATION A company is considering two mutually exclusive projects requiring an initial cash outlay of Sh 10,000 cach and with a useful life of 5 years. The company required rate of return is 10% and the appropriate corporate tax rate is 50%. The projects will be depreciated on a straight line basis. The before depreciation and taxes cashflows expected to be generated by the projects are as follows. YEAR Project A 3 5 Shs 4,000 4,000 4,000 4,000 4,000 Project B Shs 6,000 3,000 2,000 5,000 5,000 Required: Calculate for each project i. The payback period 11. The average rate of return The net present value iv. Profitability index v. The internal rate of return Which project should be accepted? Why?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

It seems youve provided a series of images related to capital budgeting and investment decisionmaking analysis including the concepts of Abandonment V...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started