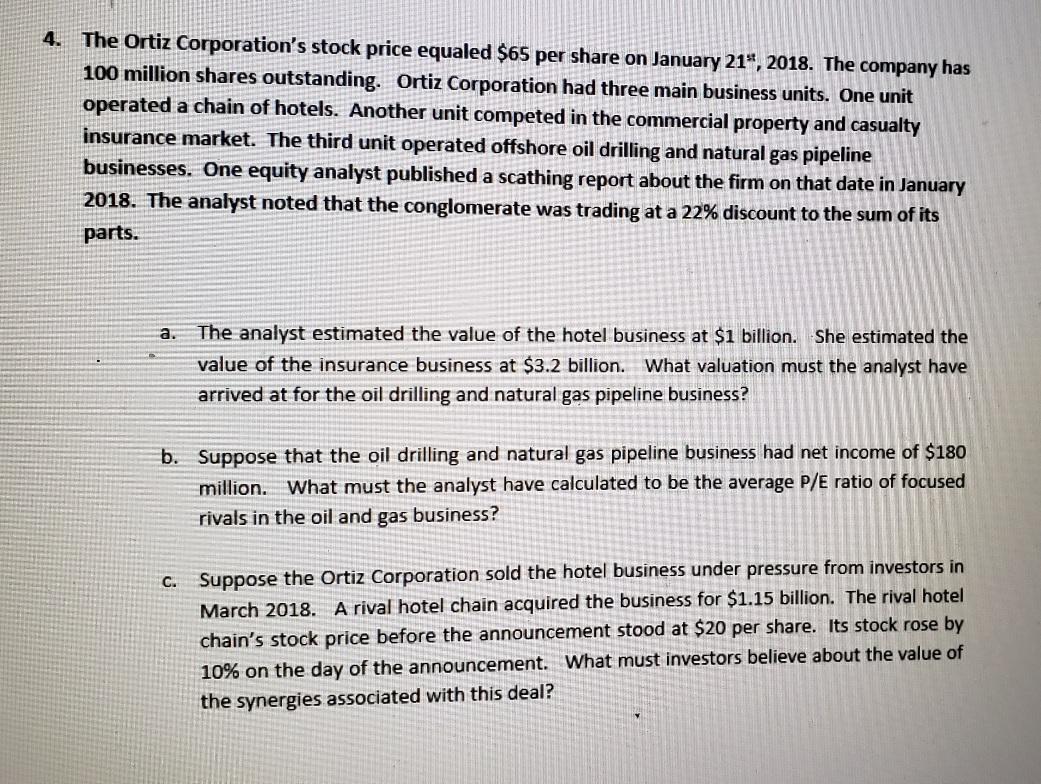

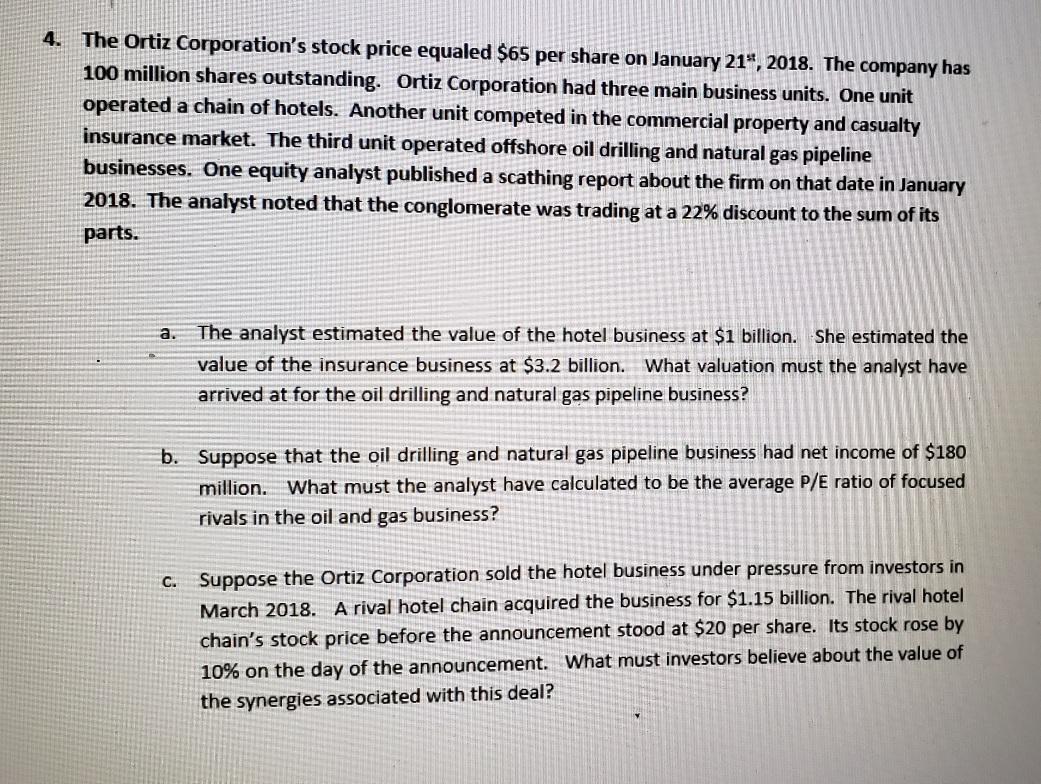

4. The Ortiz Corporation's stock price equaled $65 per share on January 21", 2018. The company has 100 million shares outstanding. Ortiz Corporation had three main business units. One unit operated a chain of hotels. Another unit competed in the commercial property and casualty insurance market. The third unit operated offshore oil drilling and natural gas pipeline businesses. One equity analyst published a scathing report about the firm on that date in January 2018. The analyst noted that the conglomerate was trading at a 22% discount to the sum of its parts. a. The analyst estimated the value of the hotel business at $1 billion. She estimated the value of the insurance business at $3.2 billion. What valuation must the analyst have arrived at for the oil drilling and natural gas pipeline business? b. Suppose that the oil drilling and natural gas pipeline business had net income of $180 million. What must the analyst have calculated to be the average P/E ratio of focused rivals in the oil and gas business? C. Suppose the Ortiz Corporation sold the hotel business under pressure from investors in March 2018. A rival hotel chain acquired the business for $1.15 billion. The rival hotel chain's stock price before the announcement stood at $20 per share. Its stock rose by 10% on the day of the announcement. What must investors believe about the value of the synergies associated with this deal? 4. The Ortiz Corporation's stock price equaled $65 per share on January 21", 2018. The company has 100 million shares outstanding. Ortiz Corporation had three main business units. One unit operated a chain of hotels. Another unit competed in the commercial property and casualty insurance market. The third unit operated offshore oil drilling and natural gas pipeline businesses. One equity analyst published a scathing report about the firm on that date in January 2018. The analyst noted that the conglomerate was trading at a 22% discount to the sum of its parts. a. The analyst estimated the value of the hotel business at $1 billion. She estimated the value of the insurance business at $3.2 billion. What valuation must the analyst have arrived at for the oil drilling and natural gas pipeline business? b. Suppose that the oil drilling and natural gas pipeline business had net income of $180 million. What must the analyst have calculated to be the average P/E ratio of focused rivals in the oil and gas business? C. Suppose the Ortiz Corporation sold the hotel business under pressure from investors in March 2018. A rival hotel chain acquired the business for $1.15 billion. The rival hotel chain's stock price before the announcement stood at $20 per share. Its stock rose by 10% on the day of the announcement. What must investors believe about the value of the synergies associated with this deal