Question: 4. The sec charged that moonstray violated FASB statement no.5, which deals with contingencies, by overstating a litigation reserve account related to environmental problems. Read

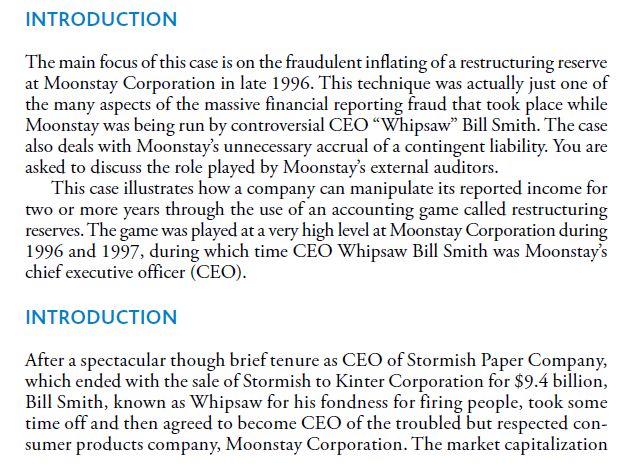

4. The sec charged that moonstray violated FASB statement no.5, which deals with contingencies, by overstating a litigation reserve account related to environmental problems. Read the discussion of loss contingencies found in any intermediate accounting textbook. What might by the nature of Moonstrays Violation of FASB Statement No.5? Why would Moonstrays management want to accrue at least $6 million more than necessary as a loss in 1996?

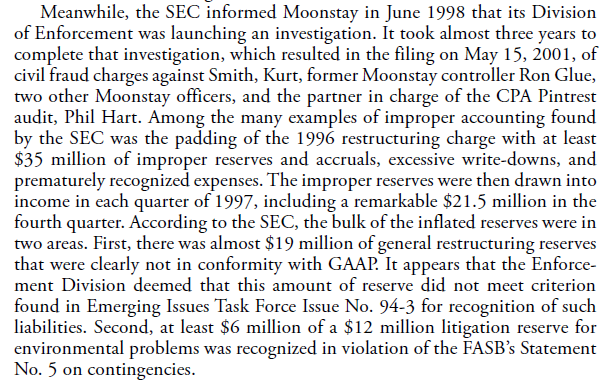

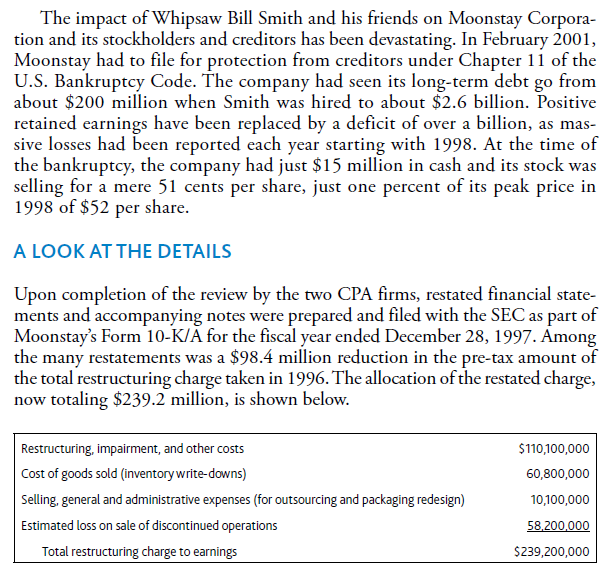

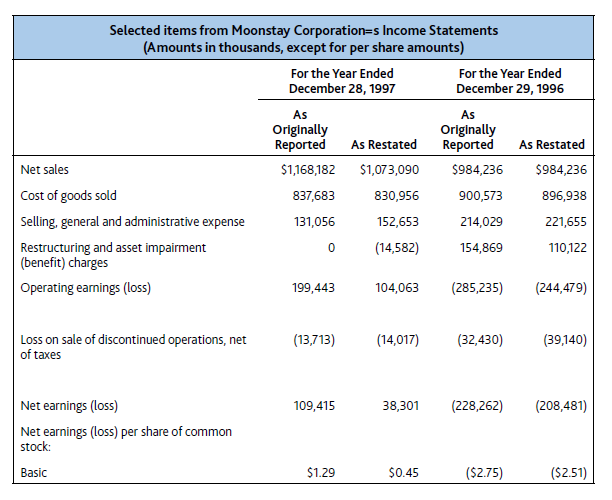

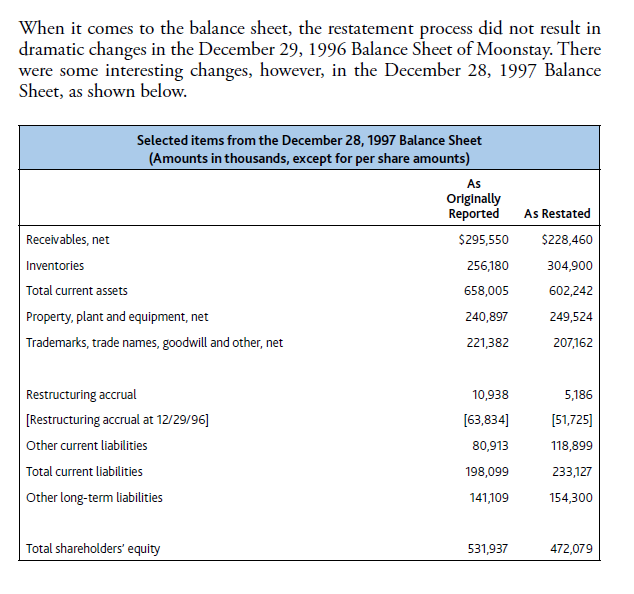

The impact of Whipsaw Bill Smith and his friends on Moonstay Corporation and its stockholders and creditors has been devastating. In February 2001, Moonstay had to file for protection from creditors under Chapter 11 of the U.S. Bankruptcy Code. The company had seen its long-term debt go from about $200 million when Smith was hired to about $2.6 billion. Positive retained earnings have been replaced by a deficit of over a billion, as massive losses had been reported each year starting with 1998. At the time of the bankruptcy, the company had just $15 million in cash and its stock was selling for a mere 51 cents per share, just one percent of its peak price in 1998 of $52 per share. A LOOK AT THE DETAILS Upon completion of the review by the two CPA firms, restated financial statements and accompanying notes were prepared and filed with the SEC as part of Moonstay's Form 10-K/A for the fiscal year ended December 28, 1997. Among the many restatements was a $98.4 million reduction in the pre-tax amount of the total restructuring charge taken in 1996. The allocation of the restated charge, now totaling $239.2 million, is shown below. restated income statement for fiscal year 1997. Interestingly, no such benefit appears on the originally reported income statement. Perhaps Moonstay's accountants were too busy reversing some of the purposely overstated reserves and accruals in ways that would not draw attention that they missed a legitimate opportunity to increase the 1997 net income. According to both the notes and the statement of cash flows found in the original 10-K filing, Moonstay paid \$43.4 million in cash during 1997 for costs associated with the 1996 restructuring plan. Included in this amount was a supposed $18.6 million for severance and other employee termination costs. However, the review by the two CPA firms only managed to find $21.2 million paid during 1997 for restructuring costs, or less than half the originally reported amount. In fact, the restated amount for severance and other employee termination costs was only $10 million. So it appears that Moonstay had charged an extra \$8.6 million to the restructuring reserve for payments to employees during 1997 for work done that year. Before posing a few questions to which you are to respond, shown below are some of the most important items from Moonstay's income statement and balance sheet as they were originally reported and as restated. When it comes to the balance sheet, the restatement process did not result in dramatic changes in the December 29, 1996 Balance Sheet of Moonstay. There were some interesting changes, however, in the December 28, 1997 Balance Sheet, as shown below. Ed Paul is considered one of the most successful stock investors in history, and he has written a series of letters to shareholders that are both informative and entertaining. There are usually a couple of pages devoted to accounting issues, and the 1998 letter focused on restructuring charges, which Paul described as a "distortion." He indicated that restructuring was frequently a device for manipulation. A part of costs for a number of years is typically dumped into a single quarter. The timing is designed to allow future quarters to exceed investor expectation. Sure enough, Moonstay reported successively larger profits for each quarter of 1997, culminating in earnings before discontinued operations for the year of over \$123 million and a bottom line of over $109 million. This result was an apparent turnaround of over $300 million from the year before, and Wall Street responded by bidding Moonstay shares up to a high of $52 per share in March 1998. Unfortunately for many investors, creditors, and other Moonstay Meanwhile, the SEC informed Moonstay in June 1998 that its Division of Enforcement was launching an investigation. It took almost three years to complete that investigation, which resulted in the filing on May 15, 2001, of civil fraud charges against Smith, Kurt, former Moonstay controller Ron Glue, two other Moonstay officers, and the partner in charge of the CPA Pintrest audit, Phil Hart. Among the many examples of improper accounting found by the SEC was the padding of the 1996 restructuring charge with at least $35 million of improper reserves and accruals, excessive write-downs, and prematurely recognized expenses. The improper reserves were then drawn into income in each quarter of 1997 , including a remarkable $21.5 million in the fourth quarter. According to the SEC, the bulk of the inflated reserves were in two areas. First, there was almost $19 million of general restructuring reserves that were clearly not in conformity with GAAP. It appears that the Enforcement Division deemed that this amount of reserve did not meet criterion found in Emerging Issues Task Force Issue No. 94-3 for recognition of such liabilities. Second, at least $6 million of a $12 million litigation reserve for environmental problems was recognized in violation of the FASB's Statement No. 5 on contingencies. of Stormish had increased by $6.3 billion during Smith's time there, with Smith's net worth increasing by about $100 million, and both Wall Street and Moonstay stockholders were thrilled at the prospect of another phenomenal turnaround at Moonstay. Indeed, on July 19, 1996, the day after Smith was hired, shares of Moonstay stock were bid up nearly 60 percent, the largest one-day increase to that point in time in the history of the New York Stock Exchange. Four months later, Whipsaw outlined a restructuring plan to the Moonstay board of directors. He told the Board that he would eliminate half of the company's 12,000 employees, stop producing 87 percent of existing products, close the majority of its factories and warehouses, and divest several lines of business. He informed the board that this downsizing would save the company $225 million per year but also result in a one-time pretax charge of $300 million. According to the Notes to the Consolidated Financial Statements found in Moonstay's 1997 Form 10-K filed with the SEC, the total restructuring charge was actually $337.6 million. This charge, which helped produce a net loss for 1996 of over $228 million, was described in the Notes as having been allocated in the manner shown below: stakeholders, much of the miraculous turnaround was the result of creative accounting. Moonstay's chief financial officer (CFO) Robert Kurt, who also worked with Smith at Stormish, liked to remind fellow executives that he was Moonstay's "biggest profit center," and Smith stated at meetings that, "if it wasn't for Robert and the accounting team, we'd be nowhere." Things started to unravel quickly at Moonstay in early 1998, with the stock price going down fast in reaction to a series of disappointing revenue and profit reports and projections. After an article in Forbes by Matthew Toast questioned the accounting practices at Moonstay, the board of directors took the extreme action of firing both Smith and Kurt on June 13, 1998. Moonstay's external auditor, the CPA firm of CPA Pintrest, then refused to allow its unqualified opinion on the 1997 financial statements to be used in connection with any securities offerings by Moonstay. The Board and the newly appointed top management team ordered a review of the company's prior financial statements. Moonstay hired the CPA firm of CPA Capital to assist the audit committee of the board and CPA Pintrest with the review. The review led to the filing of an amended 10-K with the SEC in November 1998. Included in this 10K/A were restated financial statements. When these are compared to the originally issued statements, it is apparent that Moonstay had purposely overstated its loss in 1996 (a big bath) and followed that with an vastly overstated net income in 1997 . While much of the misstatements resulted from improper accounting for revenues and various expenses, along with the use of sham transactions, the manipulation of the restructuring reserves created by the CFO in 1996 played a significant role as well. Indeed, it seems likely that Ed Paul had Moonstay in mind when he wrote about restructurings. \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{SelecteditemsfromMoonstayCorporation=sIncomeStatements(Amountsinthousands,exceptforpershareamounts)} \\ \hline & FortheYDecembe & arEnded28,1997 & FortheYDecembe & arEnded29,1996 \\ \hline & AsOriginallyReported & As Restated & AsOriginallyReported & As Restated \\ \hline Net sales & $1,168,182 & $1,073,090 & $984,236 & $984,236 \\ \hline Cost of goods sold & 837,683 & 830,956 & 900,573 & 896,938 \\ \hline Selling, general and administrative expense & 131,056 & 152,653 & 214,029 & 221,655 \\ \hline Restructuringandassetimpairment(benefit)charges & 0 & (14,582) & 154,869 & 110,122 \\ \hline Operating earnings (loss) & 199,443 & 104,063 & (285,235) & (244,479) \\ \hline Lossonsaleofdiscontinuedoperations,netoftaxes & (13,713) & (14,017) & (32,430) & (39,140) \\ \hline Net earnings (loss) & 109,415 & 38,301 & (228,262) & (208,481) \\ \hline \multicolumn{5}{|l|}{Netearnings(loss)pershareofcommonstock:} \\ \hline Basic & $1.29 & $0.45 & ($2.75) & ($2.51) \\ \hline \end{tabular} The main focus of this case is on the fraudulent inflating of a restructuring reserve at Moonstay Corporation in late 1996. This technique was actually just one of the many aspects of the massive financial reporting fraud that took place while Moonstay was being run by controversial CEO "Whipsaw" Bill Smith. The case also deals with Moonstay's unnecessary accrual of a contingent liability. You are asked to discuss the role played by Moonstay's external auditors. This case illustrates how a company can manipulate its reported income for two or more years through the use of an accounting game called restructuring reserves. The game was played at a very high level at Moonstay Corporation during 1996 and 1997, during which time CEO Whipsaw Bill Smith was Moonstay's chief executive officer (CEO). INTRODUCTION After a spectacular though brief tenure as CEO of Stormish Paper Company, which ended with the sale of Stormish to Kinter Corporation for $9.4 billion, Bill Smith, known as Whipsaw for his fondness for firing people, took some time off and then agreed to become CEO of the troubled but respected consumer products company, Moonstay Corporation. The market capitalization The impact of Whipsaw Bill Smith and his friends on Moonstay Corporation and its stockholders and creditors has been devastating. In February 2001, Moonstay had to file for protection from creditors under Chapter 11 of the U.S. Bankruptcy Code. The company had seen its long-term debt go from about $200 million when Smith was hired to about $2.6 billion. Positive retained earnings have been replaced by a deficit of over a billion, as massive losses had been reported each year starting with 1998. At the time of the bankruptcy, the company had just $15 million in cash and its stock was selling for a mere 51 cents per share, just one percent of its peak price in 1998 of $52 per share. A LOOK AT THE DETAILS Upon completion of the review by the two CPA firms, restated financial statements and accompanying notes were prepared and filed with the SEC as part of Moonstay's Form 10-K/A for the fiscal year ended December 28, 1997. Among the many restatements was a $98.4 million reduction in the pre-tax amount of the total restructuring charge taken in 1996. The allocation of the restated charge, now totaling $239.2 million, is shown below. restated income statement for fiscal year 1997. Interestingly, no such benefit appears on the originally reported income statement. Perhaps Moonstay's accountants were too busy reversing some of the purposely overstated reserves and accruals in ways that would not draw attention that they missed a legitimate opportunity to increase the 1997 net income. According to both the notes and the statement of cash flows found in the original 10-K filing, Moonstay paid \$43.4 million in cash during 1997 for costs associated with the 1996 restructuring plan. Included in this amount was a supposed $18.6 million for severance and other employee termination costs. However, the review by the two CPA firms only managed to find $21.2 million paid during 1997 for restructuring costs, or less than half the originally reported amount. In fact, the restated amount for severance and other employee termination costs was only $10 million. So it appears that Moonstay had charged an extra \$8.6 million to the restructuring reserve for payments to employees during 1997 for work done that year. Before posing a few questions to which you are to respond, shown below are some of the most important items from Moonstay's income statement and balance sheet as they were originally reported and as restated. When it comes to the balance sheet, the restatement process did not result in dramatic changes in the December 29, 1996 Balance Sheet of Moonstay. There were some interesting changes, however, in the December 28, 1997 Balance Sheet, as shown below. Ed Paul is considered one of the most successful stock investors in history, and he has written a series of letters to shareholders that are both informative and entertaining. There are usually a couple of pages devoted to accounting issues, and the 1998 letter focused on restructuring charges, which Paul described as a "distortion." He indicated that restructuring was frequently a device for manipulation. A part of costs for a number of years is typically dumped into a single quarter. The timing is designed to allow future quarters to exceed investor expectation. Sure enough, Moonstay reported successively larger profits for each quarter of 1997, culminating in earnings before discontinued operations for the year of over \$123 million and a bottom line of over $109 million. This result was an apparent turnaround of over $300 million from the year before, and Wall Street responded by bidding Moonstay shares up to a high of $52 per share in March 1998. Unfortunately for many investors, creditors, and other Moonstay Meanwhile, the SEC informed Moonstay in June 1998 that its Division of Enforcement was launching an investigation. It took almost three years to complete that investigation, which resulted in the filing on May 15, 2001, of civil fraud charges against Smith, Kurt, former Moonstay controller Ron Glue, two other Moonstay officers, and the partner in charge of the CPA Pintrest audit, Phil Hart. Among the many examples of improper accounting found by the SEC was the padding of the 1996 restructuring charge with at least $35 million of improper reserves and accruals, excessive write-downs, and prematurely recognized expenses. The improper reserves were then drawn into income in each quarter of 1997 , including a remarkable $21.5 million in the fourth quarter. According to the SEC, the bulk of the inflated reserves were in two areas. First, there was almost $19 million of general restructuring reserves that were clearly not in conformity with GAAP. It appears that the Enforcement Division deemed that this amount of reserve did not meet criterion found in Emerging Issues Task Force Issue No. 94-3 for recognition of such liabilities. Second, at least $6 million of a $12 million litigation reserve for environmental problems was recognized in violation of the FASB's Statement No. 5 on contingencies. of Stormish had increased by $6.3 billion during Smith's time there, with Smith's net worth increasing by about $100 million, and both Wall Street and Moonstay stockholders were thrilled at the prospect of another phenomenal turnaround at Moonstay. Indeed, on July 19, 1996, the day after Smith was hired, shares of Moonstay stock were bid up nearly 60 percent, the largest one-day increase to that point in time in the history of the New York Stock Exchange. Four months later, Whipsaw outlined a restructuring plan to the Moonstay board of directors. He told the Board that he would eliminate half of the company's 12,000 employees, stop producing 87 percent of existing products, close the majority of its factories and warehouses, and divest several lines of business. He informed the board that this downsizing would save the company $225 million per year but also result in a one-time pretax charge of $300 million. According to the Notes to the Consolidated Financial Statements found in Moonstay's 1997 Form 10-K filed with the SEC, the total restructuring charge was actually $337.6 million. This charge, which helped produce a net loss for 1996 of over $228 million, was described in the Notes as having been allocated in the manner shown below: stakeholders, much of the miraculous turnaround was the result of creative accounting. Moonstay's chief financial officer (CFO) Robert Kurt, who also worked with Smith at Stormish, liked to remind fellow executives that he was Moonstay's "biggest profit center," and Smith stated at meetings that, "if it wasn't for Robert and the accounting team, we'd be nowhere." Things started to unravel quickly at Moonstay in early 1998, with the stock price going down fast in reaction to a series of disappointing revenue and profit reports and projections. After an article in Forbes by Matthew Toast questioned the accounting practices at Moonstay, the board of directors took the extreme action of firing both Smith and Kurt on June 13, 1998. Moonstay's external auditor, the CPA firm of CPA Pintrest, then refused to allow its unqualified opinion on the 1997 financial statements to be used in connection with any securities offerings by Moonstay. The Board and the newly appointed top management team ordered a review of the company's prior financial statements. Moonstay hired the CPA firm of CPA Capital to assist the audit committee of the board and CPA Pintrest with the review. The review led to the filing of an amended 10-K with the SEC in November 1998. Included in this 10K/A were restated financial statements. When these are compared to the originally issued statements, it is apparent that Moonstay had purposely overstated its loss in 1996 (a big bath) and followed that with an vastly overstated net income in 1997 . While much of the misstatements resulted from improper accounting for revenues and various expenses, along with the use of sham transactions, the manipulation of the restructuring reserves created by the CFO in 1996 played a significant role as well. Indeed, it seems likely that Ed Paul had Moonstay in mind when he wrote about restructurings. \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{SelecteditemsfromMoonstayCorporation=sIncomeStatements(Amountsinthousands,exceptforpershareamounts)} \\ \hline & FortheYDecembe & arEnded28,1997 & FortheYDecembe & arEnded29,1996 \\ \hline & AsOriginallyReported & As Restated & AsOriginallyReported & As Restated \\ \hline Net sales & $1,168,182 & $1,073,090 & $984,236 & $984,236 \\ \hline Cost of goods sold & 837,683 & 830,956 & 900,573 & 896,938 \\ \hline Selling, general and administrative expense & 131,056 & 152,653 & 214,029 & 221,655 \\ \hline Restructuringandassetimpairment(benefit)charges & 0 & (14,582) & 154,869 & 110,122 \\ \hline Operating earnings (loss) & 199,443 & 104,063 & (285,235) & (244,479) \\ \hline Lossonsaleofdiscontinuedoperations,netoftaxes & (13,713) & (14,017) & (32,430) & (39,140) \\ \hline Net earnings (loss) & 109,415 & 38,301 & (228,262) & (208,481) \\ \hline \multicolumn{5}{|l|}{Netearnings(loss)pershareofcommonstock:} \\ \hline Basic & $1.29 & $0.45 & ($2.75) & ($2.51) \\ \hline \end{tabular} The main focus of this case is on the fraudulent inflating of a restructuring reserve at Moonstay Corporation in late 1996. This technique was actually just one of the many aspects of the massive financial reporting fraud that took place while Moonstay was being run by controversial CEO "Whipsaw" Bill Smith. The case also deals with Moonstay's unnecessary accrual of a contingent liability. You are asked to discuss the role played by Moonstay's external auditors. This case illustrates how a company can manipulate its reported income for two or more years through the use of an accounting game called restructuring reserves. The game was played at a very high level at Moonstay Corporation during 1996 and 1997, during which time CEO Whipsaw Bill Smith was Moonstay's chief executive officer (CEO). INTRODUCTION After a spectacular though brief tenure as CEO of Stormish Paper Company, which ended with the sale of Stormish to Kinter Corporation for $9.4 billion, Bill Smith, known as Whipsaw for his fondness for firing people, took some time off and then agreed to become CEO of the troubled but respected consumer products company, Moonstay Corporation. The market capitalization

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts