Answered step by step

Verified Expert Solution

Question

1 Approved Answer

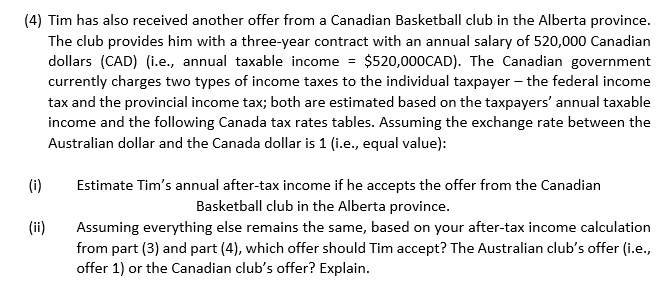

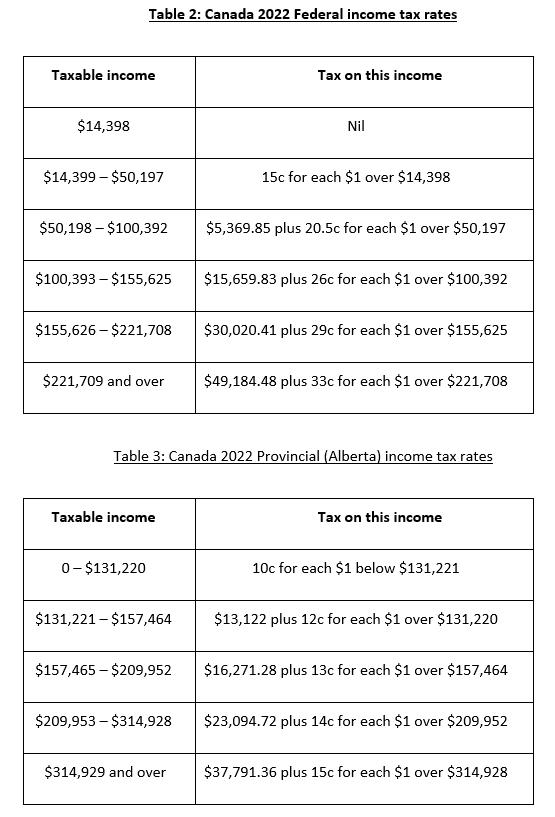

(4) Tim has also received another offer from a Canadian Basketball club in the Alberta province. The club provides him with a three-year contract

(4) Tim has also received another offer from a Canadian Basketball club in the Alberta province. The club provides him with a three-year contract with an annual salary of 520,000 Canadian dollars (CAD) (i.e., annual taxable income = $520,000CAD). The Canadian government currently charges two types of income taxes to the individual taxpayer - the federal income tax and the provincial income tax; both are estimated based on the taxpayers' annual taxable income and the following Canada tax rates tables. Assuming the exchange rate between the Australian dollar and the Canada dollar is 1 (i.e., equal value): (i) (ii) Estimate Tim's annual after-tax income if he accepts the offer from the Canadian Basketball club in the Alberta province. Assuming everything else remains the same, based on your after-tax income calculation from part (3) and part (4), which offer should Tim accept? The Australian club's offer (i.e., offer 1) or the Canadian club's offer? Explain. Taxable income $14,398 Table 2: Canada 2022 Federal income tax rates $14,399 $50,197 $50,198 - $100,392 $100,393 - $155,625 $155,626-$221,708 $221,709 and over Taxable income 0-$131,220 $131,221-$157,464 $157,465-$209,952 $209,953- $314,928 Tax on this income $314,929 and over Nil Table 3: Canada 2022 Provincial (Alberta) income tax rates 15c for each $1 over $14,398 $5,369.85 plus 20.5c for each $1 over $50,197 $15,659.83 plus 26c for each $1 over $100,392 $30,020.41 plus 29c for each $1 over $155,625 $49,184.48 plus 33c for each $1 over $221,708 Tax on this income 10c for each $1 below $131,221 $13,122 plus 12c for each $1 over $131,220 $16,271.28 plus 13c for each $1 over $157,464 $23,094.72 plus 14c for each $1 over $209,952 $37,791.36 plus 15c for each $1 over $314,928

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To estimate Tims annual aftertax income if he accepts the offer from the Canadian Basketball club in ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started