Answered step by step

Verified Expert Solution

Question

1 Approved Answer

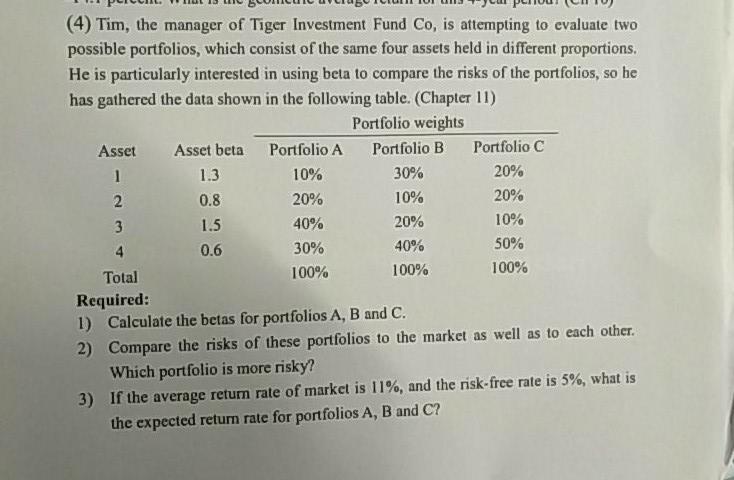

(4) Tim, the manager of Tiger Investment Fund Co, is attempting to evaluate two possible portfolios, which consist of the same four assets held

(4) Tim, the manager of Tiger Investment Fund Co, is attempting to evaluate two possible portfolios, which consist of the same four assets held in different proportions. He is particularly interested in using beta to compare the risks of the portfolios, so he has gathered the data shown in the following table. (Chapter 11) Portfolio weights Asset Asset beta Portfolio A Portfolio B Portfolio C 1 1.3 10% 30% 20% 2 0.8 20% 10% 20% 3 1.5 40% 20% 10% 4 0.6 30% 40% 50% Total 100% 100% 100% Required: 1) Calculate the betas for portfolios A, B and C. 2) Compare the risks of these portfolios to the market as well as to each other. Which portfolio is more risky? 3) If the average return rate of market is 11%, and the risk-free rate is 5%, what is the expected return rate for portfolios A, B and C?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the betas for portfolios A B and C we need to use the weighted average of the asset bet...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started