Answered step by step

Verified Expert Solution

Question

1 Approved Answer

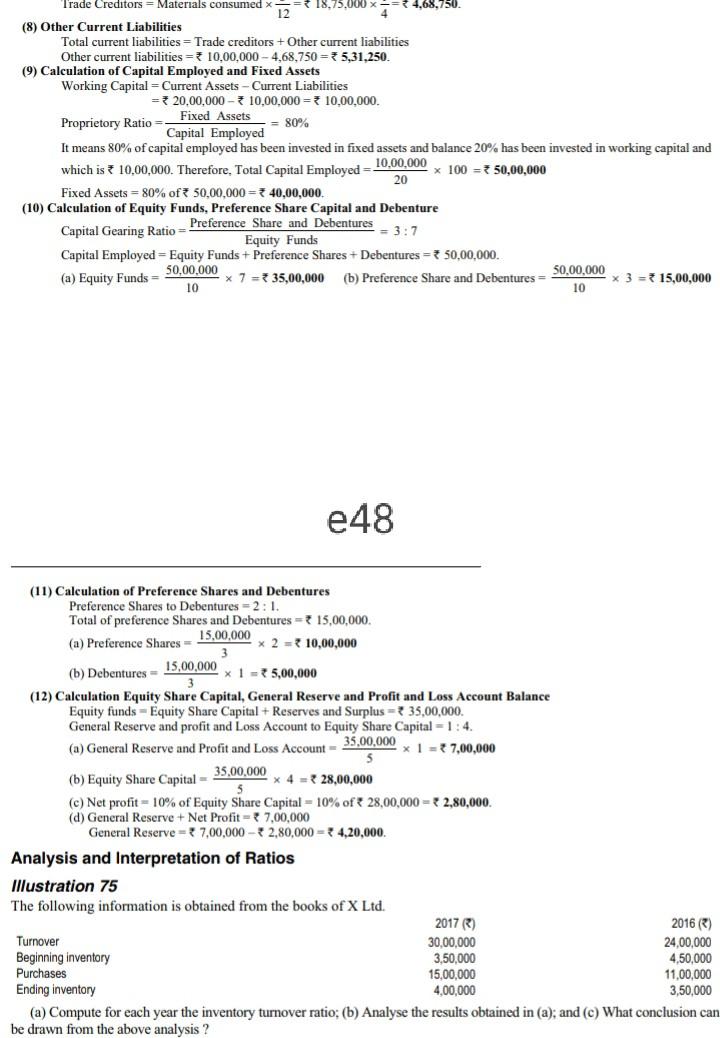

4 Trade Creditors Materials consumed 12 18,75,000 4,68,750. (8) Other Current Liabilities Total current liabilities = Trade creditors + Other current liabilities Other current liabilities

4 Trade Creditors Materials consumed 12 18,75,000 4,68,750. (8) Other Current Liabilities Total current liabilities = Trade creditors + Other current liabilities Other current liabilities = * 10,00,000 -4,68,750 = 35,31,250. (9) Calculation of Capital Employed and Fixed Assets Working Capital = Current Assets - Current Liabilities = 20,00,000 - 10,00.000 = 10,00.000 Fixed Assets Proprietory Ratio = 80% Capital Employed It means 80% of capital employed has been invested in fixed assets and balance 20% has been invested in working capital and which is 10,00,000. Therefore, Total Capital Employed = 10,00,000 x 100 = 50,00.000 20 Fixed Assets = 80% of 50,00,000= 40,00,000 (10) Calculation of Equity Funds, Preference Share Capital and Debenture Capital Gearing Ratio - Preference Share and Debentures = 3:7 Equity Funds Capital Employed Equity Funds + Preference Shares + Debentures = 50,00,000 50,00.000 50,00.000 (a) Equity Funds * 7 = 35,00,000 (b) Preference Share and Debentures x 3 =15,00,000 10 10 e48 (11) Calculation of Preference Shares and Debentures Preference Shares to Debentures = 2:1. Total of preference Shares and Debentures = 15,00,000. x 2 = 10,00,000 (a) Preference Shares 15,00.000 (b) Debentures - 15,00,000 x1 = 5,00,000 3 (12) Calculation Equity Share Capital, General Reserve and Profit and Loss Account Balance Equity funds - Equity Share Capital + Reserves and Surplus = 35,00,000. General Reserve and profit and Loss Account to Equity Share Capital - 1 : 4. 35,00,000 (a) General Reserve and Profit and Loss Account x1 = 7,00,000 35,00,000 (b) Equity Share Capital x 4 = 28,00,000 (c) Net profit=10% of Equity Share Capital = 10% of 28,00,000 = 2,80,000. (d) General Reserve + Net Profit - 7,00,000 General Reserve = 7,00,000 - 2,80,000 = 4,20,000. Analysis and Interpretation of Ratios Illustration 75 The following information is obtained from the books of X Ltd. 2017 (3) 2016 () Turnover 30,00,000 24,00,000 Beginning inventory 3,50,000 4,50.000 Purchases 15,00,000 11,00,000 Ending inventory 4,00,000 3,50,000 (a) Compute for each year the inventory turnover ratio; (b) Analyse the results obtained in (a); and (c) What conclusion can be drawn from the above analysis

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started