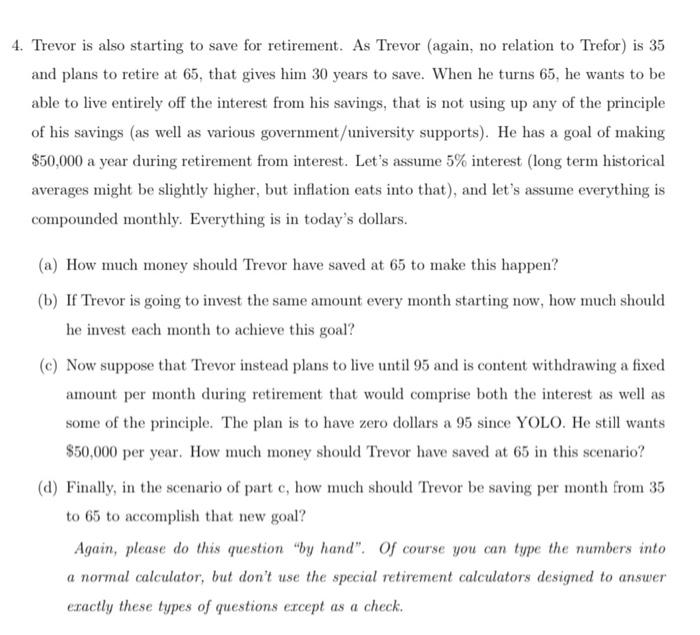

4. Trevor is also starting to save for retirement. As Trevor (again, no relation to Trefor) is 35 and plans to retire at 65, that gives him 30 years to save. When he turns 65, he wants to be able to live entirely off the interest from his savings, that is not using up any of the principle of his savings as well as various government/university supports). He has a goal of making $50,000 a year during retirement from interest. Let's assume 5% interest (long term historical averages might be slightly higher, but inflation eats into that), and let's assume everything is compounded monthly. Everything is in today's dollars. (a) How much money should Trevor have saved at 65 to make this happen? (b) If Trevor is going to invest the same amount every month starting now, how much should he invest each month to achieve this goal? (C) Now suppose that Trevor instead plans to live until 95 and is content withdrawing a fixed amount per month during retirement that would comprise both the interest as well as some of the principle. The plan is to have zero dollars a 95 since YOLO. He still wants $50,000 per year. How much money should Trevor have saved at 65 in this scenario? (d) Finally, in the scenario of part c, how much should Trevor be saving per month from 35 to 65 to accomplish that new goal? Again, please do this question "by hand". Of course you can type the numbers into a normal calculator, but don't use the special retirement calculators designed to answer eractly these types of questions except as a check. 4. Trevor is also starting to save for retirement. As Trevor (again, no relation to Trefor) is 35 and plans to retire at 65, that gives him 30 years to save. When he turns 65, he wants to be able to live entirely off the interest from his savings, that is not using up any of the principle of his savings as well as various government/university supports). He has a goal of making $50,000 a year during retirement from interest. Let's assume 5% interest (long term historical averages might be slightly higher, but inflation eats into that), and let's assume everything is compounded monthly. Everything is in today's dollars. (a) How much money should Trevor have saved at 65 to make this happen? (b) If Trevor is going to invest the same amount every month starting now, how much should he invest each month to achieve this goal? (C) Now suppose that Trevor instead plans to live until 95 and is content withdrawing a fixed amount per month during retirement that would comprise both the interest as well as some of the principle. The plan is to have zero dollars a 95 since YOLO. He still wants $50,000 per year. How much money should Trevor have saved at 65 in this scenario? (d) Finally, in the scenario of part c, how much should Trevor be saving per month from 35 to 65 to accomplish that new goal? Again, please do this question "by hand". Of course you can type the numbers into a normal calculator, but don't use the special retirement calculators designed to answer eractly these types of questions except as a check