Question

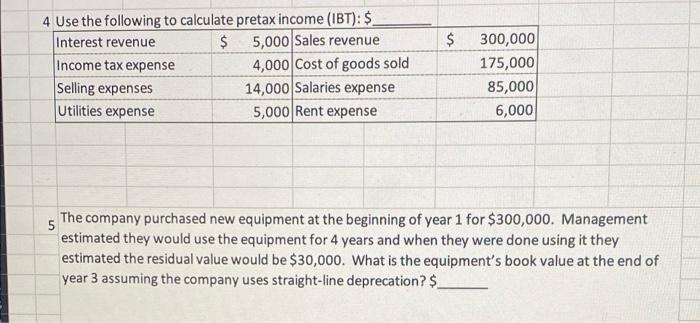

4 Use the following to calculate pretax income (IBT): $. 5,000 Sales revenue 4,000 Cost of goods sold 14,000 Salaries expense 5,000 Rent expense

4 Use the following to calculate pretax income (IBT): $. 5,000 Sales revenue 4,000 Cost of goods sold 14,000 Salaries expense 5,000 Rent expense 2$ 175,000 85,000 Interest revenue $ 300,000 Income tax expense Selling expenses Utilities expense 6,000 The company purchased new equipment at the beginning of year 1 for $300,000. Management estimated they would use the equipment for 4 years and when they were done using it they estimated the residual value would be $30,000. What is the equipment's book value at the end of year 3 assuming the company uses straight-line deprecation? $

Step by Step Solution

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Rent Ex pense 6000 4 Calculation of Pre tar Income Particula...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Management and Cost Accounting

Authors: Alnoor Bhimani, Charles T. Horngren, Srikant M. Datar, Madhav V. Rajan

6th edition

1292063467, 978-1292063461

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App