4. What is the Vacation Payable balance after the adjusting journal entry booked on 12/31/X1 based on the above fact pattern? Enter the amount as

4. What is the Vacation Payable balance after the adjusting journal entry booked on 12/31/X1 based on the above fact pattern? Enter the amount as a positive number with no symbols.

5. What is the journal entry for when 20X1 Vacations are taken in 20X2? Assume the actual expense of paying out Vacation is done with Cash.

B. Debit Vacation Payable for $1,470,000 and Credit Cash for $1,470,000

D. Debit Vacation Payable for $930,000 and Credit Cash for $930,000

C. C. Debit Vacation Payable for $1,200,000 and Credit Cash for $1,200,000

A. Debit Vacation Payable for $1,380,000 and Credit Cash for $1,380,000

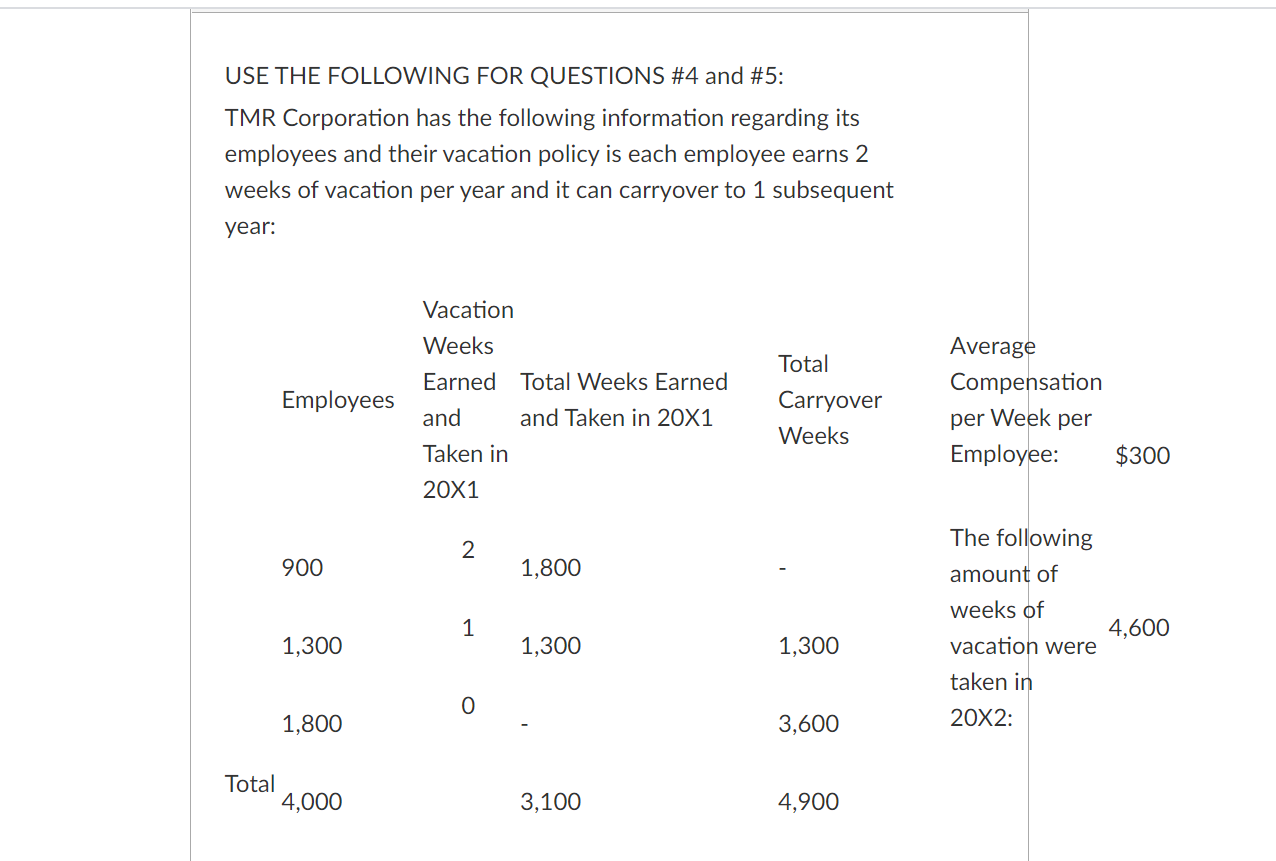

USE THE FOLLOWING FOR QUESTIONS #4 and #5: TMR Corporation has the following information regarding its employees and their vacation policy is each employee earns 2 weeks of vacation per year and it can carryover to 1 subsequent year: Vacation Weeks Total Earned Employees and Total Weeks Earned and Taken in 20X1 Average Compensation Carryover Weeks per Week per Taken in Employee: $300 20X1 The following 2 900 1,800 amount of weeks of 1 4,600 1,300 1,300 1,300 vacation were taken in 0 1,800 3,600 20X2: Total 4,000 3,100 4,900

Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started