Answered step by step

Verified Expert Solution

Question

1 Approved Answer

4. You are a U.S.-based company that just imported some raw materials for 200,000 from France. You owe 200,000 to the French supplier in

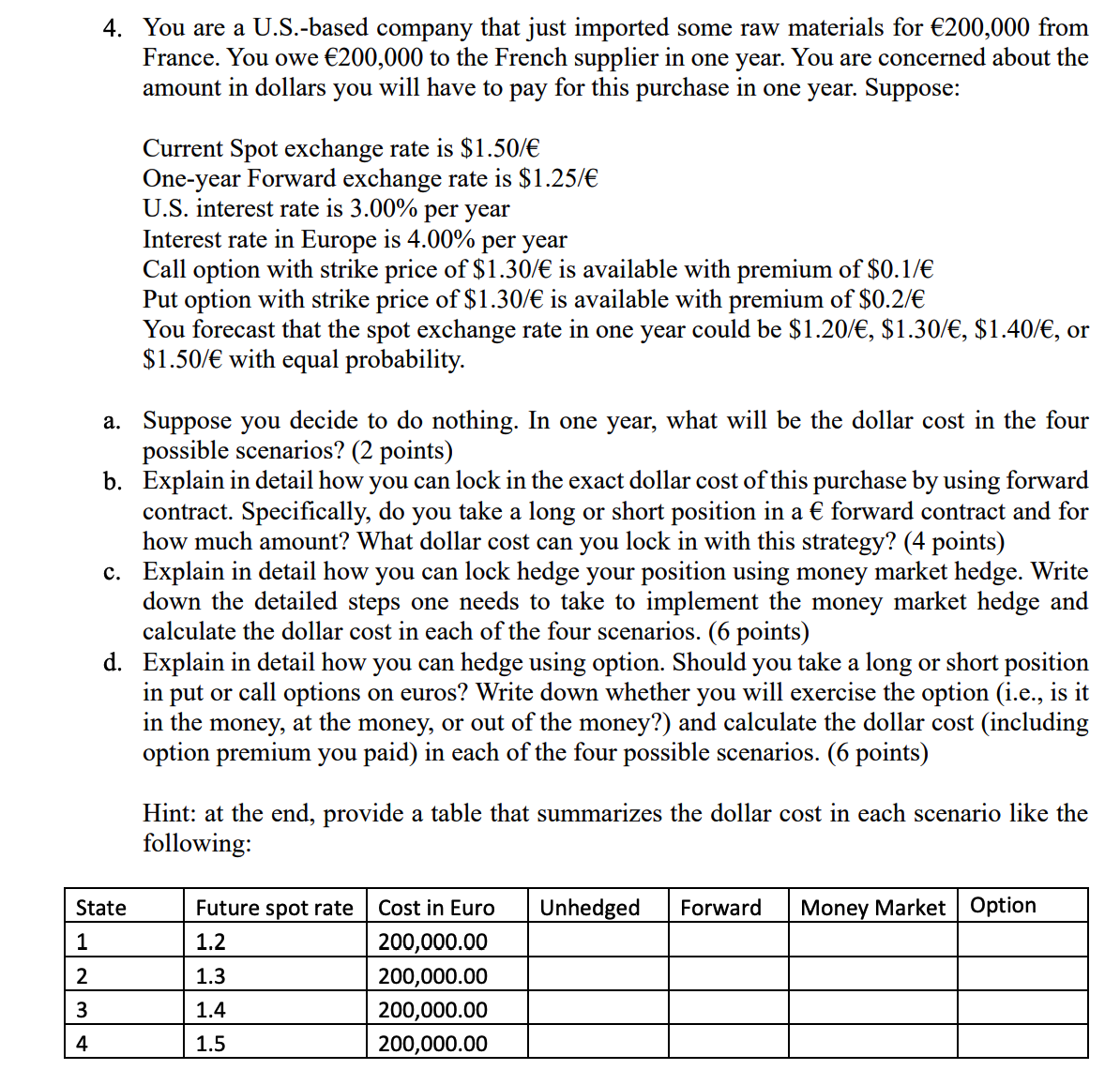

4. You are a U.S.-based company that just imported some raw materials for 200,000 from France. You owe 200,000 to the French supplier in one year. You are concerned about the amount in dollars you will have to pay for this purchase in one year. Suppose: a. b. Current Spot exchange rate is $1.50/ One-year Forward exchange rate is $1.25/ U.S. interest rate is 3.00% per year Interest rate in Europe is 4.00% per year Call option with strike price of $1.30/ is available with premium of $0.1/ Put option with strike price of $1.30/ is available with premium of $0.2/ You forecast that the spot exchange rate in one year could be $1.20/, $1.30/, $1.40/, or $1.50/ with equal probability. State 1 2 3 4 Suppose you decide to do nothing. In one year, what will be the dollar cost in the four possible scenarios? (2 points) Explain in detail how you can lock in the exact dollar cost of this purchase by using forward contract. Specifically, do you take a long or short position in a forward contract and for how much amount? What dollar cost can you lock in with this strategy? (4 points) c. Explain in detail how you can lock hedge your position using money market hedge. Write down the detailed steps one needs to take to implement the money market hedge and calculate the dollar cost in each of the four scenarios. (6 points) d. Explain in detail how you can hedge using option. Should you take a long or short position in put or call options on euros? Write down whether you will exercise the option (i.e., is it in the money, at the money, or out of the money?) and calculate the dollar cost (including option premium you paid) each of the four possible scenarios. (6 points) Hint: at the end, provide a table that summarizes the dollar cost in each scenario like the following: Future spot rate Cost in Euro 200,000.00 200,000.00 200,000.00 200,000.00 1.2 1.3 1.4 1.5 Unhedged Forward Money Market Option

Step by Step Solution

★★★★★

3.48 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

a If you decide to do nothing unhedged the dollar cost in the four possible scenarios can be calculated as follows Scenario 1 Spot exchange rate 120 Dollar cost 200000 120 240000 Scenario 2 Spot excha...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started