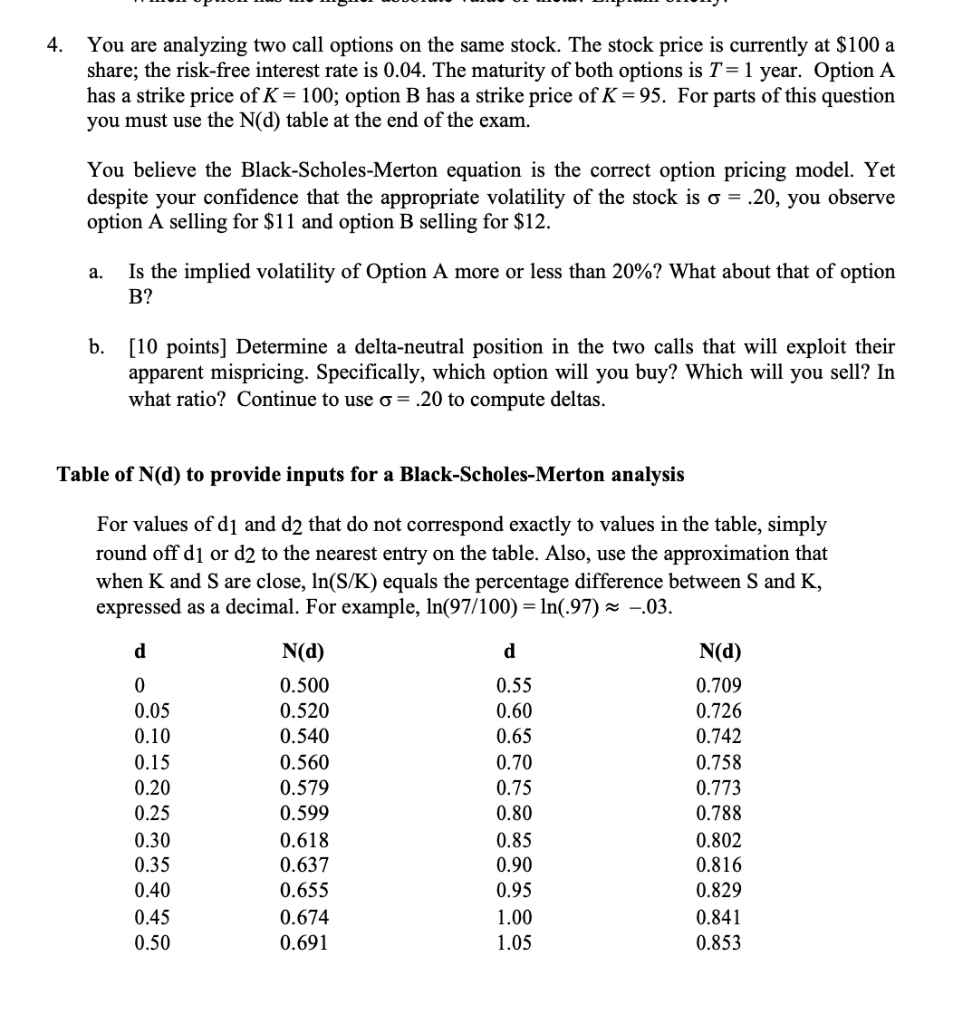

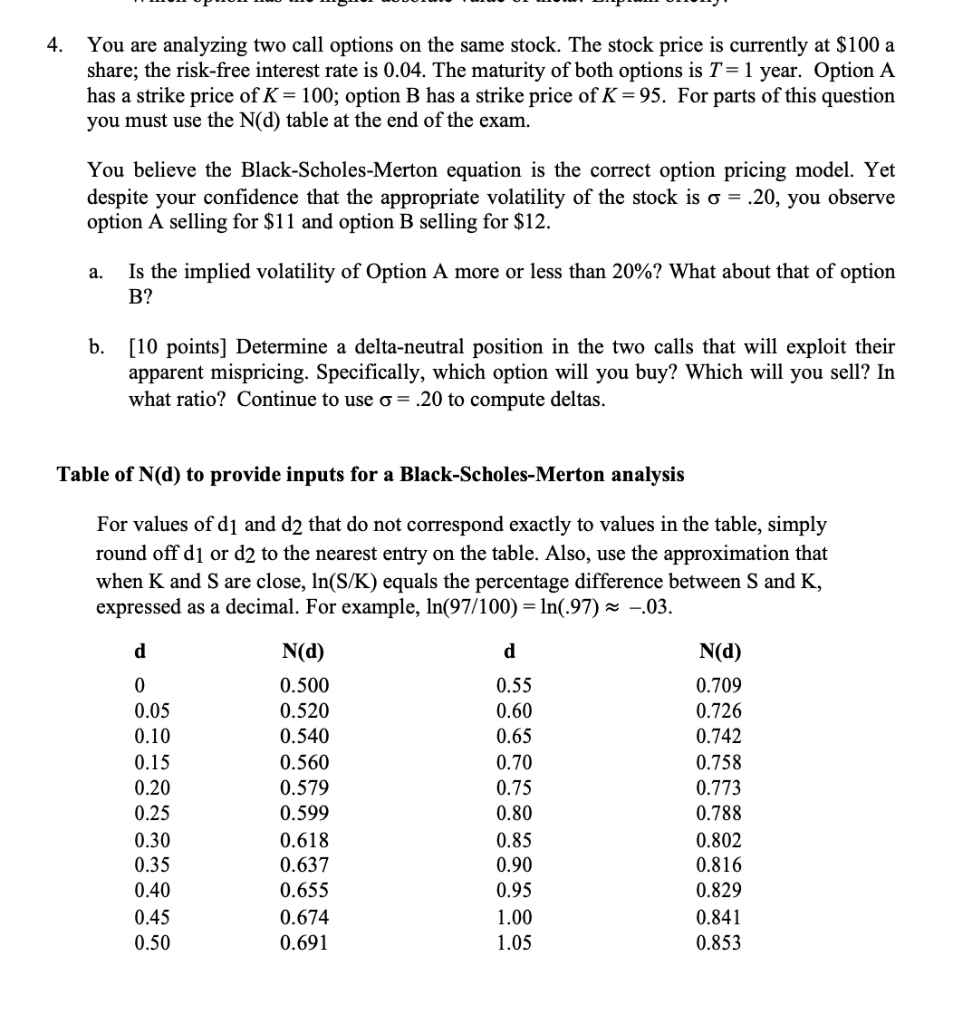

4. You are analyzing two call options on the same stock. The stock price is currently at $100 a share; the risk-free interest rate is 0.04. The maturity of both options is T = 1 year. Option A has a strike price of K = 100; option B has a strike price of K = 95. For parts of this question you must use the N(d) table at the end of the exam. You believe the Black-Scholes-Merton equation is the correct option pricing model. Yet despite your confidence that the appropriate volatility of the stock is o = .20, you observe option A selling for $11 and option B selling for $12. a. Is the implied volatility of Option A more or less than 20%? What about that of option B? b. [10 points] Determine a delta-neutral position in the two calls that will exploit their apparent mispricing. Specifically, which option will you buy? Which will you sell? In what ratio? Continue to use o= .20 to compute deltas. Table of N(d) to provide inputs for a Black-Scholes-Merton analysis For values of dj and d2 that do not correspond exactly to values in the table, simply round off dj or d2 to the nearest entry on the table. Also, use the approximation that when K and S are close, In(S/K) equals the percentage difference between S and K, expressed as a decimal. For example, In(97/100) = ln(.97) = -.03. d d 0 0.05 0.10 0.15 0.20 0.25 0.30 0.35 0.40 0.45 0.50 N(d) 0.500 0.520 0.540 0.560 0.579 0.599 0.618 0.637 0.655 0.674 0.691 0.55 0.60 0.65 0.70 0.75 0.80 0.85 0.90 0.95 1.00 1.05 N(d) 0.709 0.726 0.742 0.758 0.773 0.788 0.802 0.816 0.829 0.841 0.853 4. You are analyzing two call options on the same stock. The stock price is currently at $100 a share; the risk-free interest rate is 0.04. The maturity of both options is T = 1 year. Option A has a strike price of K = 100; option B has a strike price of K = 95. For parts of this question you must use the N(d) table at the end of the exam. You believe the Black-Scholes-Merton equation is the correct option pricing model. Yet despite your confidence that the appropriate volatility of the stock is o = .20, you observe option A selling for $11 and option B selling for $12. a. Is the implied volatility of Option A more or less than 20%? What about that of option B? b. [10 points] Determine a delta-neutral position in the two calls that will exploit their apparent mispricing. Specifically, which option will you buy? Which will you sell? In what ratio? Continue to use o= .20 to compute deltas. Table of N(d) to provide inputs for a Black-Scholes-Merton analysis For values of dj and d2 that do not correspond exactly to values in the table, simply round off dj or d2 to the nearest entry on the table. Also, use the approximation that when K and S are close, In(S/K) equals the percentage difference between S and K, expressed as a decimal. For example, In(97/100) = ln(.97) = -.03. d d 0 0.05 0.10 0.15 0.20 0.25 0.30 0.35 0.40 0.45 0.50 N(d) 0.500 0.520 0.540 0.560 0.579 0.599 0.618 0.637 0.655 0.674 0.691 0.55 0.60 0.65 0.70 0.75 0.80 0.85 0.90 0.95 1.00 1.05 N(d) 0.709 0.726 0.742 0.758 0.773 0.788 0.802 0.816 0.829 0.841 0.853