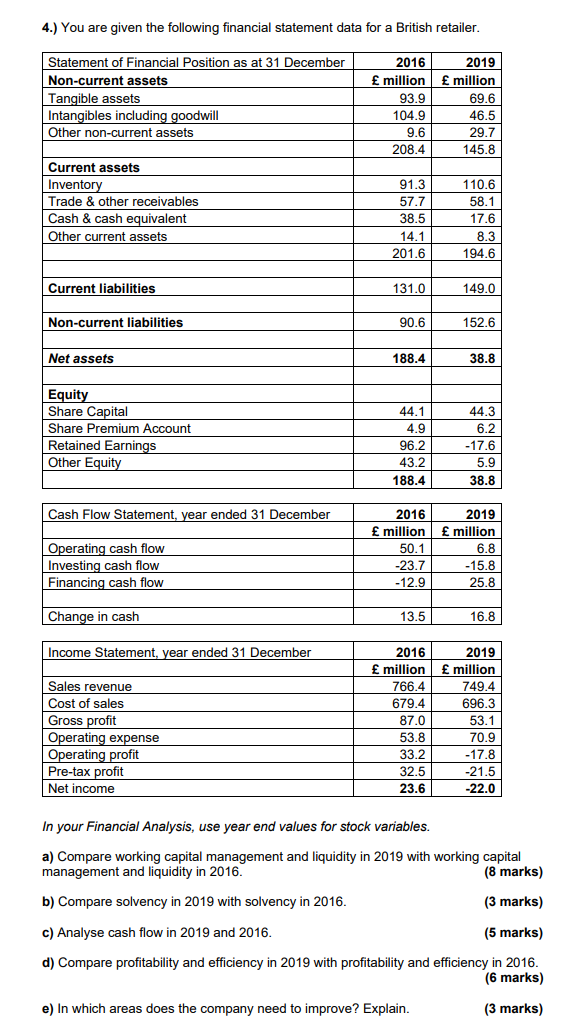

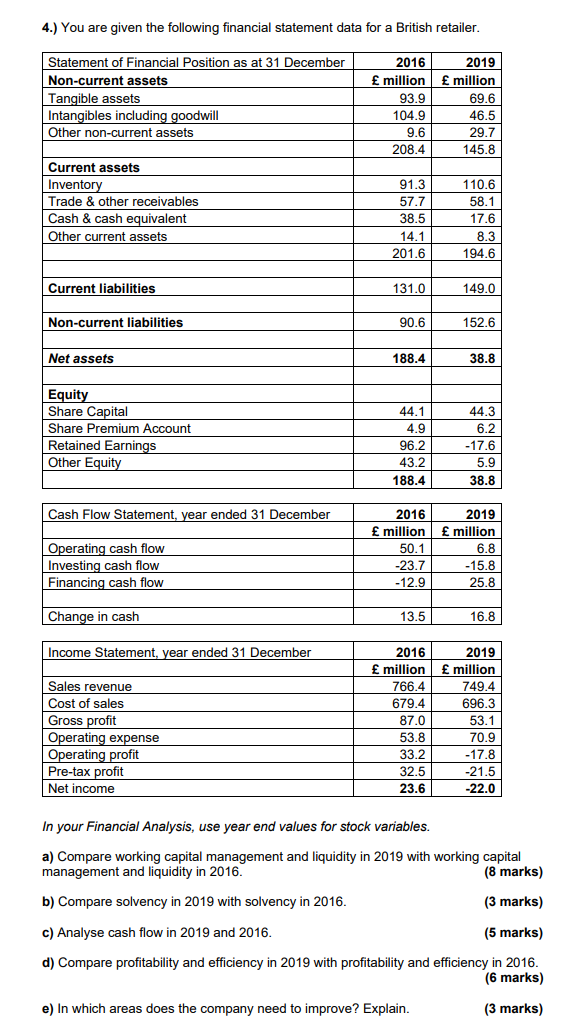

4.) You are given the following financial statement data for a British retailer. Statement of Financial Position as at 31 December Non-current assets Tangible assets Intangibles including goodwill Other non-current assets 2016 million 93.9 104.9 9.6 208.4 2019 million 69.6 46.5 29.7 145.8 Current assets Inventory Trade & other receivables Cash & cash equivalent Other current assets 91.3 57.7 38.5 14.1 201.6 110.6 58.1 17.6 8.3 194.6 Current liabilities 131.0 149.0 Non-current liabilities 90.6 152.6 Net assets 188.4 38.8 Equity Share Capital Share Premium Account Retained Earnings Other Equity 44.1 4.9 96.2 43.2 188.4 44.3 6.2 -17.6 5.9 38.8 Cash Flow Statement, year ended 31 December Operating cash flow Investing cash flow Financing cash flow 2016 million 50.1 -23.7 -12.9 2019 million 6.8 -15.8 25.8 Change in cash 13.5 16.8 Income Statement, year ended 31 December Sales revenue Cost of sales Gross profit Operating expense Operating profit Pre-tax profit Net income 2016 million 766.4 679.4 87.0 53.8 33.2 32.5 23.6 2019 million 749.4 696.3 53.1 70.9 -17.8 -21.5 -22.0 In your Financial Analysis, use year end values for stock variables. a) Compare working capital management and liquidity in 2019 with working capital management and liquidity in 2016. (8 marks) b) Compare solvency in 2019 with solvency in 2016. (3 marks) c) Analyse cash flow in 2019 and 2016 (5 marks) d) Compare profitability and efficiency in 2019 with profitability and efficiency in 2016. (6 marks) e) In which areas does the company need to improve? Explain. (3 marks) 4.) You are given the following financial statement data for a British retailer. Statement of Financial Position as at 31 December Non-current assets Tangible assets Intangibles including goodwill Other non-current assets 2016 million 93.9 104.9 9.6 208.4 2019 million 69.6 46.5 29.7 145.8 Current assets Inventory Trade & other receivables Cash & cash equivalent Other current assets 91.3 57.7 38.5 14.1 201.6 110.6 58.1 17.6 8.3 194.6 Current liabilities 131.0 149.0 Non-current liabilities 90.6 152.6 Net assets 188.4 38.8 Equity Share Capital Share Premium Account Retained Earnings Other Equity 44.1 4.9 96.2 43.2 188.4 44.3 6.2 -17.6 5.9 38.8 Cash Flow Statement, year ended 31 December Operating cash flow Investing cash flow Financing cash flow 2016 million 50.1 -23.7 -12.9 2019 million 6.8 -15.8 25.8 Change in cash 13.5 16.8 Income Statement, year ended 31 December Sales revenue Cost of sales Gross profit Operating expense Operating profit Pre-tax profit Net income 2016 million 766.4 679.4 87.0 53.8 33.2 32.5 23.6 2019 million 749.4 696.3 53.1 70.9 -17.8 -21.5 -22.0 In your Financial Analysis, use year end values for stock variables. a) Compare working capital management and liquidity in 2019 with working capital management and liquidity in 2016. (8 marks) b) Compare solvency in 2019 with solvency in 2016. (3 marks) c) Analyse cash flow in 2019 and 2016 (5 marks) d) Compare profitability and efficiency in 2019 with profitability and efficiency in 2016. (6 marks) e) In which areas does the company need to improve? Explain