Question

4. You are given the following information about two stocks, the market index and the risk free rate. The forecasted returns are based on

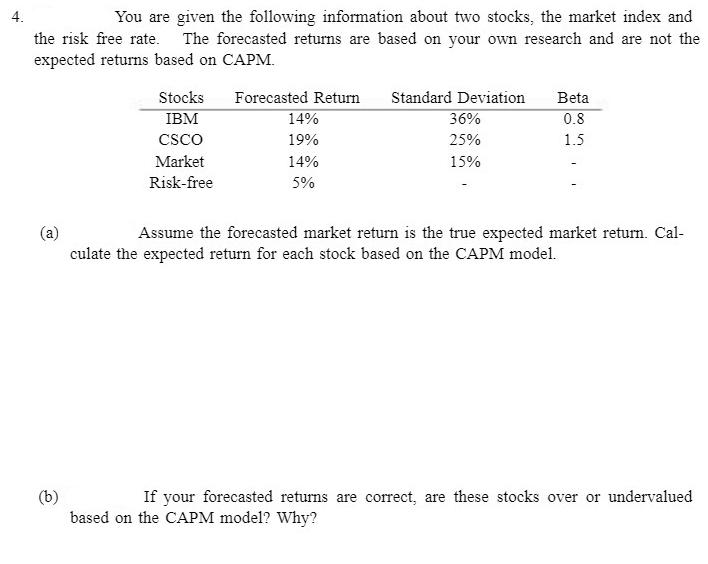

4. You are given the following information about two stocks, the market index and the risk free rate. The forecasted returns are based on your own research and are not the expected returns based on CAPM. Stocks IBM CSCO Market Risk-free Forecasted Return 14% 19% 14% 5% Standard Deviation 36% 25% 15% Beta 0.8 1.5 (a) Assume the forecasted market return is the true expected market return. Cal- culate the expected return for each stock based on the CAPM model. (b) If your forecasted returns are correct, are these stocks over or undervalued based on the CAPM model? Why?

Step by Step Solution

3.49 Rating (169 Votes )

There are 3 Steps involved in it

Step: 1

The Capital Asset Pricing Model CAPM is given by the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Financial Management

Authors: Eugene F. Brigham, Phillip R. Daves

11th edition

978-1111530266

Students also viewed these General Management questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App