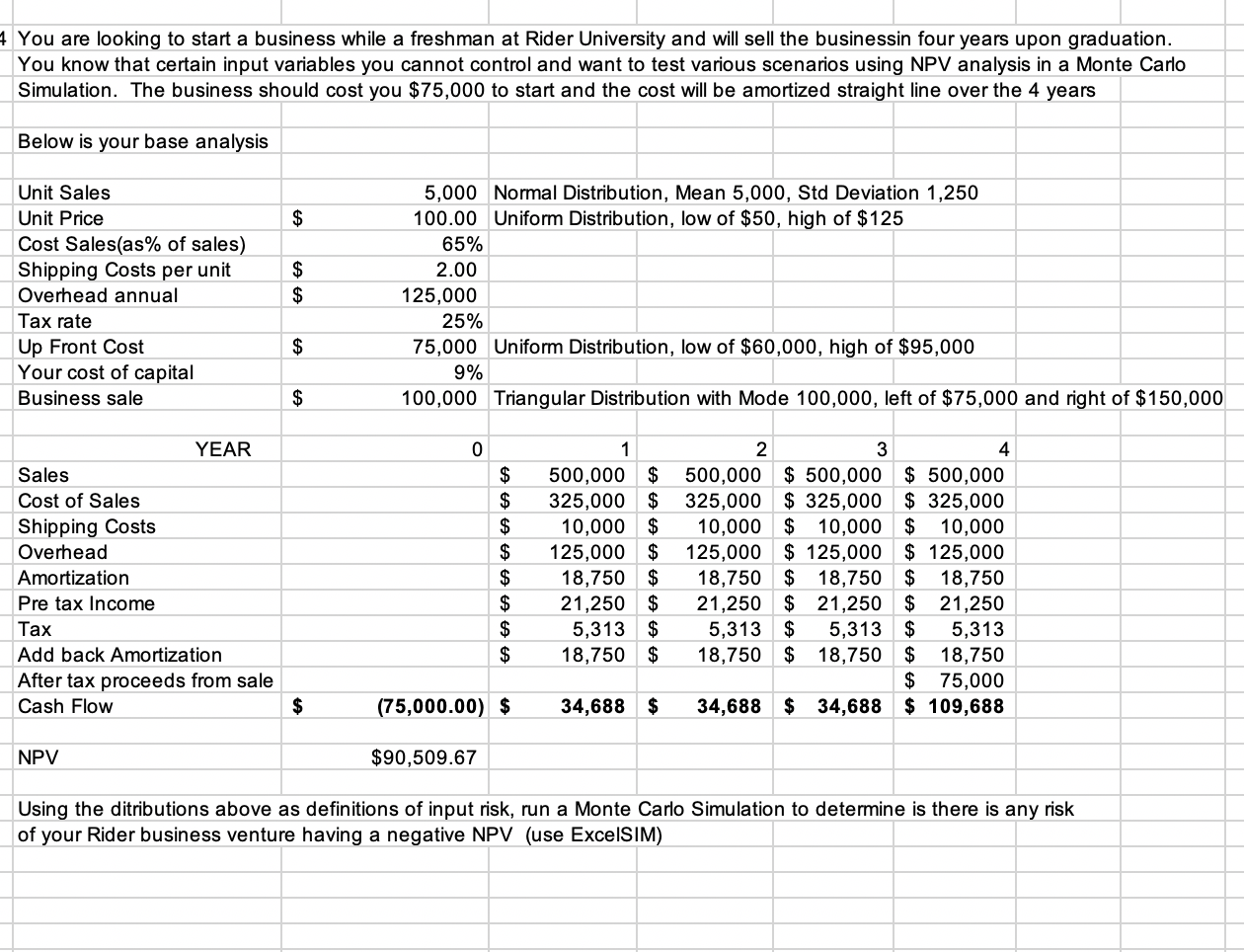

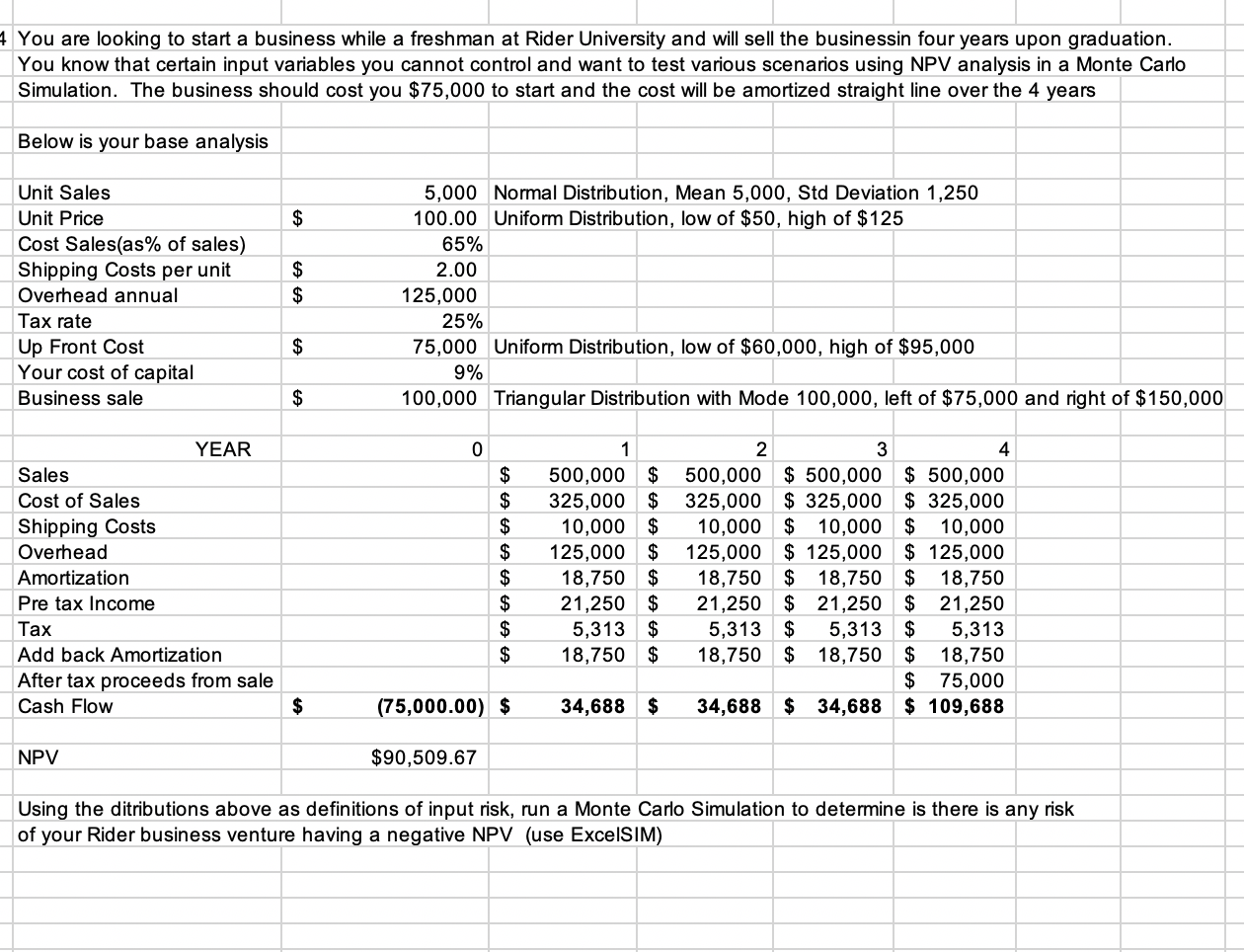

4 You are looking to start a business while a freshman at Rider University and will sell the businessin four years upon graduation. You know that certain input variables you cannot control and want to test various scenarios using NPV analysis in a Monte Carlo Simulation. The business should cost you $75,000 to start and the cost will be amortized straight line over the 4 years Below is your base analysis $ Unit Sales Unit Price Cost Sales(as% of sales) Shipping Costs per unit Overhead annual Tax rate Up Front Cost Your cost of capital Business sale $ $ 5,000 Normal Distribution, Mean 5,000, Std Deviation 1,250 100.00 Uniform Distribution, low of $50, high of $125 65% 2.00 125,000 25% 75,000 Uniform Distribution, low of $60,000, high of $95,000 $ 9% $ 100,000 Triangular Distribution with Mode 100,000, left of $75,000 and right of $150,000 0 YEAR Sales Cost of Sales Shipping Costs Overhead Amortization Pre tax Income Tax Add back Amortization After tax proceeds from sale Cash Flow $ $ $ $ $ $ $ $ 1 500,000 $ 325,000 $ 10,000 $ 125,000 $ 18,750 $ 21,250 $ 5,313 $ 18,750 $ 2 3 4 500,000 $ 500,000 $ 500,000 325,000 $ 325,000 $325,000 10,000 $ 10,000 $ 10,000 125,000 $ 125,000 $ 125,000 18,750 $ 18,750 $ 18,750 21,250 $ 21,250 $ 21,250 5,313 $ 5,313 $ 5,313 18,750 $ 18,750 $ 18,750 $ 75,000 34,688 $ 34,688 $ 109,688 $ (75,000.00 $ 34,688 $ NPV $90,509.67 Using the ditributions above as definitions of input risk, run a Monte Carlo Simulation to determine is there is any risk of your Rider business venture having a negative NPV (use ExcelSIM) 4 You are looking to start a business while a freshman at Rider University and will sell the businessin four years upon graduation. You know that certain input variables you cannot control and want to test various scenarios using NPV analysis in a Monte Carlo Simulation. The business should cost you $75,000 to start and the cost will be amortized straight line over the 4 years Below is your base analysis $ Unit Sales Unit Price Cost Sales(as% of sales) Shipping Costs per unit Overhead annual Tax rate Up Front Cost Your cost of capital Business sale $ $ 5,000 Normal Distribution, Mean 5,000, Std Deviation 1,250 100.00 Uniform Distribution, low of $50, high of $125 65% 2.00 125,000 25% 75,000 Uniform Distribution, low of $60,000, high of $95,000 $ 9% $ 100,000 Triangular Distribution with Mode 100,000, left of $75,000 and right of $150,000 0 YEAR Sales Cost of Sales Shipping Costs Overhead Amortization Pre tax Income Tax Add back Amortization After tax proceeds from sale Cash Flow $ $ $ $ $ $ $ $ 1 500,000 $ 325,000 $ 10,000 $ 125,000 $ 18,750 $ 21,250 $ 5,313 $ 18,750 $ 2 3 4 500,000 $ 500,000 $ 500,000 325,000 $ 325,000 $325,000 10,000 $ 10,000 $ 10,000 125,000 $ 125,000 $ 125,000 18,750 $ 18,750 $ 18,750 21,250 $ 21,250 $ 21,250 5,313 $ 5,313 $ 5,313 18,750 $ 18,750 $ 18,750 $ 75,000 34,688 $ 34,688 $ 109,688 $ (75,000.00 $ 34,688 $ NPV $90,509.67 Using the ditributions above as definitions of input risk, run a Monte Carlo Simulation to determine is there is any risk of your Rider business venture having a negative NPV (use ExcelSIM)