Answered step by step

Verified Expert Solution

Question

1 Approved Answer

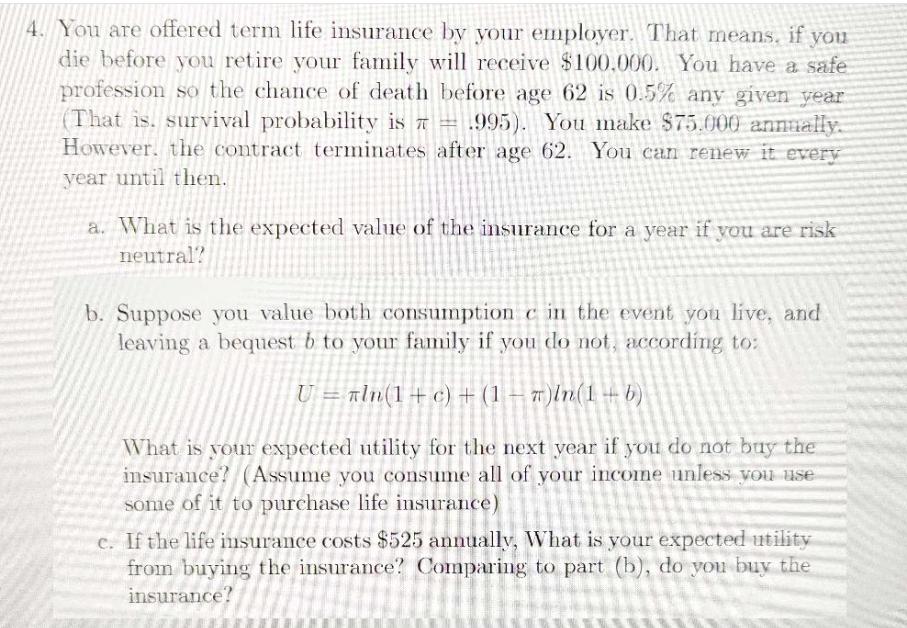

4. You are offered term life insurance by your employer. That means, if you die before you retire your family will receive $100.000. You

4. You are offered term life insurance by your employer. That means, if you die before you retire your family will receive $100.000. You have a safe profession so the chance of death before age 62 is 0.5% any given year (That is, survival probability is 1995). You make $75.000 annually. However, the contract terminates after age 62. You can renew it every year until then. a. What is the expected value of the insurance for a year if you are risk neutral? b. Suppose you value both consumption c in the event you live, and leaving a bequest b to your family if you do not, according to: U=aln(1+c) + (1-r)ln(1) What is your expected utility for the next year if you do not buy the insurance? (Assume you consume all of your income unless you use some of it to purchase life insurance) c. If the life insurance costs $525 annually, What is your expected utility from buying the insurance? Comparing to part (b), do you buy the insurance?

Step by Step Solution

★★★★★

3.50 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

a To calculate the expected value of the insurance for a year we need to consider the probability of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started