Answered step by step

Verified Expert Solution

Question

1 Approved Answer

4) You are working on the closing of a sale of a home. The sale price is $86,500. The seller must pay a 6%

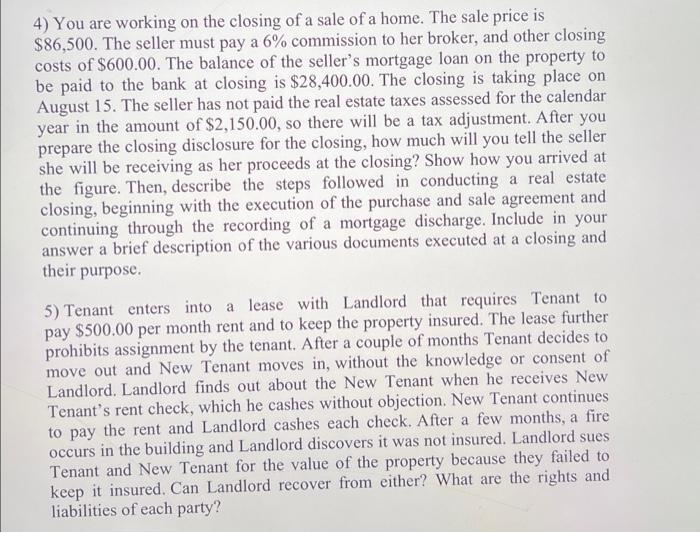

4) You are working on the closing of a sale of a home. The sale price is $86,500. The seller must pay a 6% commission to her broker, and other closing costs of $600.00. The balance of the seller's mortgage loan on the property to be paid to the bank at closing is $28,400.00. The closing is taking place on August 15. The seller has not paid the real estate taxes assessed for the calendar year in the amount of $2,150.00, so there will be a tax adjustment. After you prepare the closing disclosure for the closing, how much will you tell the seller she will be receiving as her proceeds at the closing? Show how you arrived at the figure. Then, describe the steps followed in conducting a real estate closing, beginning with the execution of the purchase and sale agreement and continuing through the recording of a mortgage discharge. Include in your answer a brief description of the various documents executed at a closing and their purpose. 5) Tenant enters into a lease with Landlord that requires Tenant to pay $500.00 per month rent and to keep the property insured. The lease further prohibits assignment by the tenant. After a couple of months Tenant decides to move out and New Tenant moves in, without the knowledge or consent of Landlord. Landlord finds out about the New Tenant when he receives New Tenant's rent check, which he cashes without objection. New Tenant continues to pay the rent and Landlord cashes each check. After a few months, a fire occurs in the building and Landlord discovers it was not insured. Landlord sues Tenant and New Tenant for the value of the property because they failed to keep it insured. Can Landlord recover from either? What are the rights and liabilities of each party?

Step by Step Solution

★★★★★

3.49 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Question 4 Real Estate Closing Calculation of Sellers Proceeds To calculate the sellers proceeds at the closing we need to subtract all expenses and amounts that the seller owes from the sale price of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started