Answered step by step

Verified Expert Solution

Question

1 Approved Answer

4. You have found three investment choices for a one-year deposit: 10% APR compounded monthly, 10% APR compounded annually, and 9% APR compounded daily. Compute

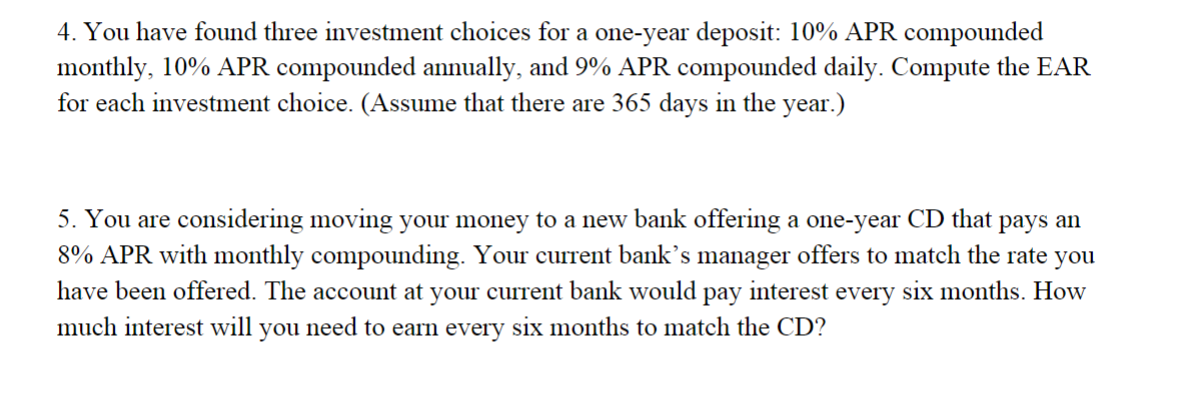

4. You have found three investment choices for a one-year deposit: 10% APR compounded monthly, 10\% APR compounded annually, and 9% APR compounded daily. Compute the EAR for each investment choice. (Assume that there are 365 days in the year.) 5. You are considering moving your money to a new bank offering a one-year CD that pays an 8% APR with monthly compounding. Your current bank's manager offers to match the rate you have been offered. The account at your current bank would pay interest every six months. How much interest will you need to earn every six months to match the CD

4. You have found three investment choices for a one-year deposit: 10% APR compounded monthly, 10\% APR compounded annually, and 9% APR compounded daily. Compute the EAR for each investment choice. (Assume that there are 365 days in the year.) 5. You are considering moving your money to a new bank offering a one-year CD that pays an 8% APR with monthly compounding. Your current bank's manager offers to match the rate you have been offered. The account at your current bank would pay interest every six months. How much interest will you need to earn every six months to match the CD Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started