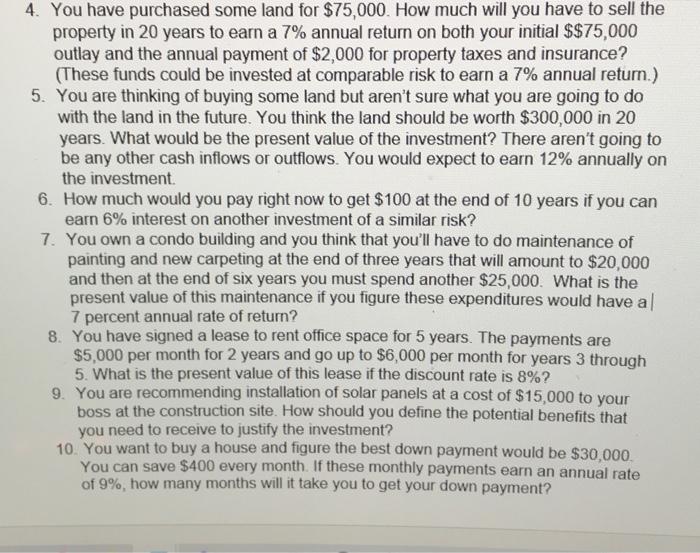

4. You have purchased some land for $75,000. How much will you have to sell the property in 20 years to earn a 7% annual return on both your initial $$75,000 outlay and the annual payment of $2,000 for property taxes and insurance? (These funds could be invested at comparable risk to earn a 7% annual return.) 5. You are thinking of buying some land but aren't sure what you are going to do with the land in the future. You think the land should be worth $300,000 in 20 years. What would be the present value of the investment? There aren't going to be any other cash inflows or outflows. You would expect to earn 12% annually on the investment 6. How much would you pay right now to get $100 at the end of 10 years if you can earn 6% interest on another investment of a similar risk? 7. You own a condo building and you think that you'll have to do maintenance of painting and new carpeting at the end of three years that will amount to $20,000 and then at the end of six years you must spend another $25,000. What is the present value of this maintenance if you figure these expenditures would have al 7 percent annual rate of return? 8. You have signed a lease to rent office space for 5 years. The payments are $5,000 per month for 2 years and go up to $6,000 per month for years 3 through 5. What is the present value of this lease if the discount rate is 8%? 9. You are recommending installation of solar panels at a cost of $15,000 to your boss at the construction site. How should you define the potential benefits that you need to receive to justify the investment? 10. You want to buy a house and figure the best down payment would be $30,000 You can save $400 every month. If these monthly payments earn an annual rate of 9%, how many months will it take you to get your down payment? 4. You have purchased some land for $75,000. How much will you have to sell the property in 20 years to earn a 7% annual return on both your initial $$75,000 outlay and the annual payment of $2,000 for property taxes and insurance? (These funds could be invested at comparable risk to earn a 7% annual return.) 5. You are thinking of buying some land but aren't sure what you are going to do with the land in the future. You think the land should be worth $300,000 in 20 years. What would be the present value of the investment? There aren't going to be any other cash inflows or outflows. You would expect to earn 12% annually on the investment 6. How much would you pay right now to get $100 at the end of 10 years if you can earn 6% interest on another investment of a similar risk? 7. You own a condo building and you think that you'll have to do maintenance of painting and new carpeting at the end of three years that will amount to $20,000 and then at the end of six years you must spend another $25,000. What is the present value of this maintenance if you figure these expenditures would have al 7 percent annual rate of return? 8. You have signed a lease to rent office space for 5 years. The payments are $5,000 per month for 2 years and go up to $6,000 per month for years 3 through 5. What is the present value of this lease if the discount rate is 8%? 9. You are recommending installation of solar panels at a cost of $15,000 to your boss at the construction site. How should you define the potential benefits that you need to receive to justify the investment? 10. You want to buy a house and figure the best down payment would be $30,000 You can save $400 every month. If these monthly payments earn an annual rate of 9%, how many months will it take you to get your down payment