Answered step by step

Verified Expert Solution

Question

1 Approved Answer

4. You sell one American call option contract on Xerox stock maturing in June 2022 with the strike price of $60 and simultaneously you

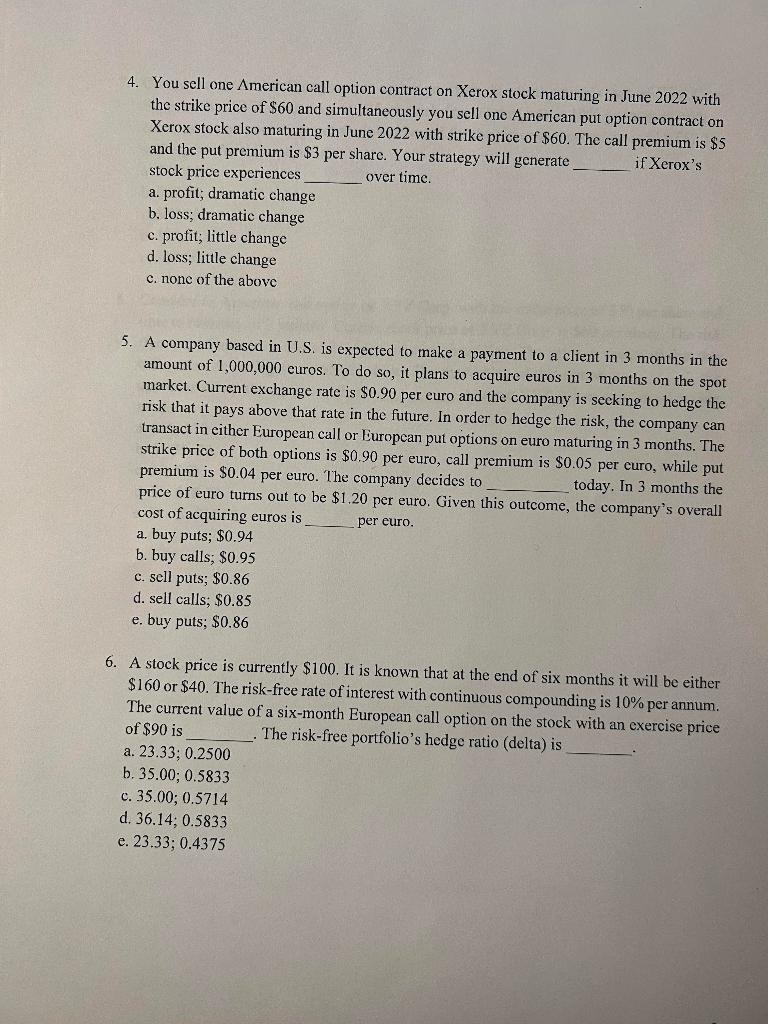

4. You sell one American call option contract on Xerox stock maturing in June 2022 with the strike price of $60 and simultaneously you sell one American put option contract on Xerox stock also maturing in June 2022 with strike price of $60. The call premium is $5 and the put premium is $3 per share. Your strategy will generate if Xerox's stock price experiences over time. a. profit; dramatic change b. loss; dramatic change c. profit; little change d. loss; little change c. none of the above 5. A company based in U.S. is expected to make a payment to a client in 3 months in the amount of 1,000,000 euros. To do so, it plans to acquire euros in 3 months on the spot market. Current exchange rate is $0.90 per euro and the company is seeking to hedge the risk that it pays above that rate in the future. In order to hedge the risk, the company can transact in either European call or European put options on euro maturing in 3 months. The strike price of both options is $0.90 per euro, call premium is $0.05 per curo, while put premium is $0.04 per euro. The company decides to price of euro turns out to be $1.20 per euro. Given this outcome, the company's overall today. In 3 months the cost of acquiring euros is per euro. a. buy puts; $0.94 b. buy calls; $0.95 c. sell puts; $0.86 d. sell calls; $0.85 e. buy puts; $0.86 6. A stock price is currently $100. It is known that at the end of six months it will be either $160 or $40. The risk-free rate of interest with continuous compounding is 10% per annum. The current value of a six-month European call option on the stock with an exercise price of $90 is The risk-free portfolio's hedge ratio (delta) is a. 23.33; 0.2500 b. 35.00; 0.5833 c. 35.00; 0.5714 d. 36.14; 0.5833 e. 23.33; 0.4375

Step by Step Solution

★★★★★

3.42 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

4 ANSWER c Profit little change EXPLANATION In this case the call and put premiums cancel each other ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started