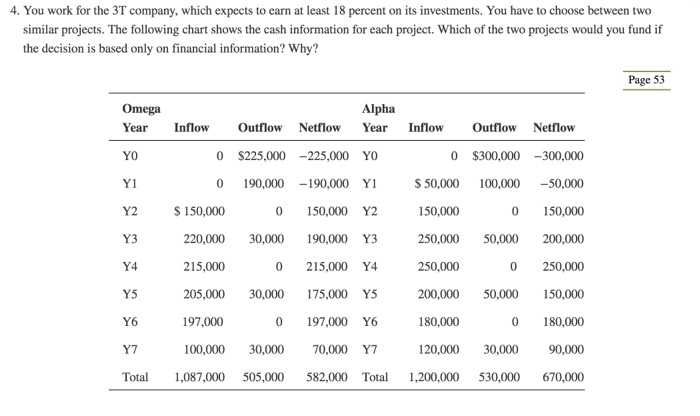

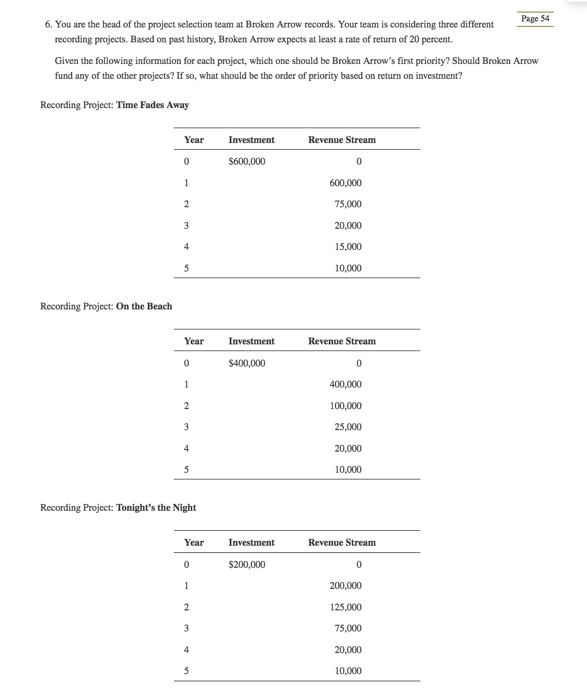

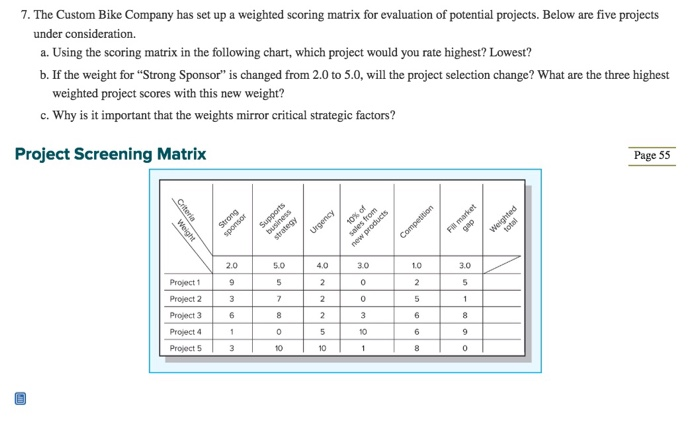

4. You work for the 3T company, which expects to earn at least 18 percent on its investments. You have to choose between two similar projects. The following chart shows the cash information for each project. Which of the two projects would you fund if the decision is based only on financial information? Why? Page 53 Omega Year Inflow Outflow Netflow Year Inflow Outflo Netflow Yo Y1 Y2 Y3 Y4 YS Y6 Y7 Tota 1,087,000 505,000 582,000 Tta 1,200,000 530,000 670,000 Alpha 0 $225,000225,000 YO 0 190,000 -190,000 Y1 0 150,000 Y2 220,000 30,000 190,000 Y3 0 215,000 Y4 205,000 30,000 175,000 Y5 0 197,000 Y6 100,000 30,000 70,000 Y7 0 $300,000 -300,000 S 50,000 100,000-50,000 150,000 0 150,000 150,000 250,000 50,000 200,000 250,000 200,000 50,000 150,000 180,000 120,000 30,000 90,000 215,000 0 250,000 197,000 0 180,000 Page 54 6. You are the head of the project selection team at Broken Arrow records. Your team is considering three different recording projects. Based on past history, Broken Arrow expects at least a rate of return of 20 percent Given the following information for each project, which one should be Broken Arrow's first priority? Should Broken Arrow fund any of the other projects? If so, what should be the order of priority based on return on investment? Recording Project: Time Fades Away Year Revenue Stream 600,000 75,000 20,000 15,000 10,000 Recording Project: On the Beach Year Investment Revenue Stream 400,000 100,000 25,000 10,000 Recording Project: Tonight's the Night Revenue Stream $200,000 200,000 125,000 75,000 20,000 10,000 7. The Custom Bike Company has set up a weighted scoring matrix for evaluation of potential projects. Below are five projects under consideration. a. Using the scoring matrix in the following chart, which project would you rate highest? Lowest? b. If the weight for "Strong Sponsor" is changed from 2.0 to 5.0, will the project selection change? What are the three highest weighted project scores with this new weight? c. Why is it important that the weights mirror critical strategic factors? Project Screening Matrix Page 55 2.0 5.0 4.0 3.0 1.0 3.0 Project 1 Project 2 Project 36 Project 4 Project 5