Question

4. Your firm, Cambridge Entertainment (CE), has two distinct operating divisions. The first division, which represents 60% of market value, is a traditional publishing company

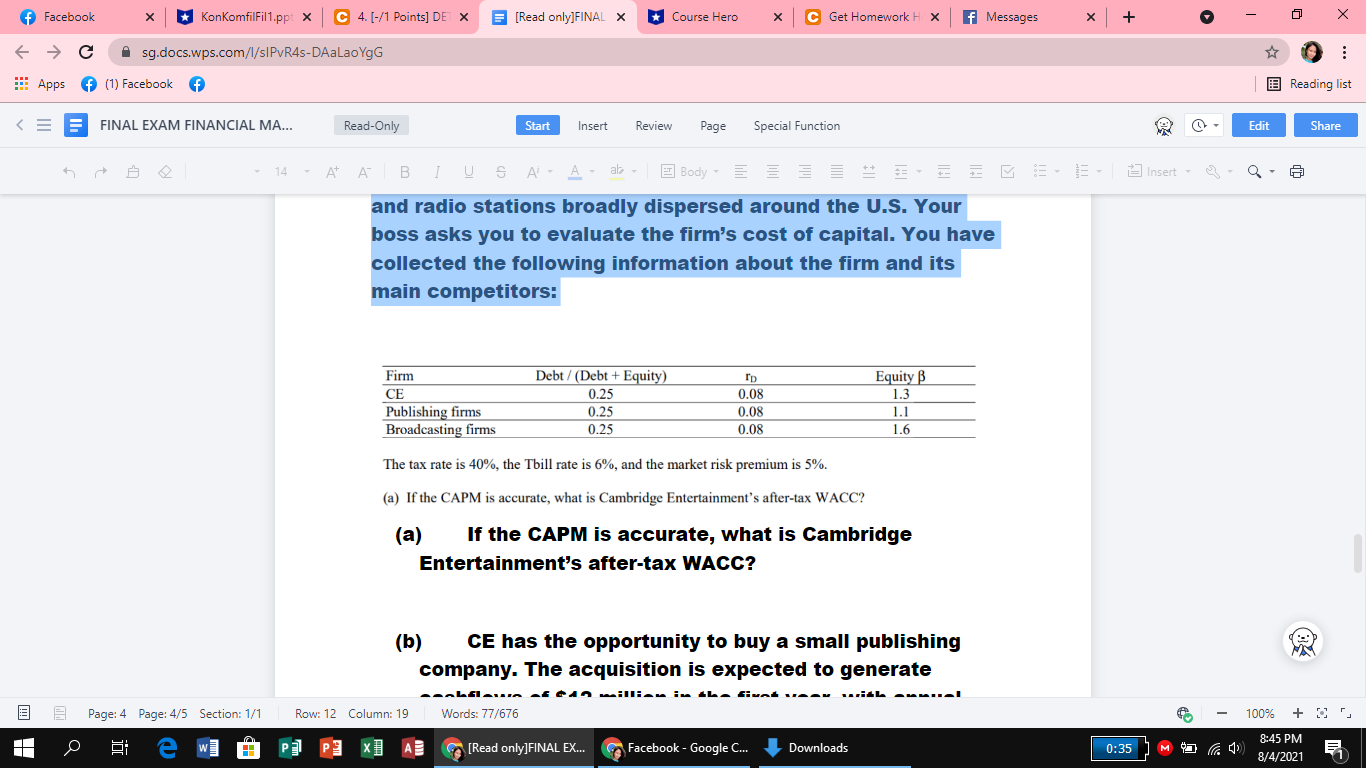

4. Your firm, Cambridge Entertainment (CE), has two distinct operating divisions. The first division, which represents 60% of market value, is a traditional publishing company (magazines, books, etc.). The second division, which represents 40% of market value, owns a large collection of TV and radio stations broadly dispersed around the U.S. Your boss asks you to evaluate the firms cost of capital. You have collected the following information about the firm and its main competitors:

a. If the CAPM is accurate, what is Cambridge Entertainments after-tax WACC?

b. CE has the opportunity to buy a small publishing company. The acquisition is expected to generate cashflows of $12 million in the first year, with annual growth of 4%. CE will finance the acquisition entirely with equity, but the deal will have a negligible effect on the firms overall capital structure (D/V will remain at 25%). How much should CE be willing to pay for the acquisition?

f Facebook KonKomfilFil1.ppi x C4. [-/1 Points] DE X [Read only]FINAL X Course Hero C Get Homework H X f Messages > c sg.docs.wps.com/l/sIPvR45-DAaLao YgG : * Apps (1) Facebook f. 2 Reading listStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started