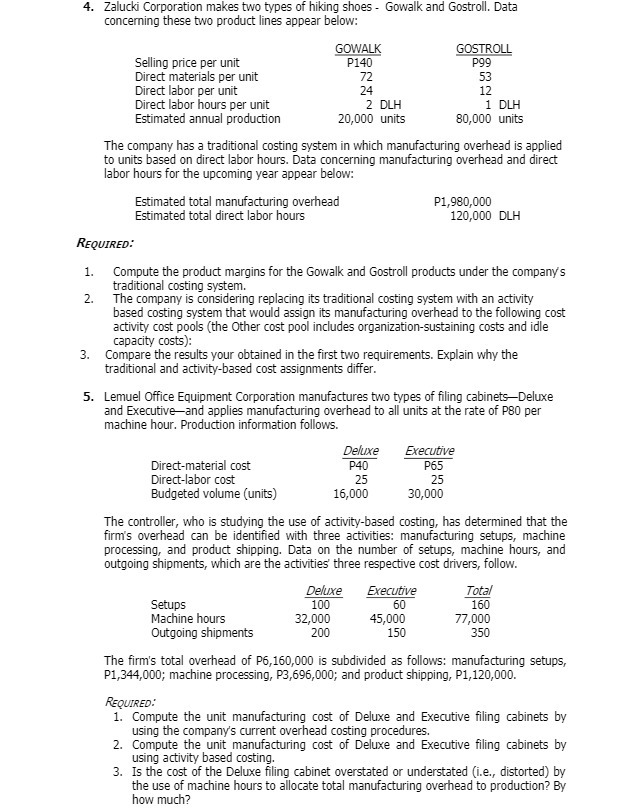

4. Zalucki Corporation makes two types of hiking shoes - Gowalk and Gostroll. Data concerning these two product lines appear below: GOWALK GOSTROLL Selling price per unit P140 P99 Direct materials per unit 72 53 Direct labor per unit 24 12 Direct labor hours per unit 2 DLH 1 DLH Estimated annual production 20,000 units 80,000 units The company has a traditional costing system in which manufacturing overhead is applied to units based on direct labor hours. Data concerning manufacturing overhead and direct labor hours for the upcoming year appear below: Estimated total manufacturing overhead P1,980,000 Estimated total direct labor hours 120,000 DLH REQUIRED: 1. Compute the product margins for the Gowalk and Gostroll products under the company's traditional costing system. 2. The company is considering replacing its traditional costing system with an activity based costing system that would assign its manufacturing overhead to the following cost activity cost pools (the Other cost pool includes organization-sustaining costs and idle capacity costs): 3. Compare the results your obtained in the first two requirements. Explain why the traditional and activity-based cost assignments differ. 5. Lemuel Office Equipment Corporation manufactures two types of filing cabinets-Deluxe and Executive-and applies manufacturing overhead to all units at the rate of P80 per machine hour. Production information follows. Deluxe Executive Direct-material cost P40 P65 Direct-labor cost 25 25 Budgeted volume (units) 16,000 30,000 The controller, who is studying the use of activity-based costing, has determined that the firm's overhead can be identified with three activities: manufacturing setups, machine processing, and product shipping. Data on the number of setups, machine hours, and outgoing shipments, which are the activities three respective cost drivers, follow. Deluxe Executive Total Setups 100 60 160 Machine hours 32,000 45,000 77,000 Outgoing shipments 200 150 350 The firm's total overhead of P6,160,000 is subdivided as follows: manufacturing setups, P1,344,000; machine processing, P3,696,000; and product shipping, P1,120,000. REQUIRED: 1. Compute the unit manufacturing cost of Deluxe and Executive filing cabinets by using the company's current overhead costing procedures. 2. Compute the unit manufacturing cost of Deluxe and Executive filing cabinets by using activity based costing. 3. Is the cost of the Deluxe filing cabinet overstated or understated (i.e., distorted) by the use of machine hours to allocate total manufacturing overhead to production? By how much