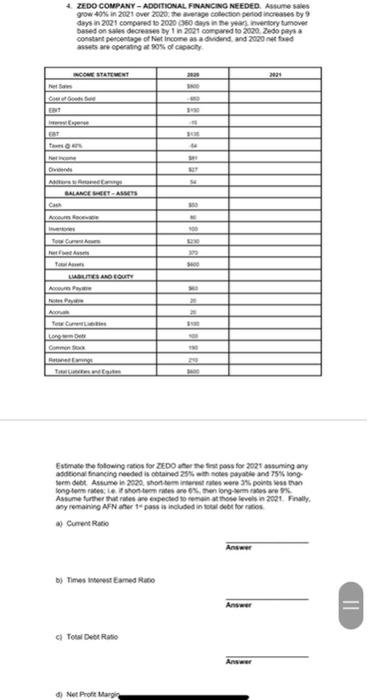

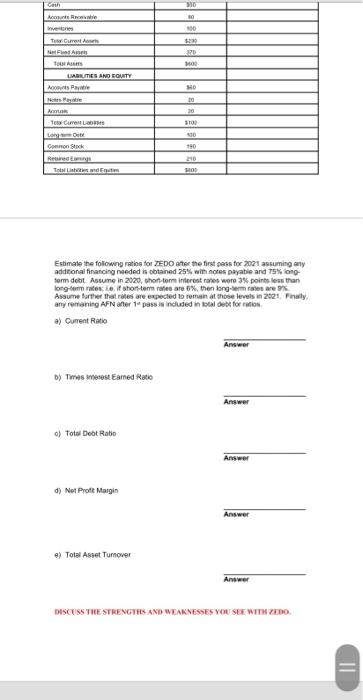

4 ZEDO COMPANY - ADDITIONAL FINANCING NEEDED. Assume sales gow 40% in 2021 over 2020. hege colection period increases by days in 2021 compared to 2020 2360 days in the years, invertory tumover based on sales decreases by tn 2021 compared to 2020. Zedo pays constant percentage of Net Income as add and 2020 asts are operating 90% of 2020 EN BALANCE SEITANTS LABILITIES AND OUT A Town Commons Estimate the following for ZEDO eposs for 2021 ssuming any additional financing needed is obtained 25% the pytand 75% mit Assume in 2020, short term were points than long termelon termine the form Assun further rates are expected to remontthon levels 2021 Frally myremaning AFN er en is included in total de fotos * Current Ratio by Times interest Eames Ruto Answer II Total De Ratio Ans Net Profi 10 Goth con 100 TuCarrots LABUITIES AND COMITY Aco Pay No HO 70 TuCarrer LO Cook Recogs 90 190 20 HOD Estimate the following ratios for MEDO after the first pass to 2021 assuming my additional financing needed is obtained 25% with notes payable and 19% form dobt Astume in 2020, thon tar interest rates were 3 points less than long-commerce if shon-term rates are 6%, then long-termes are 9% Assume further that rates are expected to remain at the levels in 2021. Finally, any reaning AFN er 1"pass is indluded in total de formation a) Current Ratio Answer by Times mores Eamed Rete Answer c) Total Debt Ratio Answer d) Net Prote Margin Answer a) Total Asset Tumover Answer DISCUSS THE STRENGTHS AND WEAKNESSES YOU SEE WITH ZEDO. = 4 ZEDO COMPANY - ADDITIONAL FINANCING NEEDED. Assume sales gow 40% in 2021 over 2020. hege colection period increases by days in 2021 compared to 2020 2360 days in the years, invertory tumover based on sales decreases by tn 2021 compared to 2020. Zedo pays constant percentage of Net Income as add and 2020 asts are operating 90% of 2020 EN BALANCE SEITANTS LABILITIES AND OUT A Town Commons Estimate the following for ZEDO eposs for 2021 ssuming any additional financing needed is obtained 25% the pytand 75% mit Assume in 2020, short term were points than long termelon termine the form Assun further rates are expected to remontthon levels 2021 Frally myremaning AFN er en is included in total de fotos * Current Ratio by Times interest Eames Ruto Answer II Total De Ratio Ans Net Profi 10 Goth con 100 TuCarrots LABUITIES AND COMITY Aco Pay No HO 70 TuCarrer LO Cook Recogs 90 190 20 HOD Estimate the following ratios for MEDO after the first pass to 2021 assuming my additional financing needed is obtained 25% with notes payable and 19% form dobt Astume in 2020, thon tar interest rates were 3 points less than long-commerce if shon-term rates are 6%, then long-termes are 9% Assume further that rates are expected to remain at the levels in 2021. Finally, any reaning AFN er 1"pass is indluded in total de formation a) Current Ratio Answer by Times mores Eamed Rete Answer c) Total Debt Ratio Answer d) Net Prote Margin Answer a) Total Asset Tumover Answer DISCUSS THE STRENGTHS AND WEAKNESSES YOU SEE WITH ZEDO. =