Answered step by step

Verified Expert Solution

Question

1 Approved Answer

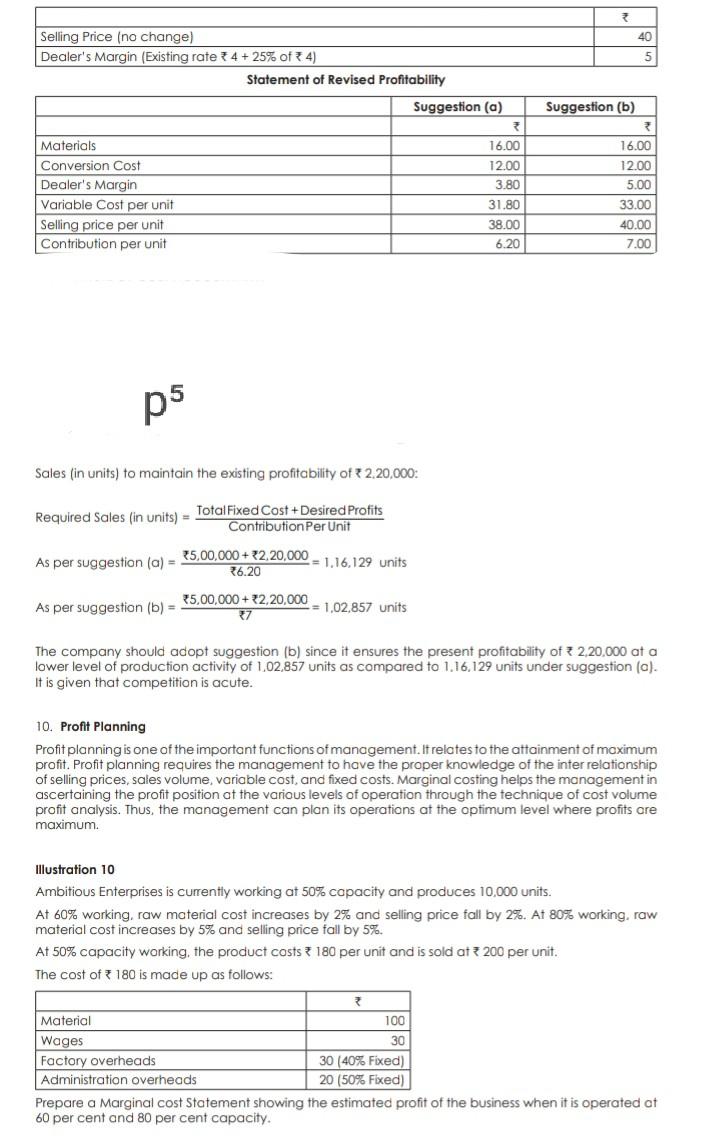

40 5 Suggestion (b) Selling Price (no change) Dealer's Margin (Existing rate 4 + 25% of 4) Statement of Revised Profitability Suggestion (a) Materials 16.00

40 5 Suggestion (b) Selling Price (no change) Dealer's Margin (Existing rate 4 + 25% of 4) Statement of Revised Profitability Suggestion (a) Materials 16.00 Conversion Cost 12.00 Dealer's Margin 3.80 Variable Cost per unit 31.80 Selling price per unit 38.00 Contribution per unit 6.20 16.00 12.00 5.00 33.00 40.00 7.00 ps Sales (in units) to maintain the existing profitability of +2.20,000: Required Sales (in units) - Total Fixed Cost + Desired Profits Contribution Per Unit As per suggestion (a) = 5,00,000+ 2.20.000 - 1.16,129 units 26.20 As per suggestion (b) = *5,00,000+ 2.20,000 = 1,02,857 units 7 The company should adopt suggestion (b) since it ensures the present profitability of +2,20,000 at a lower level of production activity of 1,02.857 units as compared to 1.16,129 units under suggestion (a). It is given that competition is acute. 10. Profit Planning Profit planning is one of the important functions of management. It relates to the attainment of maximum profit. Profit planning requires the management to have the proper knowledge of the inter relationship of selling prices, sales volume, variable cost, and fixed costs. Marginal costing helps the management in ascertaining the profit position at the various levels of operation through the technique of cost volume profit analysis. Thus, the management can plan its operations at the optimum level where profits are maximum. Hlustration 10 Ambitious Enterprises is currently working at 50% capacity and produces 10,000 units. At 60% working, raw material cost increases by 2% and selling price fall by 2%. At 80% working, raw material cost increases by 5% and selling price fall by 5%. At 50% capacity working, the product costs 180 per unit and is sold at 3 200 per unit. The cost of 180 is made up as follows: Material 100 Wages 30 Factory overheads 30 (40% Fixed) Administration overheads 20 (50% Fixed) Prepare a Marginal cost Statement showing the estimated profit of the business when it is operated at 60 per cent and 80 per cent capacity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started