Answered step by step

Verified Expert Solution

Question

1 Approved Answer

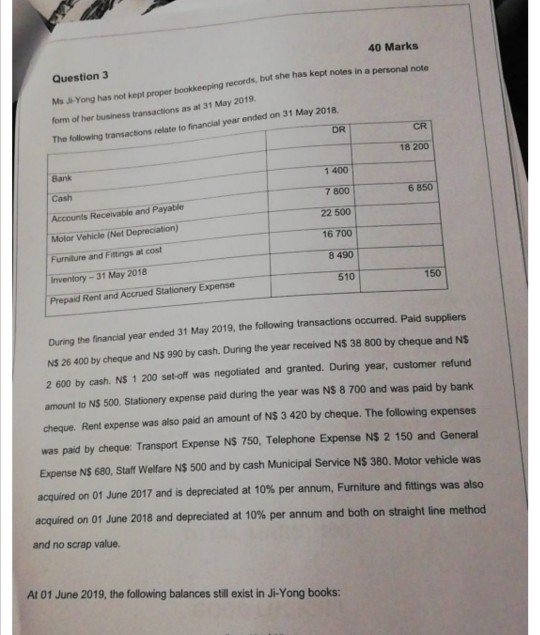

40 Marks Question 3 Ms J-Yong has not kept proper bookkeeping records, but she has kept notes in a personal note form of her business

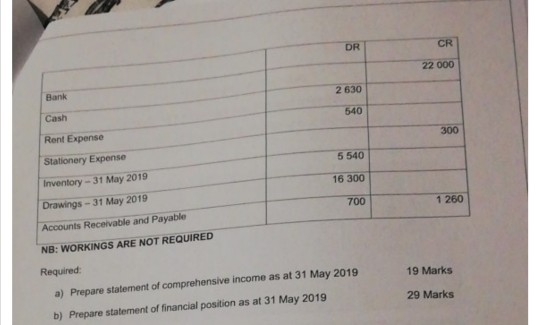

40 Marks Question 3 Ms J-Yong has not kept proper bookkeeping records, but she has kept notes in a personal note form of her business transactions as at 31 May 2019 The following transactions relate to financial year ended on 31 May 2018. DR CR 18 200 Bank 1 400 Cash 6 850 7 800 Accounts Receivable and Payable 22 500 Motor Vehicle (Net Depreciation) 16 700 Furniture and Fittings at cost 8 490 Inventory-31 May 2018 510 150 Prepaid Rent and Accrued Stationery Expense During the financial year ended 31 May 2019, the following transactions occured. Paid suppliers NS 26 400 by cheque and NS 990 by cash. During the year received N$ 38 800 by cheque and NS 2 600 by cash. NS 1 200 set-off was negotiated and granted. During year, customer refund amount to N$ 500. Stationery expense paid during the year was NS 8 700 and was paid by bank cheque. Rent expense was also paid an amount of NS 3 420 by cheque. The following expenses was paid by cheque: Transport Expense NS 750, Telephone Expense N$ 2 150 and General Expense N$ 680, Staff Welfare NS 500 and by cash Municipal Service N$ 380. Motor vehicle was acquired on 01 June 2017 and is depreciated at 10 % per annum, Furniture and fittings was also acquired on 01 June 2018 and depreciated at 10% per annum and both on straight line method and no scrap value. At 01 June 2019, the following balances still exist in Ji-Yong books: CR DR 22 000 Bank 2 630 Cash 540 Rent Expense 300 Stationery Expense 5 540 Inventory-31 May 2019 16 300 Drawings-31 May 2019 700 1 260 Accounts Receivable and Payable NB: WORKINGS ARE NOT REQUIRED Required 19 Marks a) Prepare statement of comprehensive income as at 31 May 2019 29 Marks b) Prepare statement of financial position as at 31 May 2019

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started