Answered step by step

Verified Expert Solution

Question

1 Approved Answer

40. Sam and Devon agree to go into business together selling college-licensed clothing. According to the agreement, Sam will contribute inventory valued at $100,000

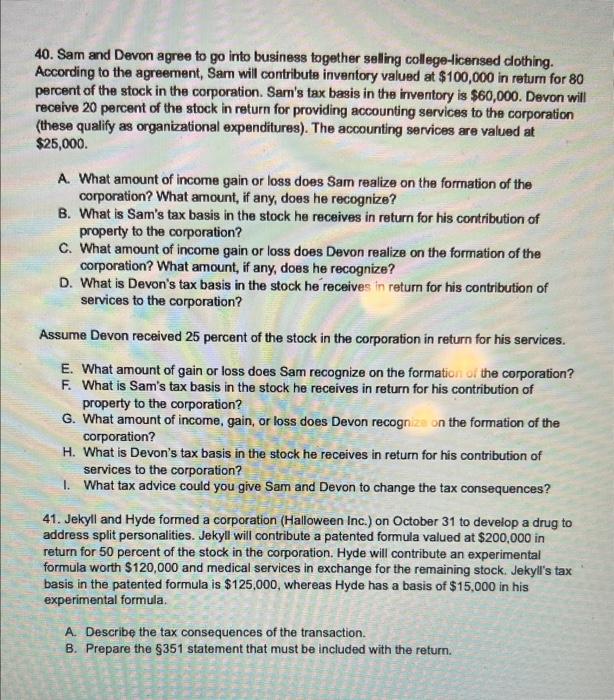

40. Sam and Devon agree to go into business together selling college-licensed clothing. According to the agreement, Sam will contribute inventory valued at $100,000 in return for 80 percent of the stock in the corporation. Sam's tax basis in the inventory is $60,000. Devon will receive 20 percent of the stock in return for providing accounting services to the corporation (these qualify as organizational expenditures). The accounting services are valued at $25,000. A. What amount of income gain or loss does Sam realize on the formation of the corporation? What amount, if any, does he recognize? B. What is Sam's tax basis in the stock he receives in return for his contribution of property to the corporation? C. What amount of income gain or loss does Devon realize on the formation of the corporation? What amount, if any, does he recognize? D. What is Devon's tax basis in the stock he receives in return for his contribution of services to the corporation? Assume Devon received 25 percent of the stock in the corporation in return for his services. E. What amount of gain or loss does Sam recognize on the formation of the corporation? F. What is Sam's tax basis in the stock he receives in return for his contribution of property to the corporation? G. What amount of income, gain, or loss does Devon recognize on the formation of the corporation? H. What is Devon's tax basis in the stock he receives in return for his contribution of services to the corporation? 1. What tax advice could you give Sam and Devon to change the tax consequences? 41. Jekyll and Hyde formed a corporation (Halloween Inc.) on October 31 to develop a drug to address split personalities. Jekyll will contribute a patented formula valued at $200,000 in return for 50 percent of the stock in the corporation. Hyde will contribute an experimental formula worth $120,000 and medical services in exchange for the remaining stock. Jekyll's tax basis in the patented formula is $125,000, whereas Hyde has a basis of $15,000 in his experimental formula. A. Describe the tax consequences of the transaction. B. Prepare the $351 statement that must be included with the return.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started