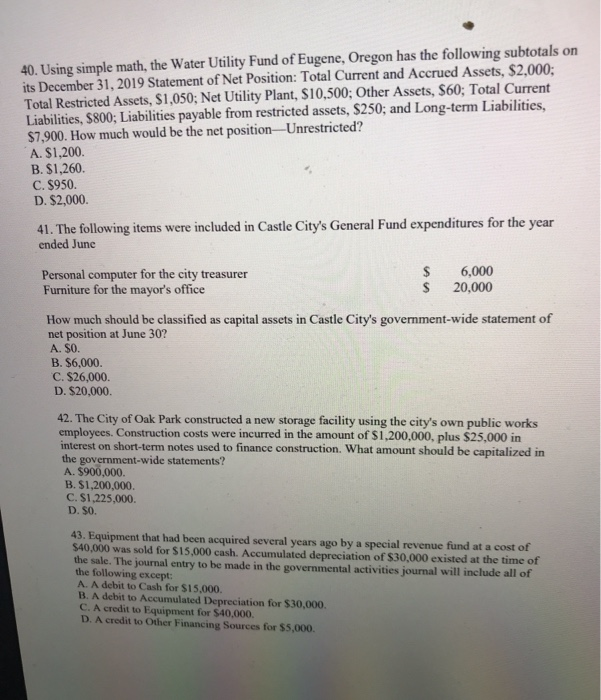

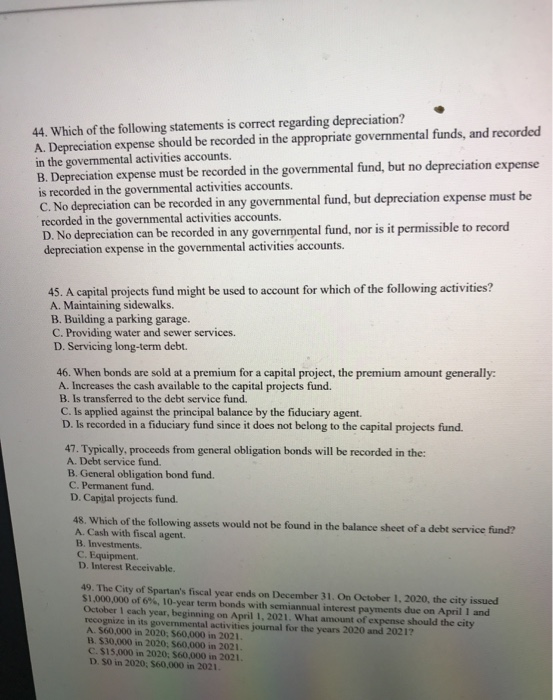

40. Using simple math, the Water Utility Fund of Eugene, Oregon has the following subtotals on its December 31, 2019 Statement of Net Position: Total Current and Accrued Assets, $2.000: Total Restricted Assets, $1,050; Net Utility Plant, $10,500; Other Assets, S60; Total Current Liabilities, $800; Liabilities payable from restricted assets, $250; and Long-term Liabilities, $7,900. How much would be the net position -Unrestricted? A. $1,200. B. $1,260 C. $950. D. $2,000. 41. The following items were included in Castle City's General Fund expenditures for the year ended June Personal computer for the city treasurer Furniture for the mayor's office 6,000 20,000 How much should be classified as capital assets in Castle City's government-wide statement of net position at June 302 A. $O. B. $6,000 C. $26,000 D. $20,000. 42. The City of Oak Park constructed a new storage facility using the city's own public works employees. Construction costs were incurred in the amount of $1,200,000, plus $25.000 in interest on short-term notes used to finance construction. What amount should be capitalized in the government-wide statements? A. $900,000. B. $1,200,000. C. $1,225.000 D. SO. 43. Equipment that had been acquired several years ago by a special revenue fund at a cost of $40,000 was sold for $15,000 cash. Accumulated depreciation of $30,000 existed at the time of the sale. The journal entry to be made in the governmental activities journal will include all of the following except: A. A debit to Cash for $15.000. B. A debit to Accumulated Depreciation for $30,000 C. A credit to Equipment for $40,000. D. A credit to Other Financing Sources for $5,000. 44. Which of the following statements is correct regarding depreciation? A. Depreciation expense should be recorded in the appropriate governmental funds, and recorded in the governmental activities accounts. B. Depreciation expense must be recorded in the governmental fund, but no depreciation expense is recorded in the governmental activities accounts. C. No depreciation can be recorded in any governmental fund, but depreciation expense must be recorded in the governmental activities accounts. D. No depreciation can be recorded in any governmental fund, nor is it permissible to record depreciation expense in the governmental activities accounts. 45. A capital projects fund might be used to account for which of the following activities? A. Maintaining sidewalks. B. Building a parking garage. C. Providing water and sewer services. D. Servicing long-term debt. 46. When bonds are sold at a premium for a capital project, the premium amount generally: A. Increases the cash available to the capital projects fund. B. Is transferred to the debt service fund. C. Is applied against the principal balance by the fiduciary agent. D. Is recorded in a fiduciary fund since it does not belong to the capital projects fund. 47. Typically, proceeds from general obligation bonds will be recorded in the: A. Debt service fund. B. General obligation bond fund. C. Permanent fund. D. Capital projects fund. 48. Which of the following assets would not be found in the balance sheet of a debt service fund? A. Cash with fiscal agent. B. Investments C. Equipment D. Interest Receivable. 49. The City of Spartan's fiscal year ends on December 31. On October 1, 2020, the city issued $1,000,000 of 6%, 10-year term bonds with semiannual interest payments due on April 1 and October each year, beginning on April 1. 2021. What amount of expense should the city recognize in its governmental activities journal for the years 2020 and 2021? A $60,000 in 2020, S60,000 in 2021 B. $30,000 in 2020, S60,000 in 2021. C. $15.000 in 2020, S60,000 in 2021. D. SO in 2020; $60,000 in 2021