Question

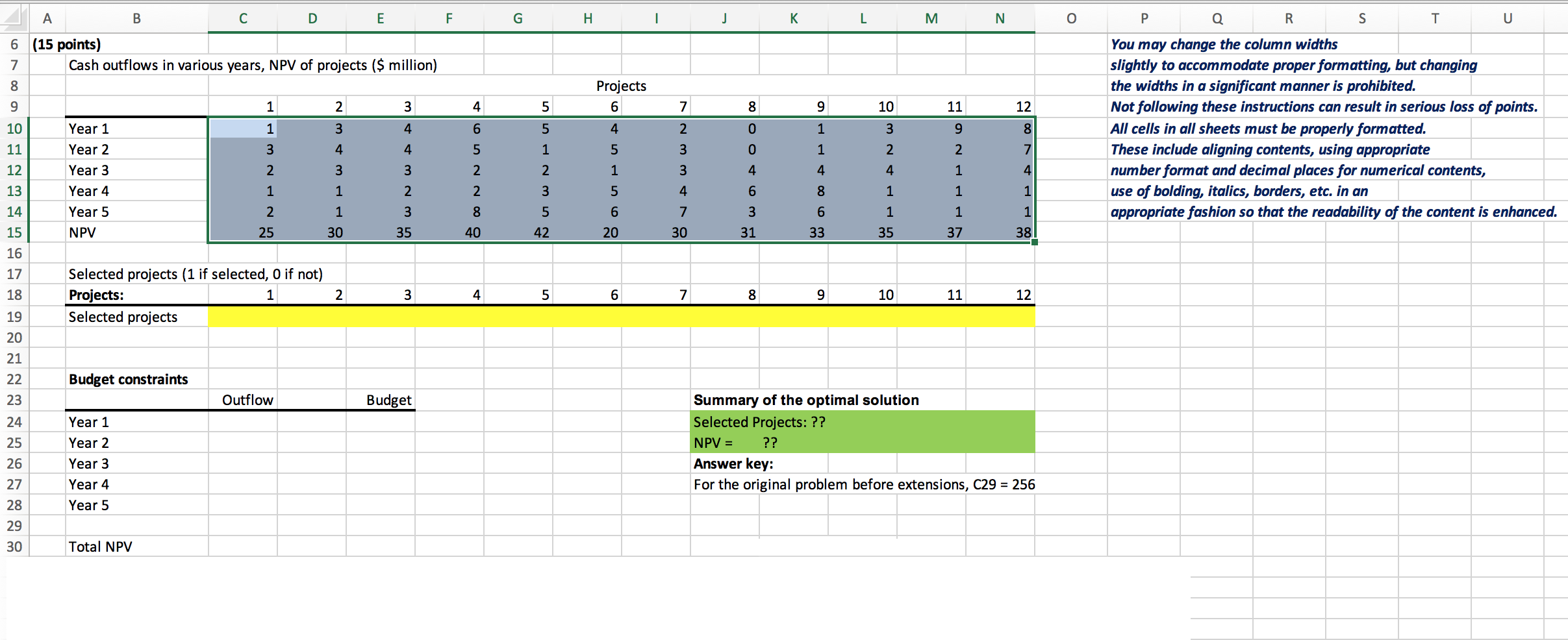

40. You are given a group of possible investment projects for your companys capital. For each project, you are given the NPV the project would

40.

You are given a group of possible investment projects for your companys capital. For each project, you are given the NPV the project would add to the firm, as well as the cash outflow required by each project during each year. Determine the investments that maximize the firms NPV. The firm has $25 million available during each of the next five years. All numbers are in millions of dollars.

I intend to leave a thumbs up no matter what! I am just happy for a response so Experts please don't worry!!!!

I intend to leave a thumbs up no matter what! I am just happy for a response so Experts please don't worry!!!!

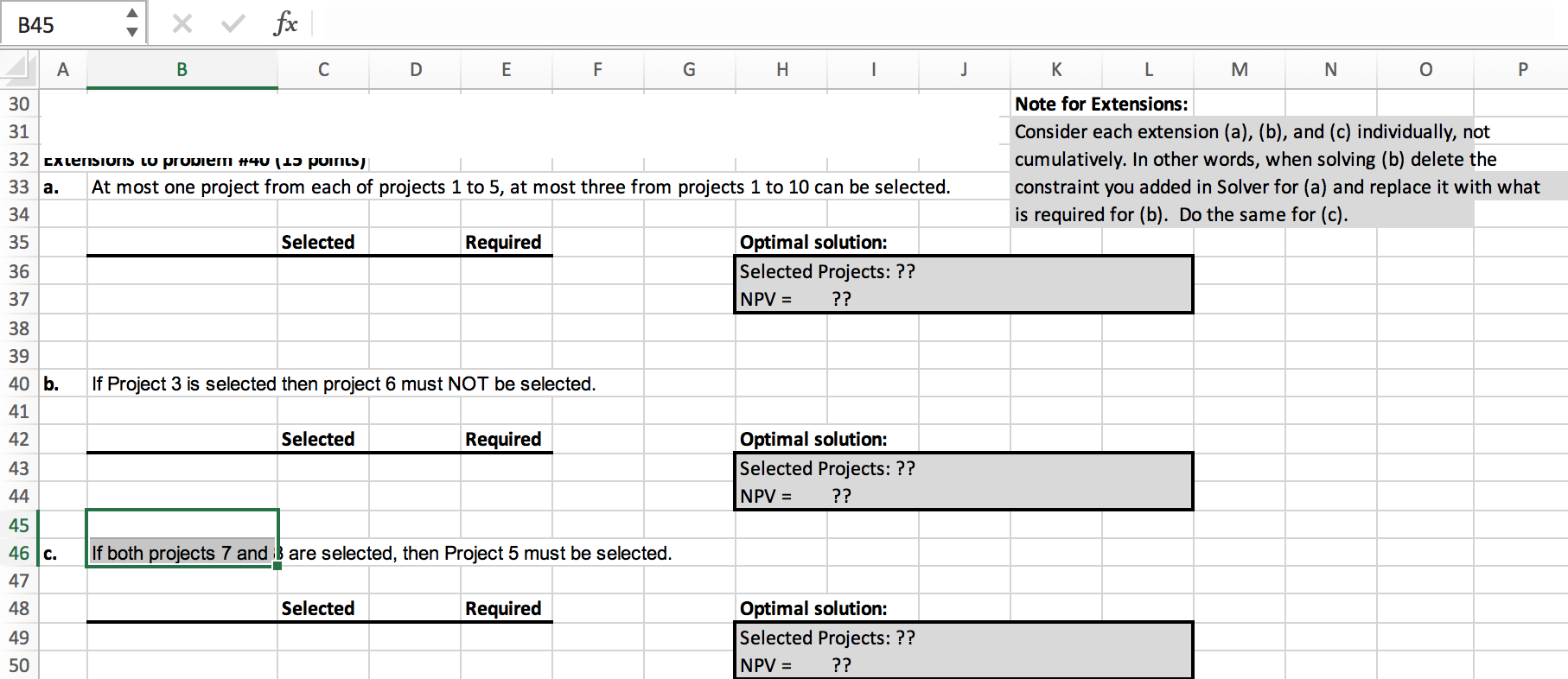

A F G H I J K L M N O 6 C D E (15 points) Cash outflows in various years, NPV of projects ($ million) Projects 0 Year 1 Year 2 Year 3 Year 4 Year 5 NPV HNEN WPA SPAW WIN mm Nm CONNO P Q R S T U You may change the column widths slightly to accommodate proper formatting, but changing the widths in a significant manner is prohibited. Not following these instructions can result in serious loss of points. All cells in all sheets must be properly formatted. These include aligning contents, using appropriate number format and decimal places for numerical contents, use of bolding, italics, borders, etc. in an appropriate fashion so that the readability of the content is enhanced. oooom Ruw NEU PENWO HS Selected projects (1 if selected, O if not) Projects: 1 Selected projects 2 4 - 3 5 6 7 8 10 9 11 Budget constraints Outflow Budget Year 1 Year 2 Year 3 Year 4 Year 5 Summary of the optimal solution Selected Projects: ?? NPV = ?? Answer key: For the original problem before extensions, C29 = 256 Total NPV B45 A V fx x B C D E F G H I J 30 31 K L M N O P Note for Extensions: Consider each extension (a), (b), and (c) individually, not cumulatively. In other words, when solving (b) delete the constraint you added in Solver for (a) and replace it with what is required for (b). Do the same for (c). 33 32 Extensions w progren H400 pomisy a. At most one project from each of projects 1 to 5, at most three from projects 1 to 10 can be selected. 34 Selected Required Optimal solution: Selected Projects: ?? NPV = ?? b. If Project 3 is selected then project 6 must NOT be selected. Selected Required Optimal solution: Selected Projects: ?? NPV = ?? If both projects 7 and B are selected, then Project 5 must be selected. Selected Required Optimal solution: Selected Projects: ?? NPV =Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started